Holiday Inn 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

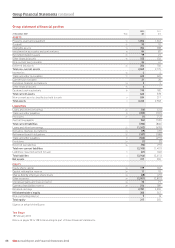

90 IHG Annual Report and Financial Statements 2012

General information

The Consolidated Financial Statements of InterContinental Hotels

Group PLC (the Group or IHG) for the year ended 31 December 2012

were authorised for issue in accordance with a resolution of the

Directors on 18 February 2013. InterContinental Hotels Group PLC

(the Company) is incorporated and domiciled in Great Britain and

registered in England and Wales.

Summary of significant accounting policies

Basis of preparation

The Consolidated Financial Statements of IHG have been prepared

in accordance with International Financial Reporting Standards

(IFRSs) as adopted by the European Union and as applied in

accordance with the provisions of the Companies Act 2006.

Changes in accounting policies

With effect from 1 January 2012, the Group has implemented

the following amendments to accounting standards. Neither of

these have had any impact on the Group’s financial performance

or position during the year and there has been no requirement to

restate prior year comparatives.

• IFRS 7 (Amendment) ‘Financial Instruments: Disclosures’,

requires additional disclosures about financial assets that have

been transferred but not derecognised and about continuing

involvement in derecognised assets.

• IAS 12 (Amendment) ‘Income Taxes’, introduces a rebuttable

presumption that deferred tax on investment property measured

at fair value should be determined on the basis that its carrying

amount will be recovered through sale. The amendment also

introduces the requirement that deferred tax on non-depreciable

assets measured using the revaluation model in IAS 16 will

always be measured on a sale basis of the asset.

Presentational currency

The Consolidated Financial Statements are presented in millions

of US dollars following a management decision to change the

reporting currency from sterling during 2008. The change was

made to reflect the profile of the Group’s revenue and operating

profit which are primarily generated in US dollars or US dollar-

linked currencies.

The currency translation reserve was set to nil at 1 January 2004

on transition to IFRS and this reserve is presented on the

basis that the Group has reported in US dollars since this date.

Equity share capital, the capital redemption reserve and shares

held by employee share trusts are translated into US dollars at

the rates of exchange on the last day of the period; the resultant

exchange differences are recorded in other reserves.

The functional currency of the parent company remains sterling

since this is a non-trading holding company located in the United

Kingdom that has sterling denominated share capital and whose

primary activity is the payment and receipt of interest on sterling

denominated external borrowings and inter-company balances.

Basis of consolidation

The Group Financial Statements comprise the Financial Statements

of the parent company and entities controlled by the Company.

All intra-group balances and transactions have been eliminated.

The results of those businesses acquired or disposed of are

consolidated for the period during which they were under the

Group’s control.

Foreign currencies

Transactions in foreign currencies are translated to functional

currency at the exchange rates ruling on the dates of the

transactions. Monetary assets and liabilities denominated in

foreign currencies are retranslated to the functional currency at

the relevant rates of exchange ruling on the last day of the period.

Foreign exchange differences arising on translation are recognised

in the income statement except on foreign currency borrowings

that provide a hedge against a net investment in a foreign operation.

These are taken directly to the currency translation reserve until

the disposal of the net investment, at which time they are recycled

against the gain or loss on disposal.

The assets and liabilities of foreign operations, including goodwill,

are translated into US dollars at the relevant rates of exchange

ruling on the last day of the period. The revenues and expenses of

foreign operations are translated into US dollars at average rates

of exchange for the period. The exchange differences arising on

the retranslation are taken directly to the currency translation

reserve. On disposal of a foreign operation, the cumulative amount

recognised in the currency translation reserve relating to that

particular foreign operation is recycled against the gain or loss

on disposal.

Property, plant and equipment

Property, plant and equipment are stated at cost less depreciation

and any impairment.

Repairs and maintenance costs are expensed as incurred.

Land is not depreciated. All other property, plant and equipment

are depreciated to a residual value over their estimated useful

lives, namely:

• buildings – lesser of 50 years and unexpired term of lease; and

• fixtures, fittings and equipment – three to 25 years.

All depreciation is charged on a straight-line basis. Residual value

is re-assessed annually.

Property, plant and equipment are tested for impairment when

events or changes in circumstances indicate that the carrying value

may not be recoverable. Assets that do not generate independent

cash flows are combined into cash-generating units. If carrying

values exceed their estimated recoverable amount, the assets

or cash-generating units are written down to the recoverable

amount. Recoverable amount is the greater of fair value less costs

to sell and value in use. Value in use is assessed based on estimated

future cash flows discounted to their present value using a pre-tax

discount rate that reflects current market assessments of the time

value of money and the risks specific to the asset. Impairment

losses, and any subsequent reversals, are recognised in the

income statement.

Accounting policies