Holiday Inn 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Directors’ Remuneration Report 61

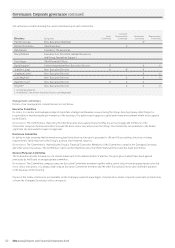

Committee membership

The independent Non-Executive Directors who served on the

Committee during 2012 were as follows:

Member Role Meetings attended Date of appointment

Luke Mayhew Chairman 6/6 1 July 2011

David Kappler Member 6/6 21 June 2004

Jonathan Linen Member 6/6 1 December 2005

Ying Yeh Member 6/6 1 December 2007

Total meetings held 6

The following attended all meetings:

David Webster (Chairman of the Board until 31 December 2012);

Richard Solomons (Chief Executive); and Tracy Robbins (Executive

Vice President, Human Resources and Group Operations Support).

Committee meetings were also attended by the following individuals

who provided advice to the Committee on remuneration proposals:

Lori Gaytan (Senior Vice President, Americas Human Resources

and Global Reward) – February, May and June meetings; and

Jean-Pierre Noel (appointed Senior Vice President, Global Reward

in April 2012) – from May meeting onwards.

None of these individuals is in attendance when his/her own

remuneration is being discussed.

Governance

The Committee’s remit is set out in its terms of reference which

are reviewed annually and were updated by the Board in

December 2012. They are available on the Company’s website

www.ihgplc.com/investors under corporate governance/committees,

or from the Company Secretary’s office on request.

Responsibilities

The Committee agrees, on behalf of the Board, all aspects of

the remuneration of the Executive Directors and the Executive

Committee, and agrees the strategy, direction and policy for the

remuneration of other senior executives who have a significant

influence over the Company’s ability to meet its strategic objectives.

Committee approach to managing risk

The approach to remuneration is to directly link it to IHG’s strategy.

Risk management is a key part of IHG being a Responsible Business

and the Committee considers risk mitigation as central to the way

that incentive arrangements are structured, for example:

• the APP, ABP and LTIP are all structured so as to have a balance

of measures that ensure senior executives are not incentivised to

behave in a way that could adversely affect the sustainable growth

of the Company and the long-term interests of its shareholders.

For instance, in the new APP, the drive for short-term financial

results is balanced by performance measures focussed on guest

satisfaction and employee engagement;

• the Committee reserves the discretion to determine that payouts

in the LTIP are adjusted if they are not consistent with the

Committee’s assessment of earnings and the quality of the

Company’s financial performance over the relevant performance

period; and

• for awards under the Company’s incentive plans made

from January 2012, clawback provisions may be used by the

Committee in any situation of misconduct that causes significant

damage or potential damage to IHG’s prospects, finances or

brand reputation, and/or actions that lead to material

misstatement or restatement of accounts.

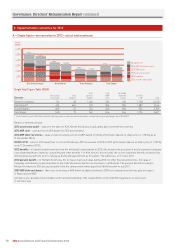

Key issues discussed in 2012 meetings

In 2012, the Committee met six times. The most significant

topic of discussion was the review of annual incentives and

the new APP. The Committee discussed, amongst others, the

following matters:

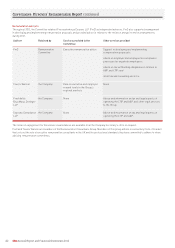

Date Key issues discussed

9 February • Executive Committee performance and

salary review;

• 2011 Directors’ Remuneration Report;

• vesting of 2011 annual incentive plan and 2009/11

long-term incentive plan; and

• design of 2012 annual incentive plan and 2012/14

long-term incentive plan.

3 May • Initial review of future annual incentive

structure; and

• 2012 incentive measure projections.

27 June • Key design principles for annual incentive

plan for 2013 onwards (APP); and

• 2012 incentive measure projections.

26 September • Detailed structure of incentives for

2013 onwards;

• 2012 incentive measure projections; and

• IHG’s return of capital to shareholders – effect

on incentive plans.

1 November • Design of APP measures for 2013.

12 December • APP targets for 2013;

• update on the Committee Chairman’s meetings

with shareholders;

• executive remuneration market updates;

• 2012 incentive measure projections;

• approach to 2012 Directors’ Remuneration

Report; and

• annual review of the Committee’s terms

of reference.

Committee interaction with stakeholders

The Committee actively engages with shareholders on remuneration

matters. Major shareholders were approached prior to the 2012 AGM

and offered the opportunity to discuss any aspect of our approach

to remuneration. In addition, in November 2012, the Chairman of the

Committee approached major shareholders outlining the changes

to annual incentive arrangements for 2013. Meetings were held with

many of them, as well as shareholder representative organisations,

at which details of the changes, best practice stemming from the

proposed regulatory changes and reporting of executive remuneration

were discussed.

Votes in favour of our Directors’ Remuneration Report at previous AGMs:

% in favour

2012 95.46%

2011 96.24%

1. The Remuneration Committee