Holiday Inn 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 IHG Annual Report and Financial Statements 2012

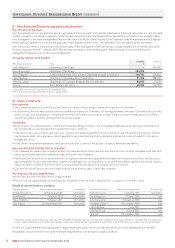

Tracy Robbins participated in the executive UK DC Plan until March

2012. This is a funded, registered, defined contribution, occupational

pension scheme. The main features applicable are:

• a normal pension age of 60;

• employee contributions of 7.5% of salary and company matching

contributions of 30% of salary (subject to the Annual Allowance,

with any excess over the Annual Allowance as a cash allowance

in lieu of pension benefits);

• life assurance cover of four times pensionable salary; and

• lump sum contributions payable in the event of ill health.

From April 2012, as a result of the reduction in the Lifetime Allowance,

contributions (including potential contributions payable in the event

of ill health) ceased and the full value of the company matching

contributions was paid as a cash allowance; life assurance cover

of four times pensionable salary continued to be provided.

Employer contributions to the UK DC Plan made for Tracy Robbins

amounted to £5,000. In addition, Tracy Robbins received a cash

allowance in lieu of pension contributions of £117,700.

Tom Singer does not participate in any pension plan and therefore

received a cash allowance in lieu of pension contributions of

£162,000; life assurance cover of four times pensionable salary

was also provided.

Kirk Kinsell has retirement benefits provided via the US 401(k) Plan

for employees of Six Continents Hotels, Inc. and the US Deferred

Compensation Plan (DCP). The US 401(k) Plan is a tax qualified plan

providing benefits on a defined contribution basis, with the member

and the relevant company both contributing. The US Deferred

Compensation Plan is a non-tax qualified plan, providing benefits

on a defined contribution basis, with the member and the relevant

company both contributing.

Contributions made by, and in respect of, Kirk Kinsell in the US

plans are*:

£

Director’s contributions to DCP in 2012 191,498

Director’s contributions to US 401(k) in 2012 14,195

Company contribution to DCP in 2012 103,620

Company contribution to US 401(k) in 2012 6,309

Age at 31 December 2012 57

* Sterling values have been calculated using an exchange rate of $1=£0.63.

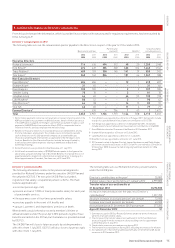

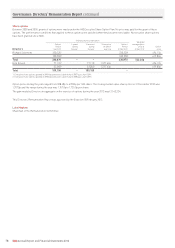

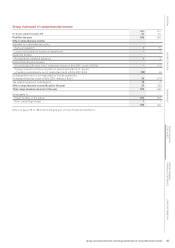

ABP deferred share awards

Directors’ pre-tax share interests during the year were as set out below:

Financial Value based

year on ABP on share

which ABP ABP Market shares Market ABP price of

performance awards awards price per vested price per Value at awards Planned 1,707.0p at

is based held at during Award share at during Vesting share at vesting held at vesting 31 Dec 2012

Directors for award1 1 Jan 2012 the year date award the year date vesting £ 31 Dec 20122 date £

Richard Solomons 2008 66,549 23.2.09 472.6p 66,549 23.2.12 1,412.7p 940,138

2009 –

2010 32,295 21.2.11 1,417.0p 30,142 21.2.14 514,524

2011 36,838 20.2.12 1,391.0p 34,382 20.2.15 586,901

Total 98,844 36,838 64,524 1,101,425

Kirk Kinsell 2008 41,427 23.2.09 472.6p 41,427 23.2.12 1,412.7p 585,239

2009 –

2010 27,375 21.2.11 1,417.0p 25,550 21.2.14 436,139

2011 26,360 20.2.12 1,391.0p 24,602 20.2.15 419,956

Total 68,802 26,360 50,152 856,095

Tracy Robbins 2008 33,132 23.2.09 472.6p 33,132 23.2.12 1,412.7p 468,056

2009 –

2010 20,377 21.2.11 1,417.0p 19,018 21.2.14 324,637

2011 22,889 20.2.12 1,391.0p 21,363 20.2.15 364,666

Total 53,509 22,889 40,381 689,303

Tom Singer3 2010 –

2011 –

Total – – – –

1 For financial year 2008, the award was based on Group EBIT, net annual rooms additions and individual performance measures. For financial year 2009, no annual incentive

award was paid. For financial year 2010, the award was based on Group EBIT and individual performance measures. For financial year 2011, the award was based on

Group EBIT and individual performance measures.

2 InterContinental Hotels Group PLC 1329/47p ordinary shares were subject to a share consolidation effective from 9 October 2012. For every 15 existing ordinary shares

held at 6.00pm on 8 October 2012, shareholders received 14 new ordinary shares of 14194 /329p each and a special dividend of 108.4p ($1.72) per existing ordinary share.

As a consequence, ABP awards held at 31 December 2012 have been reduced accordingly.

3 Tom Singer joined the Company and was appointed a Director on 26 September 2011 and did not participate in the 2011 ABP.

All Executive Directors participated in the ABP during the year ended 31 December 2012.

Governance: Directors’ Remuneration Report continued