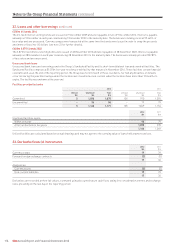

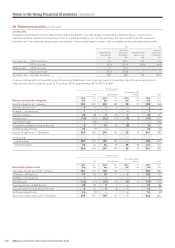

Holiday Inn 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Notes to the Group Financial Statements 121

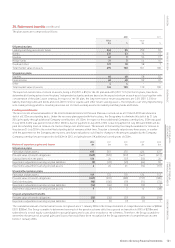

25. Retirement benefits continued

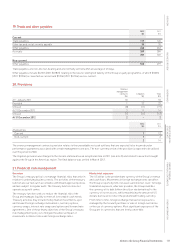

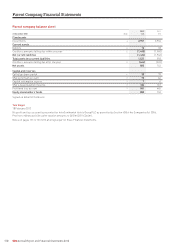

The plan assets are comprised as follows:

2012 2011

Value Value

$m % $m %

UK pension plans

Liability matching investment funds 243 35 290 53

Bonds 232 33 74 13

Equities 62 9 93 17

Hedge funds 31 5 56 10

Cash and other 127 18 38 7

Total market value of assets 695 100 551 100

US pension plans

Equities 60 48 58 53

Fixed income 60 48 52 47

Other 4 4 – –

Total market value of assets 124 100 110 100

The expected overall rates of return on assets, being 4.2% (2011 4.8%) for the UK plan and 6.8% (2011 7.3%) for the US plans, have been

determined following advice from the plans’ independent actuaries and are based on the expected return on each asset class together with

consideration of the plans’ asset strategy. In respect of the UK plan, the long-term rate of return assumptions are 3.5% (2011 3.3%) for

liability matching funds and bonds and 6.4% (2011 7.4%) for equities and other return seeking assets. The UK plan is currently implementing

a de-risking strategy which is resulting in a move out of return seeking assets into liability matching funds and bonds.

Funding commitments

The most recent actuarial valuation of the InterContinental Hotels UK Pension Plan was carried out as at 31 March 2012 and showed a

deficit of £132m on a funding basis. Under the recovery plan agreed with the trustees, the Group aims to eliminate this deficit by 31 July

2014 principally through additional Company contributions of £130m. In respect of these additional Company contributions, £10m was paid

in July 2012, £45m was paid in October 2012, £30m is due for payment in July 2013, £15m is due for payment in July 2014 and £30m will be

paid into a funding trust on release of a trustee charge over a hotel asset. The amount in the funding trust may be available for release to

the plan on 31 July 2014 to the extent that a funding deficit remains at that time. The plan is formally valued every three years, or earlier

with the agreement of the Company and trustees, and future valuations could lead to changes in the amounts payable by the Company.

Company contributions are expected to be $62m in 2013, including known UK additional contributions of £30m.

