Holiday Inn 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 IHG Annual Report and Financial Statements 2012

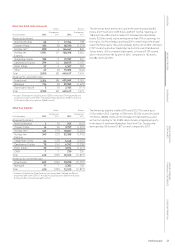

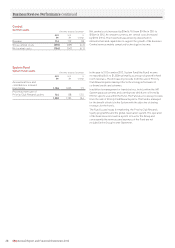

Greater China results

12 months ended 31 December

2012

$m

2011

$m

%

change

Revenue

Franchised 32 50.0

Managed 89 77 15.6

Owned and leased 138 126 9.5

Total 230 205 12.2

Operating profit before exceptional items

Franchised 43 33.3

Managed 51 43 18.6

Owned and leased 45 37 21.6

100 83 20.5

Regional overheads (19) (16) (18.8)

Total 81 67 20.9

Greater China comparable RevPAR movement on previous year

12 months ended

31 December 2012

Managed

All brands 5.6%

Owned and leased

InterContinental 6.7%

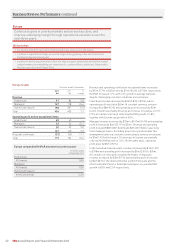

Revenue and operating profit before exceptional items increased by

$25m (12.2%) to $230m and by $14m (20.9%) to $81m respectively.

RevPAR increased 5.4% with 3.1% growth in average daily rate.

Franchised revenue increased by $1m (50.0%) to $3m and operating

profit by $1m (33.3%) to $4m, boosted by the opening of the

1,224-room Holiday Inn Macao Cotai Central.

Managed revenue increased by $12m (15.6%) to $89m and operating

profit increased by $8m (18.6%) to $51m. RevPAR growth of 5.6%

reflected continued economic growth in the region, although the

whole industry was affected in the latter part of the year by the once

in a decade political leadership change and the Diaoyu/Senkaku

islands territorial dispute. There was also continued significant

System size growth for the managed estate in the region (9.7% rooms

growth in 2012 following 14.2% rooms growth in 2011).

Owned and leased revenue increased by $12m (9.5%) to $138m and

operating profit increased by $8m (21.6%) to $45m, with RevPAR

growth of 6.7% at the InterContinental Hong Kong.

Regional costs increased by $3m (18.8%) to $19m reflecting

increased investment in operations and infrastructure in the region.

Greater China

Maximise scale and strength and establish multi-segment local

operating expertise to drive margin and expand our strong portfolio

of Brands over the next three years.

2013 priorities

• Grow distribution and expand our portfolio of Brands with a particular focus on Crowne Plaza

Hotels & Resorts and HUALUXE Hotels & Resorts;

• build upon the success of the Holiday Inn relaunch to continue to grow the Holiday Inn

brand family;

• extend IHG’s leading presence in the market with strategic distribution of brands in

established and emerging cities in Greater China; and

• localise IHG channels, systems, processes, brands, Responsible Business practices

and People Tools to increase efficiency and margin performance.

Business Review: Performance continued