Holiday Inn 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 IHG Annual Report and Financial Statements 2012

Remuneration advisers

Throughout 2012, the Committee retained PricewaterhouseCoopers LLP (PwC) as independent advisers. PwC also supported management

in developing and implementing remuneration proposals and provided advice in relation to the review of annual incentive arrangements

during 2012.

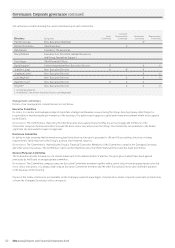

Adviser Retained by Services provided to the

Committee

Other services provided

PwC Remuneration

Committee

Executive remuneration advice Support in developing and implementing

remuneration proposals;

advice on employer and employee tax compliance

processes for expatriate employees;

advice on tax withholding obligations in relation to

ABP and LTIP; and

other tax and consulting services.

Towers Watson the Company Data on executive and employee

reward levels in the Group’s

regional markets

None

Freshfields

Bruckhaus Deringer

LLP

the Company None Advice and information on tax and legal aspects of

operating the LTIP and ABP, and other legal services

to the Group.

Tapestry Compliance

LLP

the Company None Advice and information on tax and legal aspects of

operating the LTIP and ABP.

The terms of engagement for the advisers named above are available from the Company Secretary’s office on request.

PwC and Towers Watson are members of the Remuneration Consultants Group. Members of this group adhere to a voluntary Code of Conduct

that sets out the role of executive remuneration consultants in the UK and the professional standards they have committed to adhere to when

advising remuneration committees.

Governance: Directors’ Remuneration Report continued