Holiday Inn 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 IHG Annual Report and Financial Statements 2012

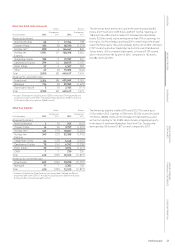

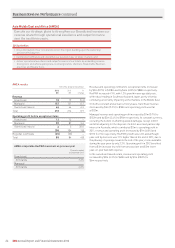

Americas results

12 months ended 31 December

2012

$m

2011

$m

%

change

Revenue

Franchised 541 502 7.8

Managed 97 124 (21.8)

Owned and leased 199 204 (2.5)

Total 837 830 0.8

Operating profit before exceptional items

Franchised 466 431 8.1

Managed 48 52 (7.7)

Owned and leased 24 17 41.2

538 500 7.6

Regional overheads (52) (49) (6.1)

Total 486 451 7.8

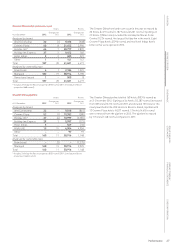

Americas comparable RevPAR movement on previous year

12 months ended

31 December 2012

Franchised

Crowne Plaza 5.4%

Holiday Inn 5.9%

Holiday Inn Express 6.1%

All brands 6.0%

Managed

InterContinental 10.5%

Crowne Plaza 3.8%

Holiday Inn 9.6%

Staybridge Suites (1.7)%

Candlewood Suites (0.8)%

All brands 7.3%

Owned and leased

All brands 6.3%

Revenue and operating profit before exceptional items increased

by $7m (0.8%) to $837m and by $35m (7.8%) to $486m respectively.

RevPAR increased 6.1%, with 4.1% growth in average daily rate.

US RevPAR was up 6.3% in 2012 despite uncertainty regarding the

presidential election and the ‘fiscal cliff’ in the latter part of the year.

Franchised revenue increased by $39m (7.8%) to $541m. Royalties

growth of 8.7% was driven by RevPAR growth of 6.0%, including 6.1%

for Holiday Inn Express, together with System size growth of 2.3%.

Operating profit increased by $35m (8.1%) to $466m.

Managed revenue decreased by $27m (21.8%) to $97m and operating

profit decreased by $4m (7.7%) to $48m. Revenue and operating

profit included $34m (2011 $59m) and $nil (2011 $1m) respectively

from managed leases. Excluding properties operated under this

arrangement, as well as the benefit of a $3m liquidated damages

receipt in 2012 and a $10m liquidated damages receipt in 2011,

revenue and operating profit grew by $5m (9.1%) and $4m (9.8%)

respectively. Growth was driven by a RevPAR increase of 7.3%,

including 9.6% for Holiday Inn.

Owned and leased revenue declined by $5m (2.5%) to $199m and

operating profit grew by $7m (41.2%) to $24m. Excluding the impact

of disposals, revenue increased by $4m (2.1%) and operating profit

increased by $8m (50.0%). The increase in revenue was driven by

RevPAR growth of 6.3%, offset by the impact of the partial closure

of an owned hotel in the Caribbean. The operating profit increase

of $7m included a $1m year-on-year benefit from lower depreciation

recorded for the InterContinental New York Barclay since the hotel

was categorised as held for sale in the first quarter of 2011, after

which no depreciation was charged, and a $3m year-on-year benefit

relating to one-off reorganisation costs at one hotel in 2011.

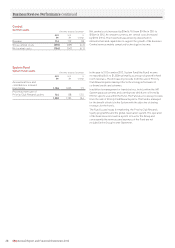

The Americas

Maximise the performance and growth of our portfolio of preferred

Brands, focussing on our core midscale and upscale segments, mostly

through franchise agreements over the next three years.

2013 priorities

• Build upon the success of the Holiday Inn relaunch by continuing to improve the guest

experience, investing to drive guest consideration and differentiation between the Holiday

Inn brand family, particularly Holiday Inn and Holiday Inn Express, improving hotel

performance and unit growth;

• execute the multi-year programme to reposition Crowne Plaza Hotels & Resorts;

• activate growth in our newest brands by successfully launching EVEN Hotels and continuing

to accelerate growth from Hotel Indigo; and

• further deploy IHG tools throughout the franchised estate, across revenue management,

brand standards, channel management, Responsible Business practices and People Tools.

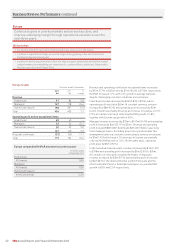

Business Review: Performance continued