Holiday Inn 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Accounting policies 95

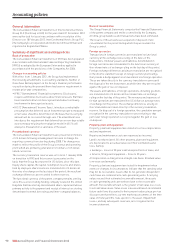

Retirement and other post-employment benefits – the cost

of defined benefit pension plans and other post-employment

benefits is determined using actuarial valuations. The actuarial

valuation involves making assumptions about discount rates,

expected rates of return on assets, future salary increases,

mortality rates and future pension increases.

Tax – provisions for tax accruals require judgements on the

interpretation of tax legislation, developments in tax case law

and the potential outcomes of tax audits and appeals. In addition,

deferred tax assets are recognised for unused tax attributes to the

extent that it is probable that taxable profit will be available against

which they can be utilised. Judgement is required as to the amount

that can be recognised based on the likely amount and timing of

future taxable profits. Deferred tax balances are dependent on

management’s expectations regarding the manner and timing

of recovery of the related assets.

Other – the Group also makes estimates and judgements in the

valuation of franchise and management agreements acquired

on asset disposals, the valuation of financial assets classified as

available-for-sale, the outcome of legal proceedings and claims

and in the valuation of share-based payment costs.

New standards issued but not effective

The following accounting standards, amendments and

interpretations with an effective date after the date of these

Financial Statements have not been adopted early by the Group

and will be adopted as set out below. Unless otherwise indicated,

the Directors do not anticipate that the adoption of these standards,

amendments and interpretations will have a material impact on the

Group’s reported income or net assets in the period of adoption.

• IAS 1 (Amendment) ‘Presentation of Financial Statements’,

which is effective from 1 July 2012, changes the grouping of items

presented in other comprehensive income (OCI) so that items

which may be reclassified to profit or loss in the future are

presented separately from items that will never be reclassified.

• IAS 19 (Revised) ‘Employee Benefits’, which is effective from

1 January 2013, introduces numerous changes including the

removal of the option to defer recognition of some actuarial

gains and losses (‘the corridor mechanism’) and the concept of

expected returns on plan assets. The Group currently recognises

all actuarial gains and losses in OCI, therefore the removal of

the corridor mechanism will have no impact on financial

performance or position. The impact of calculating the expected

return on plan assets (after relevant asset restrictions) using

the same interest rate as applied to discounting the benefit

obligations is expected to result in a higher operating profit

charge of approximately $3m in 2013 compared with the 2012

charge under the current version of IAS 19.

• IAS 28 (Amendment) ‘Investments in Associates and Joint

Ventures’, which will be adopted by the Group from 1 January

2013, has been renamed as a consequence of the new IFRS 11

and IFRS 12 (see below) and describes the application of the

equity method to investments in joint ventures in addition

to associates.

• IFRS 10 ‘Consolidated Financial Statements’, which will be

adopted by the Group from 1 January 2013, introduces a single

control model for all entities, including special purpose entities,

which will require significant judgement to determine which

entities are controlled and therefore consolidated in the Group

Financial Statements. Based on the preliminary analyses

performed, IFRS 10 is not expected to have any material impact

on the investments held by the Group.

• IFRS 11 ‘Joint Arrangements’, which will be adopted by the Group

from 1 January 2013, eliminates the option to account for jointly

controlled entities (JCEs) using proportionate consolidation. The

Group currently accounts for its JCEs using the equity method

which is the requirement of IFRS 11.

• IFRS 12 ‘Disclosure of Interests in Other Entities’, which will be

adopted by the Group from 1 January 2013, incorporates all of

the disclosures required in respect of an entity’s interests in

subsidiaries, joint arrangements, associates and structured

entities. The requirements are extensive and likely to result in

new disclosures in the Group Financial Statements.

• IFRS 13 ‘Fair Value Measurement’, which is effective from

1 January 2013, establishes a single source of guidance under

IFRS for fair value measurements. IFRS 13 does not change

when an entity is required to use fair value, but rather provides

guidance on how to measure fair value when fair value is required

or permitted. Based on the preliminary analyses performed,

IFRS 13 is not expected to have a material impact on the Group’s

Financial Statements.

• IFRS 9 ‘Financial Instruments: Classification and Measurement’,

which is effective from 1 January 2015, introduces new

requirements for classifying and measuring financial assets

and financial liabilities and, when finalised, will address hedge

accounting and impairment of financial assets. The Group will

assess the impacts when the final standard is issued.

Note: with the exception of IFRS 9, all of the above will be adopted

by the Group with effect from 1 January 2013. IAS 28 (Amendment),

IFRS 10, IFRS 11 and IFRS 12 have been endorsed for adoption by

the EU with effect from 1 January 2014 and are therefore being

adopted early by the Group.