Holiday Inn 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 IHG Annual Report and Financial Statements 2012

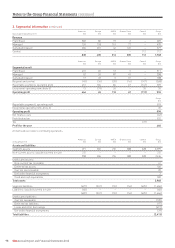

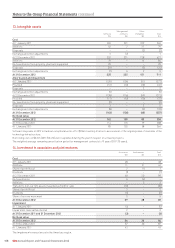

9. Earnings per ordinary share

Basic earnings per ordinary share is calculated by dividing the profit for the year available for IHG equity holders by the weighted average

number of ordinary shares, excluding investment in own shares, in issue during the year.

Diluted earnings per ordinary share is calculated by adjusting basic earnings per ordinary share to reflect the notional exercise of the

weighted average number of dilutive ordinary share options outstanding during the year.

Adjusted earnings per ordinary share is disclosed in order to show performance undistorted by exceptional items, to give a more

meaningful comparison of the Group’s performance.

Continuing and total operations 2012 2011

Basic earnings per ordinary share

Profit available for equity holders ($m) 544 460

Basic weighted average number of ordinary shares (millions) 287 289

Basic earnings per ordinary share (cents) 189.5 159.2

Diluted earnings per ordinary share

Profit available for equity holders ($m) 544 460

Diluted weighted average number of ordinary shares (millions) 292 296

Diluted earnings per ordinary share (cents) 186.3 155.4

Adjusted earnings per ordinary share

Profit available for equity holders ($m) 544 460

Adjusting items (note 5):

Exceptional operating items ($m) 4 (35)

Tax on exceptional operating items ($m) (1) (5)

Exceptional tax credit ($m) (141) (43)

Adjusted earnings ($m) 406 377

Basic weighted average number of ordinary shares (millions) 287 289

Adjusted earnings per ordinary share (cents) 141.5 130.4

Adjusted diluted earnings per ordinary share

Adjusted earnings ($m) 406 377

Diluted weighted average number of ordinary shares (millions) 292 296

Adjusted diluted earnings per ordinary share (cents) 139.0 127.4

2012 2011

millions millions

Diluted weighted average number of ordinary shares is calculated as:

Basic weighted average number of ordinary shares 287 289

Dilutive potential ordinary shares – employee share options 5 7

292 296

Notes to the Group Financial Statements continued