Holiday Inn 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Notes to the Group Financial Statements 101

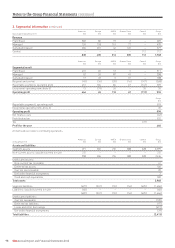

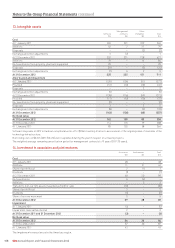

5. Exceptional items

2012 2011

Note $m $m

Exceptional operating items

Administrative expenses:

Litigation provision a – (22)

Resolution of commercial dispute b – (37)

Pension curtailment gain c – 28

Reorganisation costs d (16) –

(16) (31)

Other operating income and expenses:

(Loss)/gain on disposal of hotels (note 11) (2) 37

Write-off of software (note 13) (18) –

Demerger liability released e 9 –

VAT refund f – 9

(11) 46

Impairment:

Impairment charges:

Property, plant and equipment (note 10) – (2)

Other financial assets (note 15) – (3)

Reversals of previously recorded impairment:

Property, plant and equipment (note 10) 23 23

Associates (note 14) – 2

23 20

(4) 35

Tax

Tax on exceptional operating items 1 5

Exceptional tax credit g 141 43

142 48

All items above relate to continuing operations.

The above items are treated as exceptional by reason of their size or nature.

a Related to a lawsuit filed against the Group in the Americas region, for which the final balance was paid in March 2012.

b Related to the settlement of a prior period commercial dispute in the Europe region.

c Related to the closure of the UK defined benefit pension scheme to future accrual with effect from 1 July 2013.

d Arises from a reorganisation of the Group’s support functions together with a restructuring within the AMEA region.

e Release of a liability no longer required relating to the demerger of the Group from Six Continents PLC.

f Arose in the UK relating to periods prior to 1996.

g Represents the recognition of $104m of deferred tax assets, principally relating to pre-existing overseas tax losses, whose value has become more certain as a result of a

change in law and the resolution of prior period tax matters, together with the associated release of $37m of provisions. In 2011, related to a $30m revision of the estimated

tax impacts of an internal reorganisation completed in 2010 together with the release of $13m of provisions.