Holiday Inn 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Notes to the Group Financial Statements 111

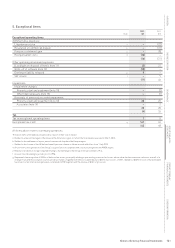

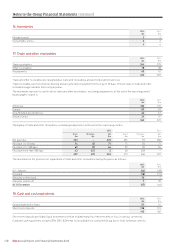

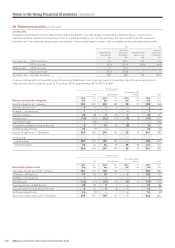

19. Trade and other payables

2012 2011

$m $m

Current

Trade payables 117 126

Other tax and social security payable 35 35

Other payables 268 262

Accruals 289 284

709 707

Non-current

Other payables 563 497

Trade payables are non-interest-bearing and are normally settled within an average of 45 days.

Other payables include $623m (2011 $578m) relating to the future redemption liability of the Group’s loyalty programme, of which $108m

(2011 $105m) is classified as current and $515m (2011 $473m) as non-current.

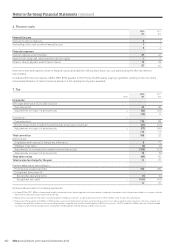

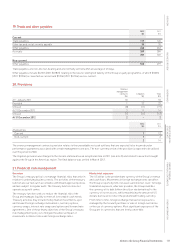

20. Provisions

Onerous

management

contracts Litigation Total

$m $m $m

At 1 January 2011 10 – 10

Provided 1 22 23

Utilised (8) (11) (19)

At 31 December 2011 3 11 14

Utilised (1) (11) (12)

At 31 December 2012 2 – 2

2012 2011

$m $m

Analysed as:

Current 1 12

Non-current 1 2

2 14

The onerous management contracts provision relates to the unavoidable net cash outflows that are expected to be incurred under

performance guarantees associated with certain management contracts. The non-current portion of the provision is expected to be utilised

over the period to 2020.

The litigation provision was charged in the income statement as an exceptional item in 2011 (see note 5) and related to an action brought

against the Group in the Americas region. The final balance was settled in March 2012.

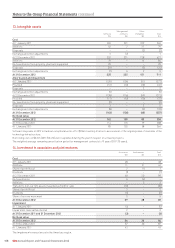

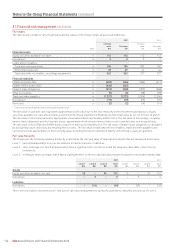

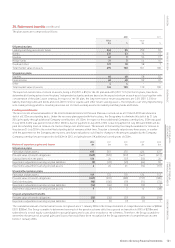

21. Financial risk management

Overview

The Group’s treasury policy is to manage financial risks that arise in

relation to underlying business needs. The activities of the treasury

function are carried out in accordance with Board approved policies

and are subject to regular audit. The treasury function does not

operate as a profit centre.

The treasury function seeks to reduce the financial risk of the

Group and manages liquidity to meet all foreseeable cash needs.

Treasury activities may include money market investments, spot

and forward foreign exchange instruments, currency options,

currency swaps, interest rate swaps and options and forward rate

agreements. One of the primary objectives of the Group’s treasury

risk management policy is to mitigate the adverse impact of

movements in interest rates and foreign exchange rates.

Market risk exposure

The US dollar is the predominant currency of the Group’s revenue

and cash flows. Movements in foreign exchange rates can affect

the Group’s reported profit, net assets and interest cover. To hedge

translation exposure, wherever possible, the Group matches

the currency of its debt (either directly or via derivatives) to the

currency of its net assets, whilst maximising the amount of US

dollars borrowed to reflect the predominant trading currency.

From time to time, foreign exchange transaction exposure is

managed by the forward purchase or sale of foreign currencies

or the use of currency options. Most significant exposures of the

Group are in currencies that are freely convertible.