Holiday Inn 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 IHG Annual Report and Financial Statements 2012

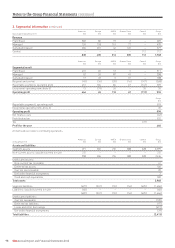

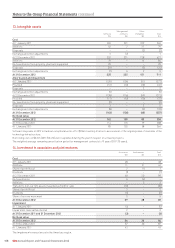

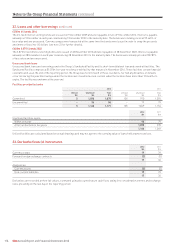

11. Assets sold and held for sale

Assets sold

During the year ended 31 December 2012, the Group sold an interest in a hotel in the Europe region.

During the year ended 31 December 2011, the Group sold four hotels, three in the Americas region and one in the AMEA region. The gain on

disposal mainly related to the sale of the Holiday Inn Burswood in Australia. The other significant disposal was the Hotel Indigo San Diego

which resulted in an impairment reversal (see note 10) in March 2011 on classification as held for sale.

2012 2011

$m $m

Consideration

Current year disposals:

Cash consideration, net of costs paid 4 142

Management contract value – 2

4 144

Net assets disposed of (6) (107)

(Loss)/gain on disposal of assets from continuing operations (2) 37

Net cash inflow

Current year disposals:

Cash consideration, net of costs paid 4 142

Tax – (1)

Prior year disposals:

Tax (3) –

1 141

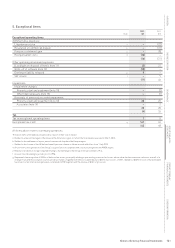

Assets held for sale

Two hotels, the InterContinental New York Barclay and the InterContinental London Park Lane, and one associate investment met the held

for sale criteria of IFRS 5 at 31 December 2012. The InterContinental New York Barclay was held for sale at 31 December 2011.

2012 2011

$m $m

Assets and liabilities held for sale

Non-current assets classified as held for sale:

Property, plant and equipment 524 217

Associates 10 –

534 217

Liabilities classified as held for sale:

Deferred tax (note 26) 61 60

Notes to the Group Financial Statements continued