Holiday Inn 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 IHG Annual Report and Financial Statements 2012

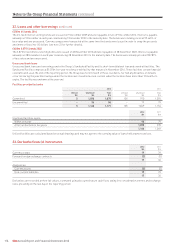

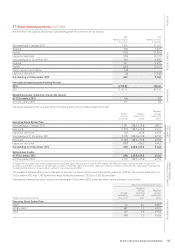

28. Issued share capital and reserves

Number of Nominal Share Equity share

shares value premium capital

Equity share capital millions $m $m $m

Allotted, called up and fully paid

At 1 January 2011 (ordinary shares of 1329⁄47p) 289 61 94 155

Issued on exercise of share options 1 – 8 8

Exchange adjustments – – (1) (1)

At 31 December 2011 (ordinary shares of 1329⁄47p) 290 61 101 162

Share capital consolidation (19) – – –

Issued on exercise of share options 1 1 9 10

Repurchased and cancelled under repurchase programme (4) (1) – (1)

Exchange adjustments – 2 6 8

At 31 December 2012 (ordinary shares of 14194 ⁄329p each) 268 63 116 179

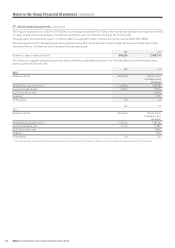

On 7 August 2012, the Group announced a planned $1bn return to shareholders comprising a $0.5bn special dividend with share

consolidation and a $0.5bn share repurchase programme. The share consolidation was approved on 8 October 2012 at a General Meeting

(GM) of the Company and became effective on 9 October 2012 on the basis of 14 new ordinary shares of 14194 ⁄329p each for every 15 existing

ordinary shares of 1329⁄47p each. The special dividend of 172.0¢ per share was paid to shareholders on 22 October 2012 at a total cost of

$505m. Under the authority granted by shareholders at the GM held on 8 October 2012, the share repurchase programme commenced in

November 2012 resulting in the repurchase of 4,143,960 shares in the period to 31 December 2012 for a total consideration of $107m.

Transaction costs relating to shareholder returns of $2m, net of tax, have been charged to retained earnings.

No shares were repurchased in 2011.

The authority given to the Company at the GM held on 8 October 2012 to purchase its own shares was still valid at 31 December 2012.

A resolution to renew the authority will be put to shareholders at the AGM on 24 May 2013.

The balance classified as equity share capital includes the total net proceeds (both nominal value and share premium) on issue of the

Company’s equity share capital, comprising 14194 ⁄329p shares. The share premium reserve represents the amount of proceeds received

for shares in excess of their nominal value.

The Company no longer has an authorised share capital.

The nature and purpose of the other reserves shown in the Group statement of changes in equity on pages 86 and 87 of the Financial

Statements is as follows:

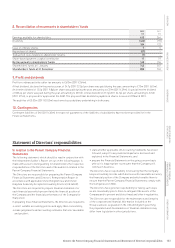

Capital redemption reserve

This reserve maintains the nominal value of the equity share capital of the Company when shares are repurchased or cancelled.

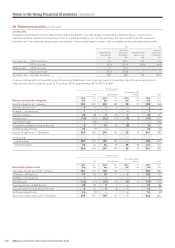

Shares held by employee share trusts

Comprises $48.0m (2011 $26.5m) in respect of 1.8m (2011 1.5m) InterContinental Hotels Group PLC ordinary shares held by employee

share trusts, with a market value at 31 December 2012 of $50m (2011 $26m).

Other reserves

Comprises the merger and revaluation reserves previously recognised under UK GAAP, together with the reserve arising as a consequence

of the Group’s capital reorganisation in June 2005. Following the change in presentational currency to the US dollar in 2008 (see page 90),

this reserve also includes exchange differences arising on the retranslation to period-end exchange rates of equity share capital, the capital

redemption reserve and shares held by employee share trusts.

Unrealised gains and losses reserve

This reserve records movements in the fair value of available-for-sale financial assets and the effective portion of the cumulative net

change in the fair value of the cash flow hedging instruments related to hedged transactions that have not yet occurred.

The fair value of cash flow hedging instruments outstanding at 31 December 2012 was $nil (2011 $nil).

Currency translation reserve

This reserve records the movement in exchange differences arising from the translation of foreign operations and exchange differences

on foreign currency borrowings and derivative instruments that provide a hedge against net investments in foreign operations. On adoption

of IFRS, cumulative exchange differences were deemed to be $nil as permitted by IFRS 1.

The fair value of derivative instruments designated as hedges of net investments in foreign operations outstanding at 31 December 2012

was a $17m net liability (2011 $36m).

The currency translation reserve includes a cumulative loss of $35m relating to non-current assets classified as held for sale.

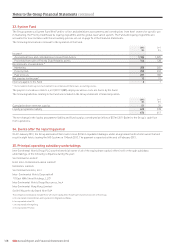

Notes to the Group Financial Statements continued