Holiday Inn 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

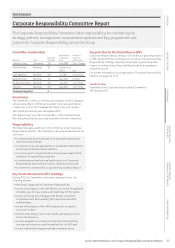

Board nationalities

■ French 9% (1)

■ Chinese 9% (1)

■ American 27% (3)

■ British 55% (6)

Independent advice

All Directors have access to the advice and services of the Company

Secretary, the Company’s external legal advisers and the external

auditors, who are currently Ernst & Young LLP. There is an agreed

process by which Directors may seek independent professional

advice at the Company’s expense in the furtherance of their duties.

Conflicts of interest

The Board reviews potential conflicts of interest as a standing

agenda item at each Board meeting. At the December 2012 Board

meeting, each of the Directors were requested to disclose any

conflicts or potential conflicts by returning a questionnaire to the

Company Secretary. The Board considered all the responses to the

questionnaires and approved potential conflicts of interest as it

deemed appropriate. Directors have continuing obligations to update

the Board on any changes to these conflicts. Under the Articles of

Association the Board is authorised to approve Director conflicts

of interest.

Directors and officers liability (D&O) insurance

The Company maintains D&O insurance which covers Directors and

officers of the Company against defending civil proceedings brought

against them in their capacity as a Director or officer of the Company.

There were no indemnity provisions relating to the UK pension plan

for the benefit of the Directors during 2012.

Effectiveness

The Board believes that in order to be most effective there must be

a mix of skills and experience, background and length of service on

the Board. The current Non-Executive Directors’ lengths of tenure as

at 1 January 2013 are illustrated below:

Length of Non-Executive Director tenure

3 directors

1 director

3 directors

4-6 years7-9 years

0-3 years

The structure, size and composition of the Board and succession

planning is continuously monitored by the Chairman and the

Nomination Committee. Further details can be found on page 58.

The Chairman, in conjunction with the Company Secretary, plans the

agenda for each Board meeting. Directors are briefed on the Group’s

financial performance and its operations, including commercial and

operational matters, relations with investors and updates on key

strategic plans, by means of comprehensive papers in advance of,

and by presentations at, Board meetings. The Board also receives

more in-depth presentations on a wide range of business issues in

a more informal context the evening before formal Board meetings.

Evening presentation topics during 2012 included updates from

the Global Operations Council, an economist presentation and

developments in our communications strategy.

Should any Director be unable to attend a meeting, he or she would

be provided with all the papers and information relevant to that

meeting and be able to discuss matters arising with the Chairman

and the Chief Executive.

Below is a chart illustrating the approximate time the Board has spent

discussing key topics at scheduled Board meetings during the year:

Board allocation of time

■ Strategy 35%

■ Operations 30%

■ Finance and Risk 22%

■ Governance 13%

Board annual strategy meeting

During 2012, the Board held a two-day strategy meeting in Delhi,

India which enabled the Board to gain a greater understanding of

growth potential in India. The discussion topics included major trends

in the industry, key responses and actions planned by IHG, new

business development opportunities, execution of IHG’s strategy and

current progress, and an overview of the medium to long-term

financial impacts of our strategic choices.

Diversity

With a presence in nearly 100 countries and territories globally,

we believe that our leadership should reflect the diversity of our

employees, our guests and the local communities in which we

operate. The Board recognises the benefits of diversity throughout

our global business and firmly believes in the importance of a diverse

Board membership.

We continue to focus on providing an inclusive environment, in which

employees are valued for who they are and what they bring to the

Group, and in which talented individuals are retained through all

levels of the organisation. Further details on our approach to

diversity are set out on pages 33 and 58.

The current Board gender and nationality split is illustrated below:

Board gender split

■ Male 73% (8)

■ Female 27% (3)

Governance: Corporate governance continued

50 IHG Annual Report and Financial Statements 2012