Holiday Inn 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 IHG Annual Report and Financial Statements 2012

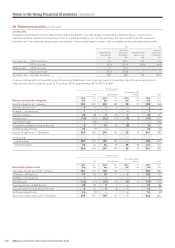

25. Retirement benefits continued

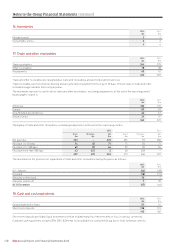

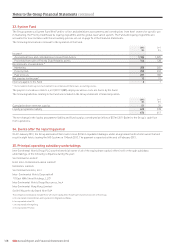

Sensitivities

Changes in assumptions used for determining retirement benefit costs and obligations may have a material impact on the income

statement and the statement of financial position. The main assumptions are the discount rate, the rate of inflation and the assumed

mortality rate. The following table provides an estimate of the potential impact of each of these variables on the principal pension plans.

UK US

Increase/ Increase/

Higher/(lower) (decrease) Higher/(lower) (decrease)

pension cost in liabilities pension cost in liabilities

$m $m $m $m

Discount rate – 0.25% decrease 1.4 20.7 0.2 7.2

– 0.25% increase (1.0) (19.1) (0.2) (6.8)

Inflation rate – 0.25% increase 1.1 17.9 – –

– 0.25% decrease (0.6) (15.8) – –

Mortality rate – one year increase 0.5 8.2 0.3 10.1

A one percentage point increase/(decrease) in assumed healthcare costs trend rate would increase/(decrease) the accumulated post-

employment benefit obligations as at 31 December 2012 by approximately $2.4m (2011 $2.8m).

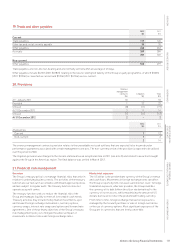

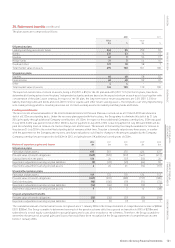

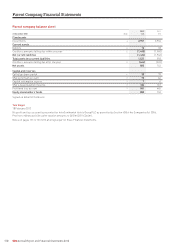

Pension plans

Post-employment

UK US and other benefits Total

2012 2011 2012 2011 2012 2011 2012 2011

Movement in benefit obligation $m $m $m $m $m $m $m $m

Benefit obligation at 1 January 525 512 233 209 30 27 788 748

Current service cost 5 6 1 1 – – 6 7

Members’ contributions 1 1 – – – – 1 1

Interest expense 25 28 9 10 1 1 35 39

Benefits paid (14) (13) (12) (13) (1) (1) (27) (27)

Curtailment gain – (28) – – – – – (28)

Actuarial loss/(gain) arising in the year 3 22 16 26 (5) 3 14 51

Exchange adjustments 24 (3) – – – – 24 (3)

Benefit obligation at 31 December 569 525 247 233 25 30 841 788

Comprising:

Funded plans 507 471 193 181 – – 700 652

Unfunded plans 62 54 54 52 25 30 141 136

569 525 247 233 25 30 841 788

Pension plans

Post-employment

UK US and other benefits Total

2012 2011 2012 2011 2012 2011 2012 2011

Movement in plan assets $m $m $m $m $m $m $m $m

Fair value of plan assets at 1 January 551 475 133 130 – – 684 605

Company contributions 97 40 10 11 1 1 108 52

Members’ contributions 1 1 – – – – 1 1

Benefits paid (14) (13) (12) (13) (1) (1) (27) (27)

Expected return on plan assets 28 29 9 9 – – 37 38

Actuarial gain/(loss) arising in the year 6 24 9 (5) – – 15 19

Exchange adjustments 26 (5) – 1 – – 26 (4)

Fair value of plan assets at 31 December 695 551 149 133 – – 844 684

Notes to the Group Financial Statements continued