Holiday Inn 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 IHG Annual Report and Financial Statements 2012

operating profit from owned and leased hotels, managed leases and

significant liquidated damages).

Currently 86 per cent of our Group operating profit (before regional and

central overheads and exceptional items) is derived from franchised

and managed operations. In some situations, IHG supports its brands

by using its capital to build or support the funding of flagship assets in

high-demand locations in order to drive growth. We plan to recycle

capital by selling these assets when the time is right and to reinvest

elsewhere in the business and across our portfolio.

On 6 November 2012, we announced that the InterContinental London

Park Lane would be the next hotel considered for sale and that

discussions regarding the disposal of the InterContinental New York

Barclay were progressing and would be opened to a wider group of

prospective buyers.

We continue to invest for growth, strengthening both our existing

brands and launching new ones.

Winning with a portfolio of preferred Brands

We aim to build a portfolio of brands that are bigger, better, and stronger:

• Bigger means we have prioritised our growth strategy to

build brand scale and leverage this scale through greater

operational efficiency.

• Better means a focus on continuous improvement in how we

develop and deliver our brands to ensure guest needs are met

with a consistent, high-quality experience.

• Stronger means a focus on driving brand preference among

guests, owners, investors and employees.

As part of our commitment to deliver against our brand strategy,

in 2012, IHG launched two unique new brands to the market, which

complement our overall portfolio of brands.

As of 31 December 2012, IHG’s portfolio comprised the following brands:

Our new brands

EVEN Hotels was launched in February 2012 following extensive

customer research in order to create a brand that meets travellers’

holistic wellness needs. EVEN Hotels is aimed at business and leisure

travellers who are looking for a wellness experience in a hotel stay

at a mainstream price point. IHG is investing up to $150 million in

establishing the brand, owning and managing the first hotels to ensure

the brand achieves its potential and market share growth in the US.

During 2012, IHG signed the first EVEN hotel located in the heart of

midtown Manhattan, New York.

How we win

Competing with an appropriate business model

COPY TO COME

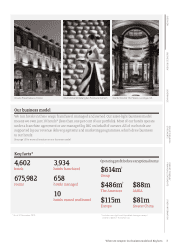

Managed

We manage 658 hotels

worldwide

Owned and leased

We own 10 hotels worldwide

(less than one per cent of

our portfolio)

IHG

IHG

IHG

IHG

IHG usually

supplies

General

Manager as

a minimum

IHG

Third-party

IHG

Low/none

High

Franchised

This is the largest part of our

business: 3,934 hotels operate

under franchise agreements

IHG IHG Third-party Third-party None Fee % of

rooms

revenue

Brand

ownership Marketing and

distribution

Staff Hotel

ownership

IHG capital

IHG income

Fee % of total

revenue plus

% of profit

All revenues

and profits

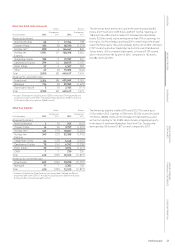

IHG global hotel count by ownership type

at 31 December 2012

■ Franchised

■ Managed

■ Owned and leased

3,934 hotels

658 hotels

10 hotels

As can be seen in the diagrams above and below, our business model

is focussed on franchising and managing hotels, rather than owning

them, enabling us to grow at an accelerated pace with limited capital

investment. This allows IHG to focus on building strong, preferred

Brands based on relevant consumer needs, leaving asset management

and real estate to our local third party owners with the necessary

expertise. With this asset-light approach, IHG also benefits from

the reduced volatility of fee based income streams, as compared with

the ownership of assets. It allows IHG to focus on building strong

Delivery systems such as our branded hotel websites and call

centres, creating greater returns for owners.

A key characteristic of the franchised and managed business

model is that it is highly cash generative, with a high return on

capital employed. It enables us to focus on growing our fee revenue

(Group revenue excluding owned and leased hotels, managed

leases and significant liquidated damages) and fee based margins

(operating profit as a percentage of revenue, excluding revenue and

■ Franchised 61%

■ Managed 25%

■ Owned and leased 14%

IHG continuing operating profit* by ownership type

for the year ended 31 December 2012

*Before regional and central overheads and exceptional items

Business Review: Our strategy continued