Holiday Inn 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Performance 19

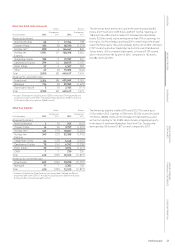

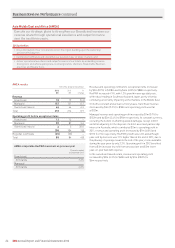

Hotels Rooms

At 31 December 2012

Change over

2011 2012

Change over

2011

Analysed by brand

InterContinental 170 157,314 (284)

Crowne Plaza 392 5108,307 3,203

Holiday Inn* 1,247 7231,488 3,232

Holiday Inn Express 2,192 78 205,631 8,965

Staybridge Suites 189 10 20,696 1,129

Candlewood Suites 299 14 28,675 1,175

Hotel Indigo 50 11 5,661 1,097

Other 63 (4) 18,210 (883)

Total 4,602 122 675,982 17,634

Analysed by ownership type

Franchised 3,934 102 500,792 11,721

Managed 658 21 170,998 6,005

Owned and leased 10 (1) 4,192 (92)

Total 4,602 122 675,982 17,634

* Includes 10 Holiday Inn Club Vacations (3,701 rooms) and 37 Holiday Inn Resort

properties (8,806 rooms) (2011: 7 Holiday Inn Club Vacations (2,928 rooms) and

32 Holiday Inn Resort properties (7,809 rooms)).

During 2012, the IHG global System (the number of hotels and rooms

which are franchised, managed, owned or leased by the Group)

increased by 122 hotels (17,634 rooms).

Openings of 226 hotels (33,922 rooms) were driven by continued

expansion in the US, particularly within the Holiday Inn brand family

which opened more than 11,000 rooms during 2012, and Greater

China. The level of hotel removals fell from 198 hotels (33,078 rooms)

in 2011 to 104 hotels (16,288 rooms) in 2012, as anticipated following

the completion of the Holiday Inn relaunch.

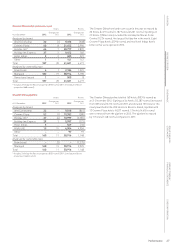

Global hotel and room count

Hotels Rooms

At 31 December 2012

Change over

2011 2012

Change over

2011

Analysed by brand

InterContinental 48 (3) 15,713 (1,910)

Crowne Plaza 98 (10) 31,183 (3,460)

Holiday Inn* 243 (24) 44,988 (5,762)

Holiday Inn Express 452 (18) 51,760 (441)

Staybridge Suites 71 (24) 7,544 (2,482)

Candlewood Suites 78 (16) 6,742 (1,320)

Hotel Indigo 47 (12) 5,869 (1,310)

EVEN 11230 230

HUALUXE 15 15 4,904 4,904

Other ––97 97

Total 1,053 (91) 169,030 (11,454)

Analysed by ownership type

Franchised 744 (109) 82,901 (13,612)

Managed 309 18 86,129 2,158

Total 1,053 (91) 169,030 (11,454)

* Includes nil Holiday Inn Club Vacations (nil rooms) and 12 Holiday Inn Resort

properties (2,390 rooms) (2011: 1 Holiday Inn Club Vacations (658 rooms) and

15 Holiday Inn Resort properties (3,037 rooms)).

Global pipeline signings

Hotels Rooms

At 31 December 2012

Change over

2011 2012

Change over

2011

Total 356 –53,812 (1,612)

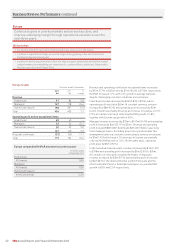

Global pipeline

At the end of 2012, the pipeline totalled 1,053 hotels (169,030 rooms).

The IHG pipeline represents hotels and rooms where a contract has

been signed and the appropriate fees paid. The continued global

demand for IHG brands is demonstrated by over 50% of pipeline

rooms being outside of The Americas region, including 30% in

Greater China.

Excluding 25 hotels (4,796 rooms) signed as part of the US

government’s Privatization of Army Lodgings initiative in 2011,

signings increased from 331 hotels (50,628 rooms) to 356 hotels

(53,812 rooms). Signings during 2012 included 15 hotels for the

HUALUXE Hotels & Resorts brand, as well as the first signing for

the EVEN Hotels brand.

During 2012, the opening of 33,922 rooms contributed to a net

pipeline decline of 11,454 rooms. Active management out of the

pipeline of deals that have become dormant or no longer viable

reduced the pipeline by 31,344 rooms, representing a decrease

of 11.8% over 2011.