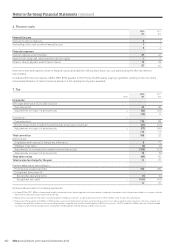

Holiday Inn 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Notes to the Group Financial Statements 105

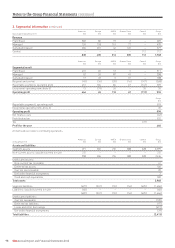

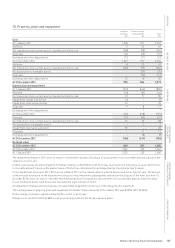

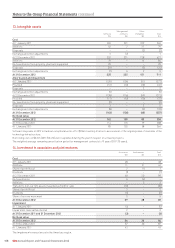

10. Property, plant and equipment

Land and Fixtures, fittings

buildings and equipment Total

$m $m $m

Cost

At 1 January 2011 1,548 997 2,545

Additions 2 54 56

Net transfers to non-current assets classified as held for sale (258) (98) (356)

Disposals (44) (25) (69)

Exchange and other adjustments (11) (11) (22)

At 31 December 2011 1,237 917 2,154

Additions 8 33 41

Net transfers to non-current assets classified as held for sale (265) (99) (364)

Reclassification to intangible assets – (25) (25)

Disposals – (12) (12)

Exchange and other adjustments 15 10 25

At 31 December 2012 995 824 1,819

Depreciation and impairment

At 1 January 2011 (213) (642) (855)

Provided (10) (56) (66)

Net transfers to non-current assets classified as held for sale 19 71 90

Impairment charge (see below) (2) – (2)

Impairment reversal (see below) 23 – 23

Disposals 9 8 17

Exchange and other adjustments – 1 1

At 31 December 2011 (174) (618) (792)

Provided (11) (46) (57)

Net transfers to non-current assets classified as held for sale 16 42 58

Reclassification to intangible assets – 2 2

Impairment reversals (see below) 23 – 23

Disposals – 11 11

Exchange and other adjustments – (8) (8)

At 31 December 2012 (146) (617) (763)

Net book value

At 31 December 2012 849 207 1,056

At 31 December 2011 1,063 299 1,362

At 1 January 2011 1,335 355 1,690

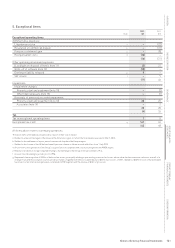

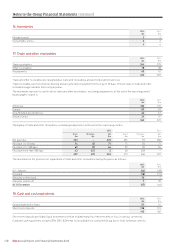

The impairment charge in 2011 arose in respect of one hotel in Europe following a re-assessment of its recoverable amount, based on fair

value less costs to sell.

In 2012, a previously recorded impairment charge relating to a North American hotel was reversed in full following a re-assessment of its

recoverable amount, based on the market value of the hotel as determined by an independent professional property valuer.

Of the impairment reversal in 2011, $11m arose in March 2011 on the classification of a North American hotel as held for sale. The amount

of the reversal was based on the expected net sales proceeds which were subsequently realised on the disposal of the hotel (see note 11).

A further $12m arose in respect of another North American hotel following a re-assessment of its recoverable amount, based on value

in use. Estimated future cash flows were discounted at a pre-tax rate of 12.6%.

All impairment charges and reversals are included within impairment on the face of the Group income statement.

The carrying value of property, plant and equipment held under finance leases at 31 December 2012 was $187m (2011 $190m).

No borrowing costs were capitalised during the current or prior year.

Charges over one hotel totalling $89m exist as security provided to the Group’s pension plans.