Holiday Inn 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

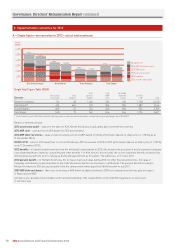

Opportunity Performance metrics Changes in year

Determined annually on the

factors set out to the left

None Directors’ salaries

increased between

2.5%-3% in 2012

Target = 115% of salary

Maximum = 200% of salary

20% Brands: year-on-year improvement in guest

satisfaction

10% People: year-on-year improvement in employee

engagement

70% Delivery: EBIT v target

All targets measured over one year

APP for senior

executives from 2013

Maximum for 2013/15 LTIP cycle =

205% of salary

Will not exceed three times annual

salary other than in exceptional

circumstances

25% relative net rooms growth and 25% relative RevPAR

growth (both measured v comparator group):

• 20% threshold vesting if equal to average growth of

comparator group;

• maximum vesting if ranked as 1st in the comparator

group; and

• straight-line vesting in between.

50% relative TSR (v DJGH index):

• 20% threshold vesting if equal to index;

• maximum vesting if 8% or more per year ahead of index; and

• straight-line vesting in between.

All targets measured over a three-year performance period

None in 2012

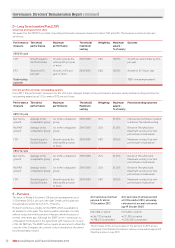

UK DB Plan: 1/30th accrual rate

UK DC Plan: 7.5% employee

contribution with 30% matching

Company contribution

US 401(k) Plan: 2%-75% employee

contribution with 4% matching

Company contribution

US Deferred Compensation Plan:

up to 75% employee contribution

with 2% matching Company

contribution and 4%-20% additional

Company contribution if certain

conditions are met

None None in 2012

UK DB Plan will close

to future accrual for

existing members with

effect from 1 July 2013

Directors’ Remuneration Report 65