Holiday Inn 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Directors’ Remuneration Report 73

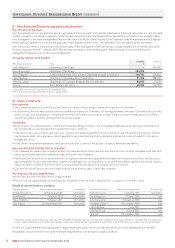

A – Share capital

Return of share capital

Background

In October 2012, the Company paid a special dividend to its shareholders. This was accompanied by a share consolidation in order to maintain

comparability (as far as possible) of the share price before and after the payment of the special dividend. In addition, the Company commenced

a share buyback programme in November 2012.

Implications for outstanding LTIP awards

LTIP award holders were not entitled to receive the special dividend. The effect of the share consolidation was broadly to preserve the value

of their awards (subject to normal market fluctuations), so no adjustment was necessary to the number of shares to which awards related.

With regard to the LTIP performance targets, consideration was given by the Committee as to whether awards needed to be adjusted

in relation to the EPS measure for the 2010/12 LTIP cycle, so that it remained economically equivalent to the target before the share

consolidation took place. It was concluded that the maximum award target would have been exceeded by a significant margin even taking

such adjustment into account and therefore no adjustment to the performance targets was required.

No adjustment was required to the TSR targets under the 2010/12, 2011/13 and 2012/14 LTIP cycles because the special dividend and share

consolidation did not result in IHG’s TSR being impacted (excluding any market fluctuations).

No adjustment was required to the net rooms or RevPAR targets as these did not relate to the share capital of the Company.

Implications for outstanding ABP deferred share awards

ABP award holders, other than Executive Directors and Executive Committee members, hold conditional awards and are not eligible to receive

dividends on their awards prior to vesting. They were similarly not entitled to receive the special dividend. The effect of the share consolidation

was broadly to preserve the value of their awards (subject to normal market fluctuations), so no adjustment was necessary to the number of

shares to which the awards related.

Executive Committee members hold forfeitable shares, rather than conditional awards (subject to one exception). Accordingly, they received

the special dividend and their share awards were subject to the share consolidation.

Kirk Kinsell holds one forfeitable share award and one conditional share award (upon which dividend equivalents are paid in order to ensure

economic parity with the rest of the Executive Committee). In order to achieve equality of treatment for Kirk Kinsell, his conditional award was

adjusted to place him in the same position as if he had held a forfeitable award, and therefore he received the special dividend and his share

award was subject to the share consolidation, in the same way as other Executive Committee members.

Implications for outstanding executive share options

IHG Executive Share Option Plan share option holders were not entitled to receive the special dividend. The effect of the share consolidation

was broadly to preserve the value of their awards (subject to normal market fluctuations), so no adjustment was made to the number of shares

to which the options related.

Share buyback programme

In relation to the share buyback programme, the effect on LTIP awards, ABP deferred shares and share options will be to broadly preserve

the value of those awards. No adjustments are required to LTIP performance targets for the same reasons as stated above.

Use of share capital in incentive plans

No awards or grants over shares were made during 2012 that would be dilutive of the Company’s ordinary share capital. Current policy is to

settle the majority of awards or grants under the Company’s share plans with shares purchased in the market. A number of options granted

up to 2005 are yet to be exercised and will be settled with the issue of new shares.

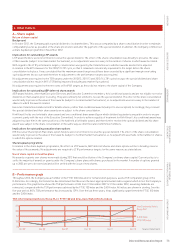

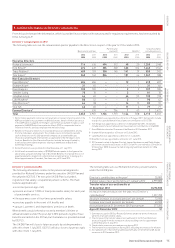

B – Performance graph

Throughout 2012, the Company was a member of the FTSE 100 index and, for remuneration purposes, used a TSR comparator group of the

DJGH index. Accordingly, the Committee has determined that these are the most appropriate market indices against which to test the Company’s

performance. The graph below shows the TSR performance of IHG from 31 December 2007 to 31 December 2012, assuming dividends are

reinvested, compared with the TSR performance achieved by the FTSE 100 index and the DJGH index. All indices are shown in sterling. Over the

five-year period, IHG’s TSR performance has increased by 139%. Over the last three years, it has significantly outperformed the FTSE 100 index

and the DJGH index.

TSR: InterContinental Hotels Group PLC v FTSE 100 and Dow Jones Global Hotels indices

250

200

150

100

50 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 Dec 12

InterContinental Hotels

Group PLC

FTSE 100 index

DJGH index

4. Other matters

Source: Datastream