Holiday Inn 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

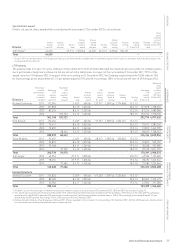

Directors’ Remuneration Report 69

H – Pensions

IHG operates the following pension arrangements in which the Executive Directors participate:

• for UK executives, the executive section of the IC Plan, which has a DB section and a DC section (the UK DB Plan and the UK DC Plan

respectively);

• for UK executives, ICETUS; this is an unfunded arrangement, but with appropriate security;

• for US executives, the DC US 401(k) Plan and the DC US Deferred Compensation Plan; and

• for executives outside the UK and US, the InterContinental Hotels Group International Savings and Retirement Plan, or other local plans.

As an alternative to the pension arrangements, a cash allowance may be taken in lieu by UK executives.

Following an extensive UK pension review and subsequent consultations with affected employees, it was announced on 29 September 2011

that the UK DB Plan would close to future accrual for existing members with effect from 1 July 2013. The UK DB Plan is already closed to new

entrants. A cap on pensionable salary increases of RPI plus 2.5% per annum became effective on 1 October 2011.

As part of the consultation with employees and the plan trustees about these changes, it was agreed that the Enhanced Early Retirement

Facility (EERF) would be retained. This provides an option for plan members, with the Company’s agreement, to retire within five years of

normal retirement age on accrued benefits without reduction. The level of plan funding provides for this facility. The Committee considered

that the reduction in risk and expense achieved by the closing of the UK DB Plan justified the cost of retaining this facility for existing

active members.

The Executive Directors participate as follows:

• Richard Solomons participates in the UK DB Plan and the ICETUS on the same basis as other senior UK-based executives;

• Tracy Robbins participated in the executive UK DC Plan on the same basis as other senior UK-based executives until March 2012; from

April 2012 she received a cash allowance in lieu of pension benefits;

• Tom Singer does not participate in any pension plan and receives a cash allowance in lieu of pension benefits; and

• Kirk Kinsell participates in the DC US 401(k) Plan and the DC US Deferred Compensation Plan.

Further details on the Executive Directors’ pension arrangements are shown on pages 75 and 76.

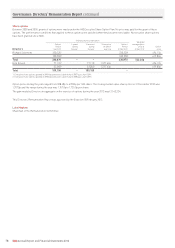

I – Executive share options

From 2006, executive share options have not formed part of the Company’s remuneration structure. Details of prior share option grants are

given on page 78.

J – Clawback in incentive plans

For awards made from January 2012, the ABP, APP and LTIP allow the Committee discretion to claw back unvested share awards in the

following circumstances:

• misconduct that causes significant damage or potential damage to IHG’s prospects, finances or brand reputation; and/or

• actions that lead to material misstatement or restatement of accounts.

This feature helps ensure alignment between executive rewards and shareholder returns.