Holiday Inn 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 IHG Annual Report and Financial Statements 2012

Overview

Report structure

In June 2012, the UK Government Department for Business, Innovation & Skills (BIS) published draft regulations setting out the proposed

content of a new two-part Directors’ Remuneration Report to consist of:

• a forward-looking remuneration policy report that sets out the parameters for directors’ pay, on which shareholders will have

a binding vote; and

• an implementation report that explains how the agreed policy has been implemented and the resulting payments, on which

shareholders will have an advisory vote.

Although the new regulations do not apply to IHG’s Directors’ Remuneration Report until 2013, we have reflected as much as is practical

of the direction and spirit of the draft BIS regulations, including the proposed structure, addressing firstly remuneration policy for 2013,

and then the 2012 outcomes.

IHG, and a number of other FTSE 100 companies, worked with the Financial Reporting Council’s Financial Reporting Lab in making

recommendations on the composition of the single figure disclosure that will be required under the new regulations.

This report has been prepared by the Remuneration Committee and has been approved by the Board. It complies with the Companies Act 2006

and related regulations. It will be put to shareholders for approval at the 2013 Annual General Meeting (AGM).

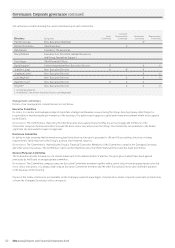

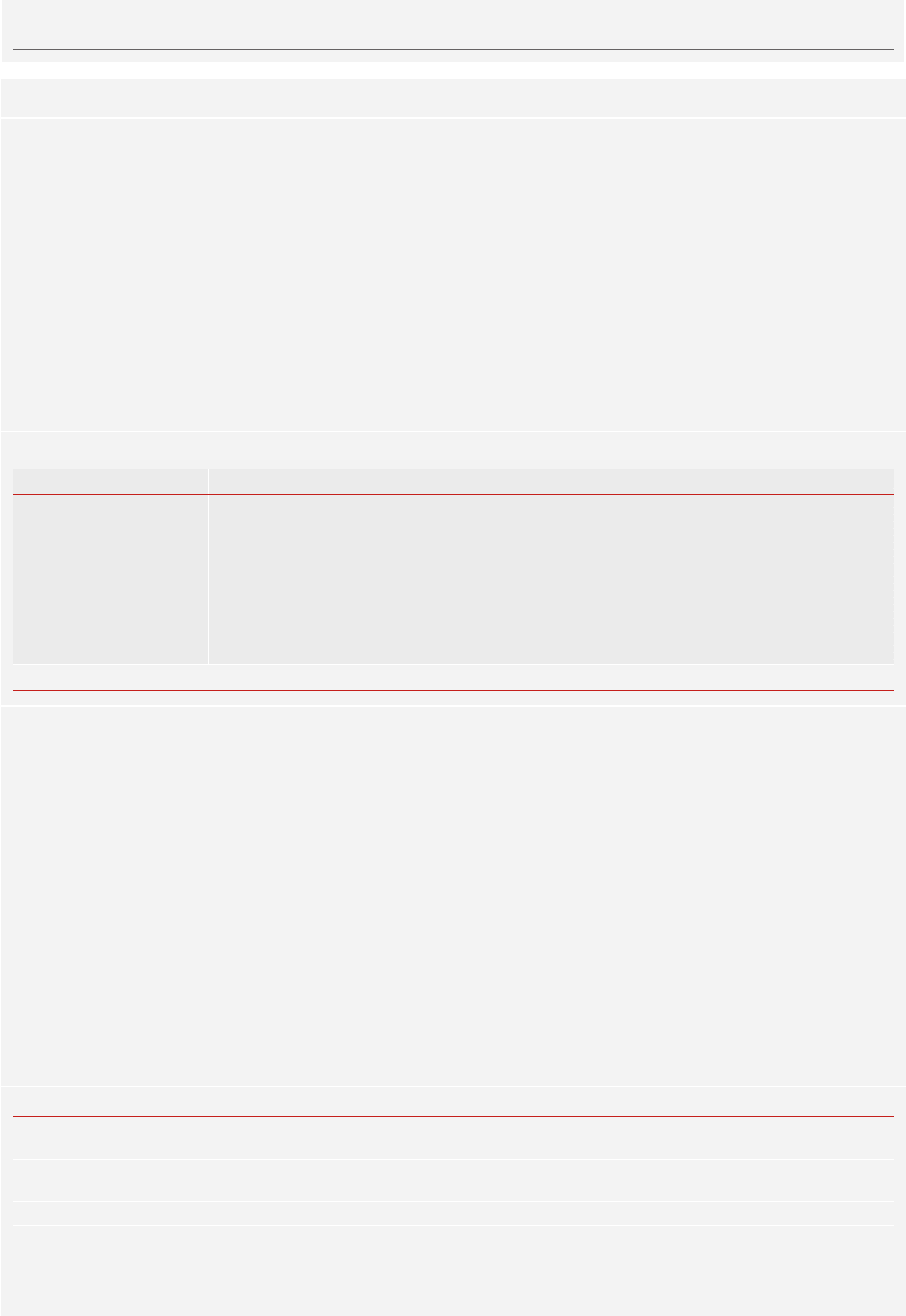

Summary of IHG’s Executive Director remuneration policy for 2013

Fixed remuneration Variable remuneration

Salary

Pension

Benefits

Annual incentive – APP

50% cash and 50% shares deferred for three years

Linked to individual and company achievement using

performance measures relating to:

– Brands;

– People; and

– Delivery.

Long-term incentive – LTIP

Share awards vest after three years if performance

conditions are met:

– 25% relative net rooms growth;

– 25% relative RevPAR growth; and

– 50% relative TSR v the DJGH index.

Minimum shareholding requirement

Approach for members of the Executive Committee

Members of the Executive Committee are rewarded on the same

basis as the Executive Directors, participating in the same incentive

