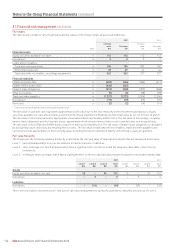

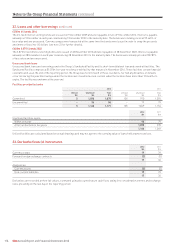

Holiday Inn 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Notes to the Group Financial Statements 109

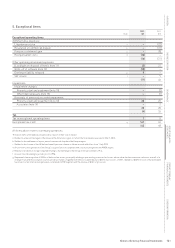

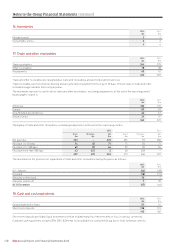

14. Investment in associates and joint ventures continued

The following table summarises the financial information of the Group’s associates and joint ventures:

Associates Joint ventures Total

2012 2011 2012 2011 2012 2011

$m $m $m $m $m $m

Share of statement of financial position

Current assets 22 9 1 3 23 12

Non-current assets 59 70 27 27 86 97

Current liabilities (6) (7) – – (6) (7)

Non-current liabilities (11) (15) – – (11) (15)

Non-controlling interests (8) – – – (8) –

Net assets 56 57 28 30 84 87

Share of revenue and profit

Revenue 30 28 – – 30 28

Profit/(loss) 3 2 – (1) 3

1

Related party transactions

Revenue from related parties 5 5 – – 5 5

Amounts owed by related parties 2 1 – – 2 1

Loans from related parties – (2) – – – (2)

The most significant investments are a 30% associate holding in President Hotel and Tower Co Ltd, the owner of the InterContinental Hotel

Bangkok and the Holiday Inn Bangkok, and a 49% holding in BCRE IHG 180 Orchard Holdings LLC, a joint venture established to develop and

build a multi-use property in Manhattan, New York, including a Hotel Indigo.

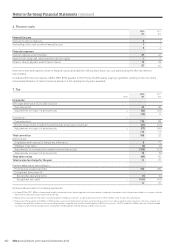

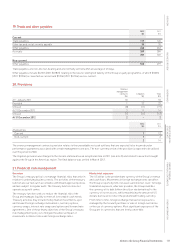

15. Other financial assets

2012 2011

$m $m

Current

Loans and receivables 6

–

Non-current

Equity securities available-for-sale 112 112

Loans and receivables 43 44

155 156

Available-for-sale financial assets, which are included in the Group statement of financial position at fair value, consist of equity investments in listed

and unlisted shares. Of the total amount of equity investments at 31 December 2012, $18m (2011 $15m) were listed securities and $94m (2011 $97m)

unlisted; $59m (2011 $61m) were denominated in US dollars, $24m (2011 $23m) in Hong Kong dollars and $29m (2011 $28m) in other currencies.

Unlisted equity shares are mainly investments in entities that own hotels which the Group manages. The fair value of unlisted equity shares has

been estimated using the International Private Equity and Venture Capital Valuation Guidelines, using either the earnings multiple or net assets

methodology as appropriate. Listed equity share valuations are based on observable market prices. Dividend income from available-for-sale

equity securities of $5m (2011 $11m) is reported as other operating income and expenses in the Group income statement.

Loans and receivables consist of trade deposits and restricted cash which are held at amortised cost. A deposit of $37m was made in 2011 to

a hotel owner in connection with the renegotiation of a management contract. The deposit is non-interest-bearing and repayable at the end of

the management contract, and is therefore held at its discounted value of $11m (2011 $10m); the discount will unwind to the income statement

within financial income over the period to repayment. Restricted cash of $29m (2011 $27m) relates to cash held in bank accounts which is

pledged as collateral to insurance companies for risks retained by the Group.

The movement in the provision for impairment of other financial assets during the year is as follows:

2012 2011

$m $m

At 1 January (25) (26)

Provided – exceptional items – (3)

Reclassification (1) 3

Amounts written off – 1

At 31 December (26) (25)

The amount provided as an exceptional item in 2011 related to an available-for-sale equity investment and arose as a result of a significant

and prolonged decline in its fair value below cost.

The provision is used to record impairment losses unless the Group is satisfied that no recovery of the amount is possible; at that point the

amount considered irrecoverable is either written off directly to the income statement or, if previously provided, against the financial asset

with no impact on the income statement.