Holiday Inn 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Nomination Committee Report and Directors’ Remuneration Report 59

Dear Shareholder

2013 is a year of transition for directors’ remuneration reports. We

have prepared this report before new final Government regulations

on executive remuneration disclosure are issued. However, we have

reflected as much as is practical of the direction and spirit of the

draft regulations in both the content and structure of this report.

There is more information on areas such as how we recognise risk

in our remuneration policy and our interactions with stakeholders,

including data on previous shareholder votes. We have historically

tried to make this report transparent and easy to read and in recent

years already included, for example, the single figure for Executive

Directors’ remuneration and a remuneration policy summary table.

Last year, I used this introduction to set out the key elements of this

report. This year, there is an overview at the start of the report itself.

However, I would like to highlight the following points in particular.

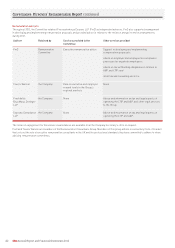

Executive Director remuneration at IHG has evolved during 2012:

• the measures under the Annual Bonus Plan (ABP) have been

changed for Executive Directors in 2013. To distinguish it from

the previous measures, we refer to it as the Annual Performance

Plan (APP). Although not a radical change, the APP does align

annual incentives more closely to the key elements of our

strategic priorities of Brands, People and Delivery; and

• the 2010/12 Long Term Incentive Plan (LTIP), which will vest

in 2013, is the last LTIP using the previous measures. The

2011/13 LTIP, which vests in 2014, is the first LTIP including the

new corporate performance measures of net rooms growth

and RevPAR.

Remuneration for Executive Directors in 2012 reflects another year

of strong results, as shown in the table below:

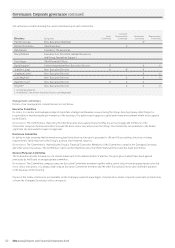

2012 2011 2010

EBIT +9.8% +25.9% +22.3%

Adjusted EPS* +21.7% +2.5% +9.6%

TSR* +28.2% +29.8% +8.0%

* Annualised three-year changes.

Remuneration has reflected these results with an ABP award just

above target for 2012 and a maximum vesting of the 2010/12 LTIP cycle.

We continually keep all aspects of remuneration under review

and listen to the views of shareholders, Government and other

stakeholders. We believe our current approach to remuneration

is responsible and appropriate as it:

• is structured to drive execution of our business strategy;

• aligns reward with the creation of shareholder value;

• allows the Company to recruit and retain talent in a competitive

global sector;

• incorporates measures and safeguards to ensure that high

rewards only follow strong, balanced results; and

• incentivises the delivery of long-term, sustainable business

growth and shareholder value, rather than the pursuit of

unsustainable short-term results.

The targets for 2013 are stretching and will require a strong corporate

performance to achieve similar levels of total remuneration.

Luke Mayhew

Chairman of the Remuneration Committee

18 February 2013

Directors’ Remuneration Report glossary of terms

ABP Annual Bonus Plan

APP Annual Performance Plan

DB Defined Benefit

DC Defined Contribution

DJGH index Dow Jones Global Hotels index

EBIT Earnings before interest and tax

EPS Earnings per share

ICETUS InterContinental Executive Top-up Scheme

IC Plan InterContinental Hotels UK Pension Plan

LTIP Long Term Incentive Plan

OPR Overall performance rating

RevPAR Revenue per available room

TSR Total Shareholder Return

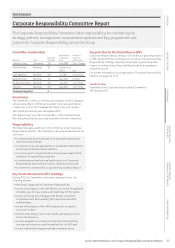

Contents of Directors’ Remuneration Report

1. The Remuneration Committee

2. Policy: remuneration policy for 2013

A – Key remuneration principles

B – Link with strategy

C – Remuneration policy summary

D – Fixed and variable pay mix

E – Salary and benefits

F – APP

G – LTIP

H – Pensions

I – Executive share options

J – Clawback

3. Implementation: outcomes for 2012

A – Single figure remuneration in 2012

B – Executive shareholding requirement

C – ABP

D – LTIP

E – Pensions

4. Other matters

A – Share capital

B – Performance graph

C – Non-Executive Directors’ pay policy and structure

D – Service contracts

5. Audited information on Directors’ emoluments

Governance

Directors’ Remuneration Report