Holiday Inn 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

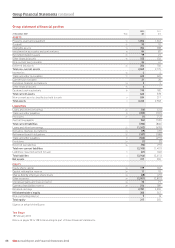

80 IHG Annual Report and Financial Statements 2012

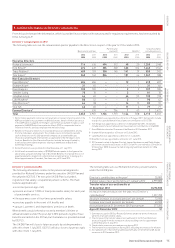

Substantial shareholdings

As at 31 December 2012 and 18 February 2013, the Company had been

notified of the following significant holdings in its ordinary shares:

As at

Shareholder 18 February 2013

Cedar Rock Capital Limited 5.07%

BlackRock, Inc. 5.02%

Legal & General Group plc 3.96%

Director share interests

Details of the beneficial interests in shares of the Company, held by

Directors who were on the Board as at 31 December 2012 (unless

otherwise indicated), are shown below. No changes to these interests

occurred between the year end and the date of this Annual Report.

As at As at

31 December 2012 31 December 2011

ordinary shares1 ordinary shares1

Executive Directors

Kirk Kinsell 155,6282 109,547

Tracy Robbins 85,703 4 3,108

Tom Singer 20,846 –

Richard Solomons 322,379 252,166

Non-Executive Directors

Patrick Cescau3 – –

David Kappler 1,308 1,400

Jennifer Laing 3,148 3,373

Jonathan Linen 6,8534 7,34 3

Luke Mayhew 1,866 2,000

Dale Morrison 4,2334 –

David Webster3 33,438 35,828

Ying Yeh – –

1 These shareholdings include all beneficial interests and those held by Directors’

spouses and other connected persons. None of the Directors have a beneficial

interest in the shares of any subsidiary. These shareholdings do not include

Executive Directors’ entitlements to share awards under the Company’s share

plans, which are set out separately in the Directors’ Remuneration Report on

pages 59 to 78.

2 155,034 ordinary shares and 594 American Depositary Receipts.

3 Patrick Cescau was appointed as a Non-Executive Chairman on 1 January 2013

following the retirement of David Webster on 31 December 2012.

4 Held in the form of American Depositary Receipts.

Finance

Charitable and political donations

In 2012, the Group donated $760,000 (2011 $1,540,000) in support of

community initiatives and charitable causes. In addition, IHG employees

and guests made contributions during 2012 to a variety of causes through

IHG facilitated channels. Taking all these contributions into account,

total donations in 2012 are estimated at $1,015,000 (2011 $2,040,000).

The Group made no political donations during the year and proposes

to maintain its policy of not making such payments.

Financial risk management

The Group’s financial risk management objectives and policies, including

its use of financial instruments, are set out on page 29 and in notes

21 to 23 to the Group Financial Statements on pages 111 to 117.

Significant agreements and change of control provisions

The Group is a party to the following arrangements which could be

terminated upon a change of control of the Company and which are

considered significant in terms of their potential impact on the

business of the Group as a whole:

• the Group’s five-year $1.07bn syndicated loan facility agreement

dated 7 November 2011, under which a change of control of the

Company would entitle each lender to cancel its commitment and

declare all amounts due to it payable;

• the terms of the £250m seven-year bond issued by the Company

on 9 December 2009, under which, if the bond’s credit rating was

downgraded in connection with a change of control, the bond

holders would have the option to require the Company to redeem

or, at the Company’s option repurchase the outstanding notes

together with interest accrued; and

• the terms of the £400m 10-year bond issued by the Company on

28 November 2012, under which, if the bond’s credit rating was

downgraded in connection with a change of control, the bond

holders would have the option to require the Company to redeem

or, at the Company’s option, repurchase the outstanding notes

together with interest accrued.

Business relationships

During 2012, the Group entered into a five-year technology

outsourcing agreement with International Business Machines

Corporation (IBM), pursuant to which IBM operates and maintains

the infrastructure of the Group’s reservations system. Otherwise,

there are no specific individual contracts or arrangements

considered to be essential to the business of the Group as a whole.

Policy on payment of suppliers

The Company has no trade creditors. Group companies apply

standard payment terms which are considered reasonable,

transparent and consistent with prevailing commercial practices.

These are agreed with suppliers, and payments are contingent on

goods or services being supplied to the required standard.

Going concern

An overview of the business activities of IHG, including a review of the key

business risks that the Group faces, is given in the Business Review on

pages 9 to 44. Information on the Group’s treasury management policies

can be found in note 21 to the Group Financial Statements on pages

111 to 115. The Group refinanced its bank debt in November 2011 and

put in place a five-year $1.07bn facility. In December 2009 the Group

issued a seven-year £250m sterling bond and, in November 2012,

a 10-year £400m sterling bond. At the end of 2012 the Group was

trading significantly within its banking covenants and debt facilities.

The Group’s fee based model and wide geographic spread means

that it is well placed to manage through uncertain times and our

forecasts and sensitivity projections, based on a range of reasonably

possible changes in trading performance, show that the Group

should be able to operate within the level of its current facilities.

After making enquiries, the Directors have a reasonable expectation

that the Company and the Group have adequate resources to

continue in operational existence for the foreseeable future and,

accordingly, they continue to adopt the going concern basis in

preparing the Financial Statements.

Events after the reporting period

As explained in note 34 to the Group Financial Statements on page 128,

the Group is expected to receive a liquidated damages payment of

$31m in February 2013.

Auditors

The Directors who held office as at the date of approval of this report

confirm that they have taken steps to make themselves aware of

relevant audit information. None of the Directors are aware of any

relevant audit information which has not been disclosed to the auditors.

Auditor reappointment

Ernst & Young LLP have expressed their willingness to continue

in office as auditors of the Company and their reappointment will

be put to shareholders at the 2013 AGM.

By order of the Board

George Turner

General Counsel and Company Secretary

18 February 2013

Governance: Other statutory information continued