Holiday Inn 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 IHG Annual Report and Financial Statements 2012

Notes to the Group Financial Statements continued

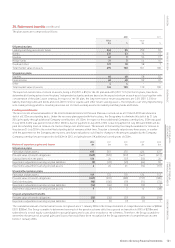

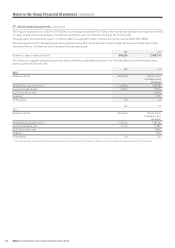

25. Retirement benefits

Retirement and death in service benefits are provided for eligible Group employees in the UK principally by the InterContinental Hotels UK

Pension Plan. The plan, which is funded and HM Revenue & Customs registered, covers approximately 598 (2011 545) employees, of which

119 (2011 125) are in the defined benefit section and 479 (2011 420) are in the defined contribution section. The defined benefit section of the

plan closed to new entrants in 2002 and will close to future accrual for current members with effect from 1 July 2013. New members

are provided with defined contribution arrangements as will be members of the defined benefit section in July 2013. The assets of the plan

are held in self-administered trust funds separate from the Group’s assets. In addition, there are unfunded UK pension arrangements for

certain members affected by the lifetime or annual allowances which will also close to future accrual from 1 July 2013. The Group also

maintains the following US-based defined benefit plans; the funded InterContinental Hotels Pension Plan, unfunded InterContinental Hotels

non-qualified pension plans and post-employment benefits schemes. These plans are closed to new members. The Group also operates

a number of smaller pension schemes outside the UK, the most significant of which is a defined contribution scheme in the US; there is no

material difference between the pension costs of, and contributions to, these schemes.

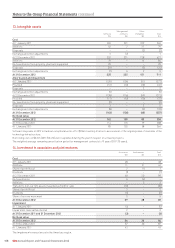

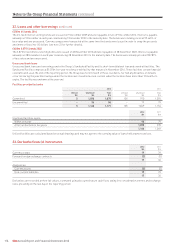

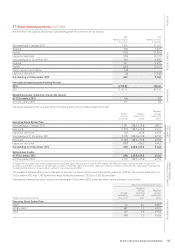

In respect of the defined benefit plans, the amounts recognised in the Group income statement, in administrative expenses, are:

Pension plans

Post-employment

UK US and other benefits Total

2012 2011 2012 2011 2012 2011 2012 2011

$m $m $m $m $m $m $m $m

Current service cost 5 6 1 1 – – 6 7

Interest cost on benefit obligation 25 28 9 10 1 1 35 39

Expected return on plan assets (28) (29) (9) (9) – – (37) (38)

Operating profit before exceptional items 2 5 1 2 1 1 4 8

Exceptional items – curtailment gain – (28) – – – – – (28)

2 (23) 1 2 1 1 4 (20)

The curtailment gain in 2011 arose in respect of the UK pension plan and from the decision to close the defined benefit section to future

accrual with effect from 1 July 2013. The plan rules were formally amended to reflect this change in September 2011.

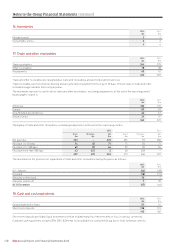

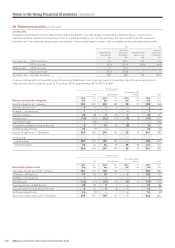

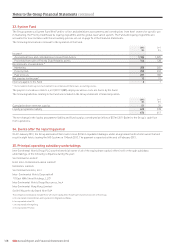

The amounts recognised in the Group statement of comprehensive income are:

Pension plans

Post-employment

UK US and other benefits Total

2012 2011 2012 2011 2012 2011 2012 2011

$m $m $m $m $m $m $m $m

Actual return on plan assets 34 53 18 4 – – 52 57

Less: expected return on plan assets (28) (29) (9) (9) – – (37) (38)

Actuarial gains/(losses) on plan assets 6 24 9 (5) – – 15 19

Actuarial (losses)/gains on plan liabilities (3) (22) (16) (26) 5 (3) (14) (51)

Total actuarial gains/(losses) 3 2 (7) (31) 5 (3) 1 (32)

Change in asset restriction and liability in respect

of funding commitments* (25) (11) – – – – (25) (11)

(22) (9) (7) (31) 5 (3) (24) (43)

* Relates to tax that would be deducted at source in respect of a refund of the surplus taking into account amounts payable under funding commitments.