Holiday Inn 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 IHG Annual Report and Financial Statements 2012

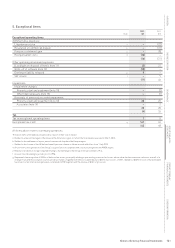

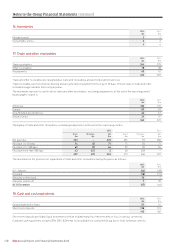

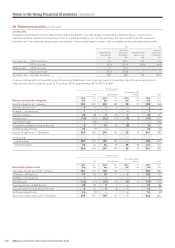

16. Inventories

2012 2011

$m $m

Finished goods 2 2

Consumable stores 2 2

4 4

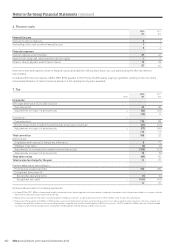

17. Trade and other receivables

2012 2011

$m $m

Trade receivables 344 299

Other receivables 18 28

Prepayments 60 42

422 369

Trade and other receivables are designated as loans and receivables and are held at amortised cost.

Trade receivables are non-interest-bearing and are generally on payment terms of up to 30 days. The fair value of trade and other

receivables approximates their carrying value.

The maximum exposure to credit risk for trade and other receivables, excluding prepayments, at the end of the reporting period

by geographic region is:

2012 2011

$m $m

Americas 186 170

Europe 83 69

Asia, Middle East and Africa 64 61

Greater China 29 27

362 327

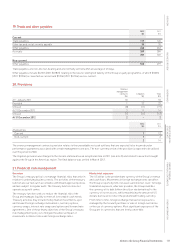

The ageing of trade and other receivables, excluding prepayments, at the end of the reporting period is:

2012 2011

Gross Provision Net Gross Provision Net

$m $m $m $m $m $m

Not past due 223 – 223 201 (1) 200

Past due 1 to 30 days 74 (3) 71 73 (2) 71

Past due 31 to 180 days 69 (3) 66 59 (3) 56

Past due more than 180 days 43 (41) 2 40 (40) –

409 (47) 362 373 (46) 327

The movement in the provision for impairment of trade and other receivables during the year is as follows:

2012 2011

$m $m

At 1 January (46) (58)

Provided (18) (15)

Amounts written back 10 7

Amounts written off 7 20

At 31 December (47) (46)

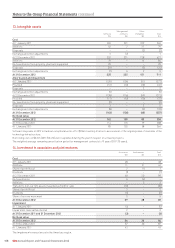

18. Cash and cash equivalents

2012 2011

$m $m

Cash at bank and in hand 57 51

Short-term deposits 138 131

195 182

Short-term deposits are highly liquid investments with an original maturity of three months or less, in various currencies.

Cash and cash equivalents includes $7m (2011 $2m) that is not available for use by the Group due to local exchange controls.

Notes to the Group Financial Statements continued