Holiday Inn 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Notes to the Group Financial Statements 115

21. Financial risk management continued

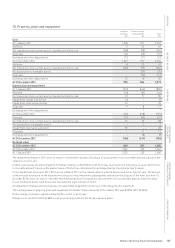

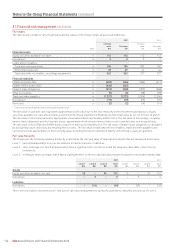

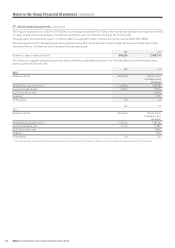

The following table reconciles movements in instruments classified as Level 3 during the year:

2012 2011

$m $m

At 1 January 97 84

Additions – 1

Repaid (1) (3)

Valuation (losses)/ gains recognised in other comprehensive income (2) 16

Impairment* – (1)

At 31 December 94 97

* The impairment charge recognised in the income statement in 2011 (see note 5) included $2m of losses reclassified from equity.

The Level 3 equity securities relate to investments in unlisted shares which are valued by applying an average price-earnings (P/E) ratio for

a competitor group to the earnings generated by the investment or by reference to share of net assets. A 10% increase in the average P/E

ratio would result in a $5m increase (2011 $5m) in the fair value of the investments and a 10% decrease in the average P/E ratio would

result in a $5m decrease (2011 $5m) in the fair value of the investments. A 10% increase in net assets would result in a $2m increase

(2011 $3m) in the fair value of the investments and a 10% decrease in net assets would result in a $2m decrease (2011 $3m) in the fair

value of the investments.

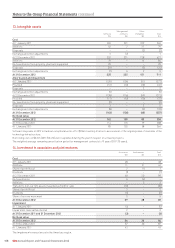

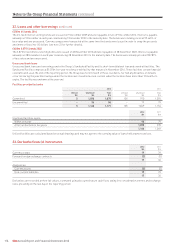

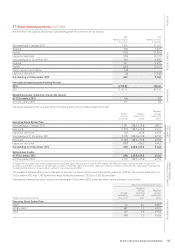

22. Loans and other borrowings

2012 2011

Current Non-current Total Current Non-current Total

$m $m $m $m $m $m

Secured bank loans – 5 5 5 – 5

Finance lease obligations 16 196 212 16 193 209

£250m 6% bonds 2016 – 403 403 – 384 384

£400m 3.875% bonds 2022 – 638 638 – – –

Unsecured bank loans – – – – 93 93

Total borrowings 16 1,242 1,258 21 670 691

Denominated in the following currencies:

Sterling – 1,041 1,041 – 384 384

US dollars 16 196 212 16 286 302

Other – 5 5 5 – 5

16 1,242 1,258 21 670 691

Secured bank loans

The New Zealand dollar mortgage is secured on the hotel property to which it relates.

Non-current amounts include $5m (2011 $nil) repayable by instalments.

Finance lease obligations

Finance lease obligations, which relate to the 99-year lease (of which 93 years remain) on the InterContinental Boston, are payable

as follows:

2012 2011

Minimum Present Minimum Present

lease value of lease value of

payments payments payments payments

$m $m $m $m

Less than one year 16 16 16 16

Between one and five years 64 48 64 48

More than five years 3,316 148 3,332 145

3,396 212 3,412 209

Less: amount representing finance charges (3,184) – (3,203) –

212 212 209 209

The Group has the option to extend the term of the lease for two additional 20-year terms. Payments under the lease step up at regular

intervals over the lease term.