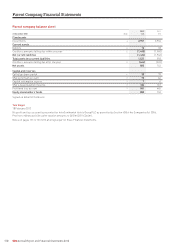

Holiday Inn 2012 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 IHG Annual Report and Financial Statements 2012

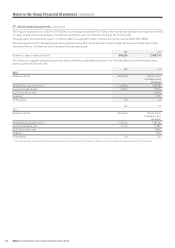

5. Creditors continued

The 6% fixed interest sterling bonds were issued on 9 December 2009 and are repayable in full on 9 December 2016. Interest is payable

annually on 9 December in each year commencing 9 December 2010 to the maturity date. The bonds were initially priced at 99.465% of

face value and are unsecured.

The 3.875% fixed interest sterling bonds were issued on 28 November 2012 and are repayable on 28 November 2022. Interest is payable

annually on 28 November in each year commencing 28 November 2013 to the maturity date. The bonds were initially priced at 98.787% of

face value and are unsecured.

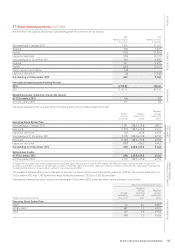

6. Share capital

Number

of shares

millions £m

Allotted, called up and fully paid

At 1 January 2012 (ordinary shares of 1329⁄47p each) 290 39

Share capital consolidation (19) –

Issued on exercise of share options 1 1

Repurchased and cancelled under repurchase programme (4) (1)

At 31 December 2012 (ordinary shares of 14194 ⁄329p each) 268 39

On 7 August 2012, the Group announced a planned $1bn return to shareholders comprising a $0.5bn special dividend with share

consolidation and a $0.5bn share repurchase programme. The share consolidation was approved on 8 October 2012 at a General Meeting

(GM) of the Company and became effective on 9 October 2012 on the basis of 14 new ordinary shares of 14194 ⁄329p each for every 15 existing

ordinary shares of 1329⁄47p each. The special dividend of 108.4p per share was paid to shareholders on 22 October 2012 at a total cost of

£315m (see note 9). Under the authority granted by shareholders at the GM held on 8 October 2012, the share repurchase programme

commenced in November 2012 resulting in the repurchase of 4,143,960 shares in the period to 31 December 2012 for a total consideration

of £67m. Transaction costs relating to shareholder returns of £1m, net of tax, have been charged to retained earnings.

No shares were repurchased in 2011.

The authority given to the Company at the GM held on 8 October 2012 to purchase its own shares was still valid at 31 December 2012.

A resolution to renew the authority will be put to shareholders at the Annual General Meeting (AGM) on 24 May 2013.

The Company no longer has an authorised share capital.

The aggregate consideration in respect of ordinary shares issued under option schemes during the year was £7m (2011 £5m).

Thousands

Options to subscribe for ordinary shares

At 1 January 2012 2,170

Exercised* (1,365)

Lapsed or cancelled (107)

At 31 December 2012 698

Option exercise price per ordinary share (pence) 438.0-619.8

Final exercise date 4 April 2015

* The weighted average option price was 492.8p for shares exercised under the Executive Share Option Plan.

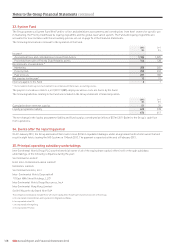

7. Movements in reserves

Share Capital Share-based

premium redemption payments Profit and

account reserve reserve loss account

£m £m £m £m

At 1 January 2012 66 6 167 465

Premium on allotment of ordinary shares 6 – – –

Repurchase of shares – – – (66)

Transfer to capital redemption reserve – 1 – (1)

Transaction costs relating to shareholder returns – – – (1)

Profit after tax – – – 610

Share-based payments capital contribution – – 17 –

Dividends – – – (426)

At 31 December 2012 72 7 184 581

Notes to the Parent Company Financial Statements continued