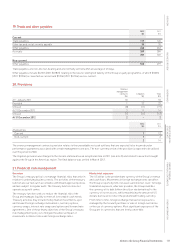

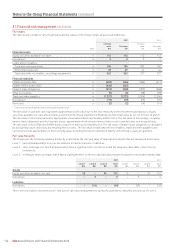

Holiday Inn 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 IHG Annual Report and Financial Statements 2012

Notes to the Group Financial Statements continued

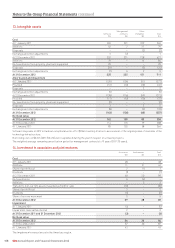

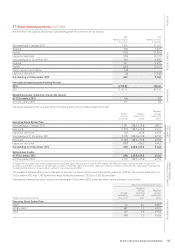

22. Loans and other borrowings continued

£250m 6% bonds 2016

The 6% fixed interest sterling bonds were issued on 9 December 2009 and are repayable in full on 9 December 2016. Interest is payable

annually on 9 December in each year commencing 9 December 2010 to the maturity date. The bonds were initially priced at 99.465% of

face value and are unsecured. Currency swaps were transacted at the same time the bonds were issued in order to swap the proceeds

and interest flows into US dollars (see note 23 for further details).

£400m 3.875% bonds 2022

The 3.875% fixed interest sterling bonds were issued on 28 November 2012 and are repayable on 28 November 2022. Interest is payable

annually on 28 November in each year commencing 28 November 2013 to the maturity date. The bonds were initially priced at 98.787%

of face value and are unsecured.

Unsecured bank loans

Unsecured bank loans are borrowings under the Group’s Syndicated Facility and its short-term bilateral loan and overdraft facilities. The

Syndicated Facility comprises a $1.07bn five-year revolving credit facility that matures in November 2016. These facilities contain financial

covenants and, as at the end of the reporting period, the Group was not in breach of these covenants, nor had any breaches or defaults

occurred during the year. Borrowings under the facilities are classified as non-current when the facilities have more than 12 months to

expiry. The facility was undrawn at the year end.

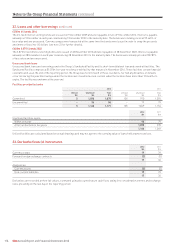

Facilities provided by banks

2012 2011

Utilised Unutilised Total Utilised Unutilised Total

$m $m $m $m $m $m

Committed 5 1,070 1,075 105 970 1,075

Uncommitted – 96 96 – 79 79

5 1,166 1,171 105 1,049 1,154

2012 2011

$m $m

Unutilised facilities expire:

Within one year 96 79

After two but before five years 1,070 970

1,166 1,049

Utilised facilities are calculated based on actual drawings and may not agree to the carrying value of loans held at amortised cost.

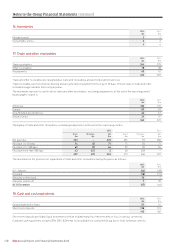

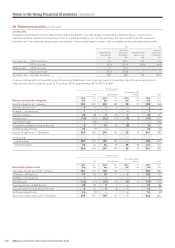

23. Derivative financial instruments

2012 2011

$m $m

Currency swaps 19 39

Forward foreign exchange contracts (2) (3)

17 36

Analysed as:

Current assets (2) (3)

Non-current liabilities 19 39

17 36

Derivatives are recorded at their fair values, estimated using discounted future cash flows taking into consideration interest and exchange

rates prevailing on the last day of the reporting period.