Holiday Inn 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Industry overview and Our strategy 11

With a portfolio of preferred Brands in the most attractive markets, our talented

People are focussed on delivering Great Hotels Guests Love and executing a clear set of priorities

to achieve our Vision of becoming one of the great companies in the world

A good strategy makes clear choices against a range of business

opportunities in order to achieve a set of defined goals. An

organisation needs to be able to execute these decisions and

measure its success using a clear set of comprehensively

aligned metrics.

IHG’s strategy determines a set of choices to balance the quality of

IHG branded hotels and the speed at which we grow. We measure

this through key performance indicators (KPIs) such as growing

RevPAR, System size and fee based margins. In addition, we ensure

we continue to improve employee engagement, guest and owner

satisfaction and increase the proportion of hotel room demand that

we generate for our owners through our proprietary distribution

and reservation systems.

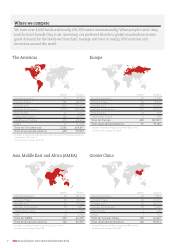

Where we compete

Where we compete

Relevant consumer segments

Most attractive markets

Appropriate business model

How we win

Portfolio of preferred Brands

Talented People

Best-in-class Delivery

Responsible Business

Delivering the elements of our strategy

Competing in relevant consumer segments

The hotel industry is usually segmented according to price point and IHG is focussed on the three segments that generate over 90 per cent

of branded hotels revenue, namely midscale (broadly three star), upscale (mostly four star) and luxury (five star). However, to build preferred

Brands, we believe we need to advance our understanding of our guests and their needs to ensure our brands remain contemporary

and relevant.

We have therefore completed a fundamental occasion-based needs segmentation analysis to understand why guests book hotels – looking at

who they are, the occasion they are travelling for and their needs when travelling. Many guests no longer have a single purpose for their hotel

stay – for example, business trips turn into family holidays, and we need to meet these demands, focussing more on the needs of our guests, to

deliver loyalty and brand preference. We used this analysis to develop the brand proposition for our two new brands, HUALUXE Hotels & Resorts

and EVEN Hotels, and we continue to work on this needs-based segmentation to help inform our view of the hotel market and our brand

strategies going forward.

Competing in the most attractive markets

Our strategy is to build preferred Brands with scale positions in the most attractive markets globally. Concentrating growth in the largest

markets means IHG and owners can operate more efficiently and benefit from enhanced revenues and reduced costs. Our key markets include

large developed markets such as the US, UK and Germany, as well as emerging markets like China and India.

The US is the largest market for branded hotels, with 3.38 million rooms, accounting for 69 per cent of all US rooms available. The segment in

the US with the greatest share is midscale, with 1.38 million branded hotel rooms, and IHG’s Holiday Inn brand family, comprising Holiday Inn,

Holiday Inn Express, Holiday Inn Club Vacations and Holiday Inn Resort, is the largest brand in this segment.

In China, IHG sees the greatest opportunity for growth of any single country and our strategy has been to enter the market early, to develop our

relationships with key local third party owners and grow our presence rapidly. In a country with 659,000 branded hotel rooms, IHG is the largest

international hotel company with over 61,000 rooms across our brands and more than 50,000 in the planning phase or under construction. This

rapid pace of openings for IHG has been in anticipation of increasing demand for hotels, driven by a large, emerging middle class and growing

domestic and international travel.

IHG is also focussed on developing in other high priority markets. We seek to develop our portfolio of brands in those markets which will be

sources of strong hotel demand in the future. We have continued to build our position in these markets in the last year. For example, we

increased the distribution of our core brands in India, building upon our leadership position of Holiday Inn. In Russia and the Commonwealth

of Independent States (CIS), there are opportunities for new construction and conversions as well as strong demand for branded hotels. IHG

continues to adapt its business model by market, choosing partnerships and joint ventures where appropriate.

Outside the largest markets, we focus on building presence in key gateway cities where our brands can generate revenue premiums from

high business and leisure demand.

During 2012, we opened 33,922 rooms in 26 countries and territories, and signed a further 53,812 rooms into our development pipeline (hotels

in planning and under construction but not yet opened) across 33 countries and territories. As part of our ongoing commitment to maintaining the

quality of our brands, we removed 16,288 rooms during the year. As at 31 December 2012, IHG had the second largest pipeline in the industry, with

169,030 rooms in 1,053 hotels across 60 countries and territories. This represents a market share of 12 per cent of all hotels under development,

including those that are independent or unaffiliated with a brand.

Business Review

Our strategy