Holiday Inn 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Directors’ Remuneration Report 71

B – Executive shareholding requirement

The Committee believes that share ownership by Executive Directors and senior executives strengthens the link between the individuals’

personal interests and those of the shareholders.

Executive Directors are expected to hold all shares earned (net of any share sales required to meet personal tax liabilities) until the guideline

shareholding requirement is achieved.

The table below excludes share options held by Richard Solomons, details of which can be found on page 78.

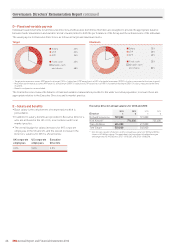

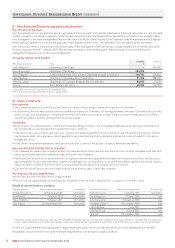

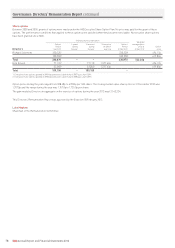

C – Annual Bonus Plan(ABP)

Structure

In 2012, Executive Directors participated in the ABP, which will be

replaced from 2013 by the APP, details of which can be found on

page 67.

The structure of the ABP is as follows:

ABP

2012

30%

individual

50%

cash

Performance

measures Payment

structure

70%

EBIT

50% shares

(deferred for

three years)

The measures for 2012 were:

• Global EBIT achievement against target for 2012:

– threshold payout: 90% of target performance;

– maximum payout: 110% of target performance; and

– straight-line vesting in between.

• OPR – based on achievement of specific individual objectives

linked directly to strategic priorities, and an assessment against

leadership competencies and behaviours. The objectives and

OPRs are reviewed and agreed by the Committee.

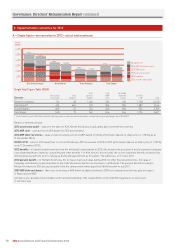

2012 target and maximum payments

Award as % of salary

Key performance

Measure indicator Target Maximum

Financial EBIT (70%) 80.5 161

Individual OPR (30%) 34.5 69

Total for 2012 115 200*

* Combined EBIT and OPR payout subject to a maximum of 200% of base salary.

Outcome for 2012

2012 EBIT achieved was 101.7% of target for the year. Based on this

performance, the following table shows the level of 2012 awards.

50% was paid in cash and 50% in deferred shares that will vest after

three years.

EBIT % OPR % Total award as

Director award award % of salary

Richard Solomons 93.8 43.1 136.9

Kirk Kinsell 93.8 34.5 128.3

Tracy Robbins 93.8 51.8 145.6

Tom Singer 93.8 34.5 128.3

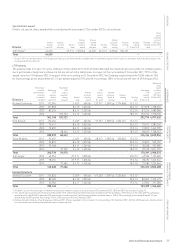

Shares held by Executive Directors

Shares held outright Total shares and awards4 Guideline shareholding requirement

ABP deferred

Guideline Shares held share LTIP share Total shares

shareholding as outright as awards as awards as and awards as

Director % of salary % of salary1 % of salary2 % of salary3 % of salary4

Richard Solomons 300 763 153 693 1,609

Kirk Kinsell 200 557 180 776 1,513

Tracy Robbins 200 355 167 706 1,228

Tom Singer5 200 66 0 715 781

Percentages are based on share price of 1,707.0p per share as at 31 December 2012.

1 Shares held outright by each Executive Director with no restrictions.

2 ABP deferred share awards subject to risk of forfeiture if employment ceases.

3 LTIP share awards subject to achievement of corporate performance targets.

4 Includes shares held outright, ABP deferred shares and LTIP share awards.

5 Tom Singer joined in 2011 and did not qualify for the 2011 ABP deferred share award.

01,600200 400 600 800 1,000 1,200 1,400

%

Richard

Solomons

Kirk

Kinsell

Tom

Singer

Tracy

Robbins