Holiday Inn 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

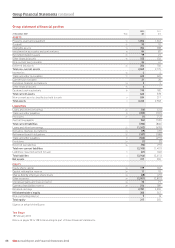

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Governance

Other statutory information

Directors’ Remuneration Report and Other statutory information 79

Pages 1 to 80 (together with the sections of the Annual Report incorporated by

reference) constitute the Directors’ Report. The Directors present their report for the

financial year ended 31 December 2012.

Principal activities

InterContinental Hotels Group PLC (the Company), registered and

domiciled in England and Wales, with registered number 5134420,

is the holding company of the InterContinental Hotels Group (the

Group). The Group franchises, manages, owns and leases over

4,600 hotels with nearly 676,000 guest rooms in nearly 100 countries

and territories around the world.

General

Articles of Association (Articles)

The Company’s Articles may only be amended by special resolution.

Subject to the Articles and any relevant legislation, all Director

appointments must be ratified by the shareholders. The Articles

are available on the Company’s website www.ihgplc.com/investors

under corporate governance.

Annual General Meeting (AGM)

The Notice convening the AGM to be held at 11.00am on Friday,

24 May 2013 is contained in a circular sent to shareholders at the

same time as this Annual Report.

Board of Directors

Biographical details of Directors who served on the Board as at

18 February 2013 are shown on pages 46 and 47. The following were

Directors during 2012 and held office throughout the year, unless

otherwise indicated:

Executive Directors Non-Executive Directors

Kirk Kinsell Graham Allan1

Tracy Robbins Patrick Cescau2

Tom Singer David Kappler

Richard Solomons Jennifer Laing

Jonathan Linen

Luke Mayhew

Dale Morrison

David Webster2

Ying Yeh

1 Graham Allan resigned as a Non-Executive Director on 15 June 2012.

2 Patrick Cescau was appointed on 1 January 2013 following the retirement of

David Webster on 31 December 2012.

Employees

IHG directly employed an average of 7,981 people worldwide during

2012, whose costs are borne by the Group. When the whole IHG

estate is taken into account (including staff working in the franchised

and managed hotels) more than 350,000 people worked globally

across all IHG’s brands at 31 December 2012.

Group Code of Ethics and Business Conduct (Group Code of Conduct)

As part of our commitment to being a Responsible Business, the

Board has a Group Code of Conduct relating to the lawful and ethical

conduct of business by its employees. All Directors and employees

are expected to observe the high standards set out in the Group Code

of Conduct and adhere to the Company values.

Further information regarding the Group’s employment policies,

including its obligations under equal opportunities legislation, its

commitment to employee communications and its approach towards

employee development, can be found on pages 30 to 33.

Subsidiaries, joint ventures and associated undertakings

The Group has over 290 subsidiary, joint venture and associated

undertakings.

Shares

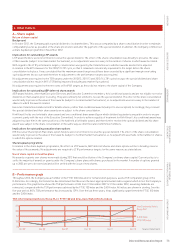

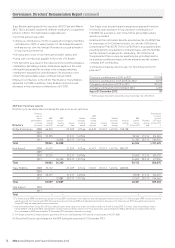

Results and dividends

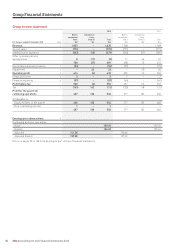

The operating profit before exceptional items was $614m: the Group’s

income statement is set out on page 84. An interim dividend of

13.5 pence per share (21.0 cents per ADR) was paid on 28 September

2012. A special dividend of 108.4 pence per share ($1.72 per ADR)

was paid on 22 October 2012. The Directors are recommending

a final dividend of 27.7 pence per share (43.0 cents per ADR) to be

paid on 31 May 2013 to shareholders on the Register of Members

at the close of business on 22 March 2013. Therefore, excluding the

special dividend, the full-year dividend will be 41.2 pence per share

(64.0 cents per ADR) (2011 34.5 pence per share (55.0 cents per

ADR)). Total dividends relating to the year, excluding the special

dividend, are expected to amount to $176m.

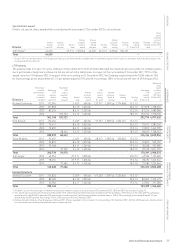

Share capital

The Company’s issued share capital at 31 December 2012 consisted

of 268,325,071 ordinary shares of 14194 /329 pence each. There are no

special control rights or restrictions on share transfers or limitations

on the holding of any class of shares. During the year, 1,365,258 new

shares were issued under employee share plans and the Company

completed a share consolidation and commenced a share buyback

(see below).

Employee share ownership trust

IHG operates an Employee Share Ownership Trust (ESOT) for the

benefit of employees and former employees. The ESOT purchases

shares in the market and releases them to current and former

employees in satisfaction of share awards. During the year, the ESOT

released 3,219,427 shares and at 31 December 2012 it held 1,814,507

shares in the Company. The ESOT adopts a prudent approach to

purchasing shares, using funds provided by the Group, based on

expectations of future requirements.

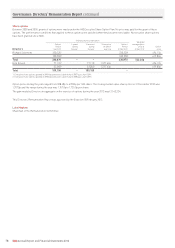

2012 share awards and grants

No awards or grants over shares were made during 2012 that would

be dilutive of the Company’s ordinary share capital. Current policy is

to settle the majority of awards or grants under the Company’s share

plans with shares purchased in the market. A number of options

granted up to 2005 are yet to be exercised and will be settled with the

issue of new shares.

The Company has not utilised the authority given by shareholders at

any of its AGMs to allot shares for cash without first offering such

shares to existing shareholders.

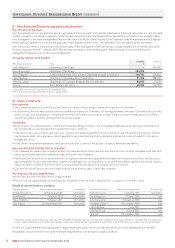

Share issues and buybacks

On 7 August 2012, the Company announced a $1bn return of funds to

shareholders via a special dividend of $0.5bn and share consolidation

on a 14 for 15 basis and a share buyback programme of $0.5bn. The

share buyback authority remains in force until the AGM in 2013, and

a resolution to renew the authority will be put to shareholders at

that AGM.

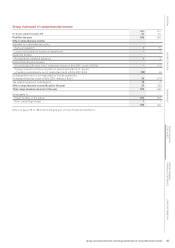

During the year the following transactions took place which affected

the Company’s issued share capital:

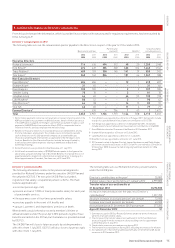

Period Event Ordinary shares

1 Jan to 31 Dec 2012 Share plan exercises 1,365,258

9 Oct 2012 14 for 15 share consolidation n/a

12 Nov to 20 Dec 2012 Share buyback 4,143,960