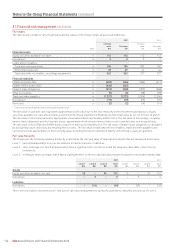

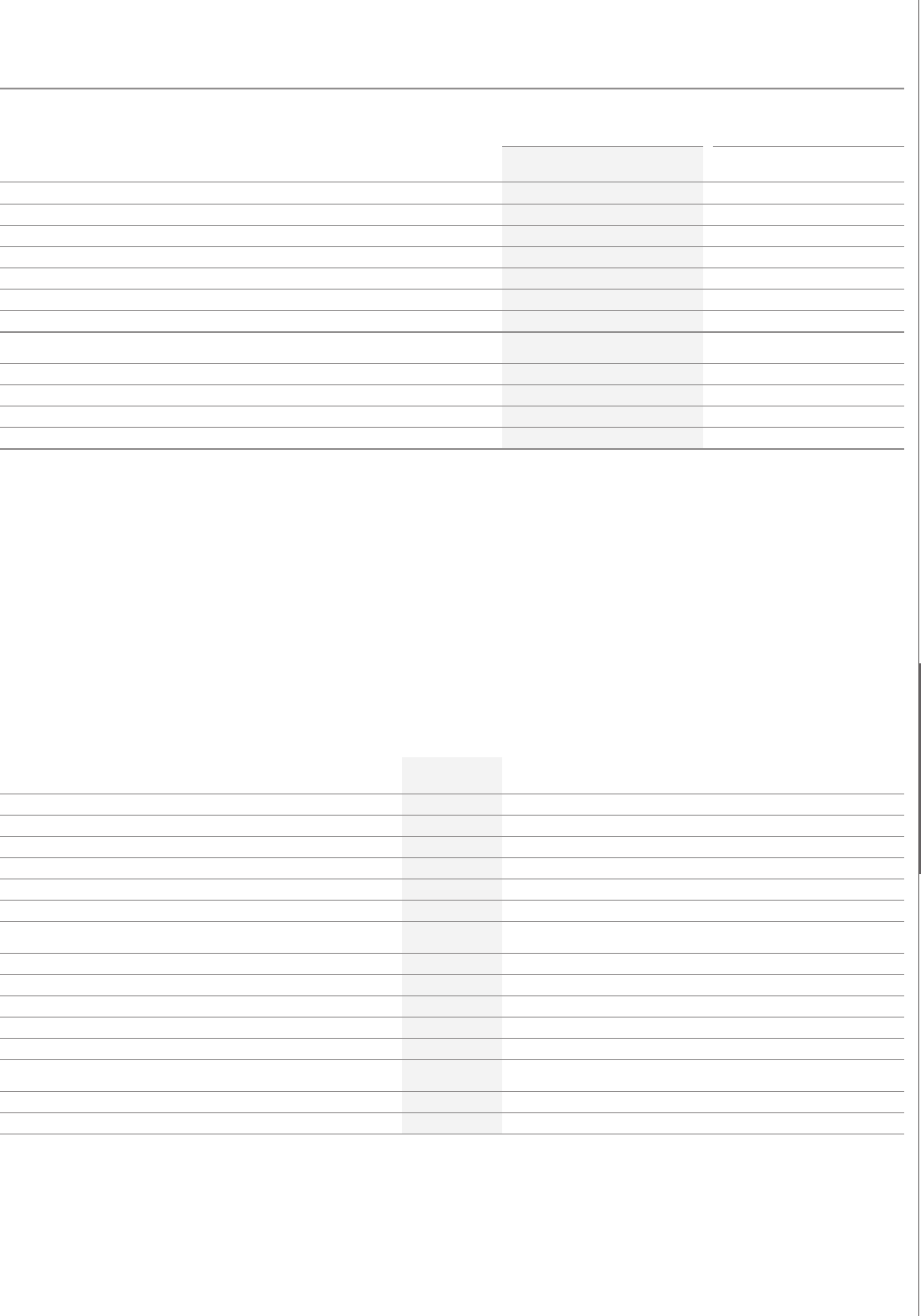

2012 2011 2010 2009 2008

History of experience gains and losses $m $m $m $m $m

UK pension plans

Fair value of plan assets 695 551 475 426 437

Present value of benefit obligations (569) (525) (512) (461) (411)

Surplus/(deficit) in the plans 126 26 (37) (35) 26

Experience adjustments arising on plan liabilities (3) (22) (49) (44) 55

Experience adjustments arising on plan assets 6 24 21 (14) (57)

US and other pension plans

Fair value of plan assets 149 133 130 126 112

Present value of benefit obligations (247) (233) (209) (197) (185)

Deficit in the plans (98) (100) (79) (71) (73)

Experience adjustments arising on plan liabilities (16) (26) (13) (13) 3

Experience adjustments arising on plan assets 9 (5) 3 14 (38)

US post-employment benefits

Present value of benefit obligations (25) (30) (27) (20) (19)

Experience adjustments arising on plan liabilities 5 (3) (7) (1) 1

The cumulative amount of net actuarial losses recognised since 1 January 2004 in the Group statement of comprehensive income is $284m

(2011 $285m). The Group is unable to determine how much of the pension scheme deficit recognised on transition to IFRS of $298m and

taken directly to total equity is attributable to actuarial gains and losses since inception of the schemes. Therefore, the Group is unable to

determine the amount of actuarial gains and losses that would have been recognised in the Group statement of comprehensive income

before 1 January 2004.