plans and with a similar split between fixed and variable

remuneration, and between cash and shares.

Key executive remuneration principles

Executive remuneration should drive delivery of strategic objectives by:

• attracting and retaining high-quality executives in an

environment where compensation is based on global market

practice;

• aligning rewards for executives with the achievement of

business performance targets, strategic objectives and returns

to shareholders;

• supporting equitable treatment between members of the same

senior executive team; and

• facilitating critical global assignments and relocations.

Factors taken into account in determining pay

In making decisions in relation to 2012 pay, the Committee took

into account:

• the achievement of corporate performance targets under the

ABP and LTIP (see pages 71 and 72);

• an appropriate mix of fixed and variable pay, with an emphasis

on driving performance through approximately two-thirds of

total pay being variable (see page 66);

• pay and conditions elsewhere in the Group, including the

average budgeted salary increase for the employee population

in the table below; and

• the corporate performance indicators in the table below.

Key changes in 2012

Changes to the annual incentive for senior executives, including the

Executive Directors, were approved by the Committee for 2013, with

the objective of more closely aligning reward to the delivery of our

strategic objectives of Brands, People and Delivery.

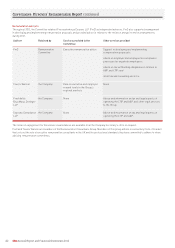

Corporate performance indicators 2012 2011 2010

Operating profit before exceptional items +9.8%

$614m†

+25.9%

$559mt

+22.3%

$444m

Full-year dividend (excluding any special dividends and capital returns) 64 cents

(41.2p) per share

55 cents

(34.5p) per share

48 cents

(30.0p) per share

Three-year total TSR (annualised) +28.2% +29.8% +8.0%

Three-year adjusted EPS (annualised) +21.7% +2.5% +9.6%

Budgeted salary increase (US and UK corporate employees) 3.0% 3.0% 2.9%

Governance: Directors’ Remuneration Report continued

†

Includes one significant liquidated damages receipt in 2012 of $3m in The Americas.

t

Includes two significant liquidated damages receipts in 2011; $10m in The Americas and $6m in Asia, Middle East and Africa.