Holiday Inn 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 IHG Annual Report and Financial Statements 2012

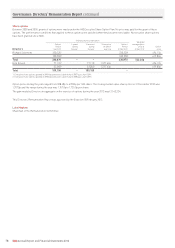

E – Pensions

The value of Richard Solomons’ DB pension arrangement as at

31 December 2012 is set out to the right. Details of this plan are

included above under Section 2.H – Pensions.

Richard Solomons is eligible for the EERF, which is available to

all members of the plan. This facility enables members to retire

without reduction in their pension if they are within five years of

normal retirement age. Although the EERF is non-contractual, its

continuation formed part of the agreement with trustees on closure

of the UK DB Plan. The EERF terms require an executive to obtain the

consent of the Company; the consent is discretionary but should not

be unreasonably refused.

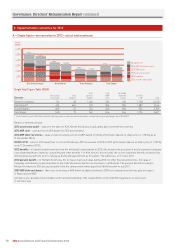

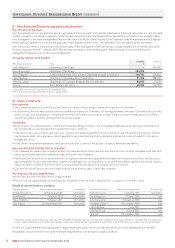

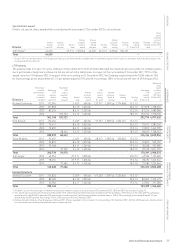

D – Long Term Incentive Plan (LTIP)

Structure and outcome for 2012

The award for the 2010/12 cycle had corporate performance measures based on relative TSR and EPS. The measures and outcomes are

as follows:

Performance

measure

Threshold

performance

Maximum

performance

Threshold/

maximum

vesting

Weighting Maximum

award –

% of salary

Outcome

2010/12 cycle

TSR Growth equal to

the DJGH index

Growth exceeds the

index by 8% per year

or more

20%/100% 50% 102.5% Growth exceeded index by 15%

per year

EPS Growth of 5%

per year

Growth of 15% per

year or more

20%/100% 50% 102.5% Growth of 21.7% per year

Total vesting

outcome

100% of maximum award

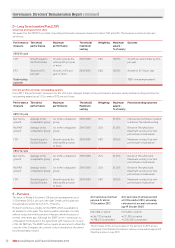

Current position on other outstanding awards

From 2011, the performance measures for the LTIP were changed. Details of the performance measures and potential vesting outcomes for

outstanding awards as at 31 December 2012 are as follows:

Performance

measure

Threshold

performance

Maximum

performance

Threshold/

Maximum

vesting

Weighting Maximum

award –

% of salary

Potential vesting outcomes

2011/13 cycle

Net rooms

growth

Average of the

comparator group

1st in the comparator

group

20%/100% 25% 51.25% Improved performance needed

to achieve Threshold vesting

RevPAR

growth

Average of the

comparator group

1st in the comparator

group

20%/100% 25% 51.25% Between Threshold and

Maximum vesting if current

performance maintained

TSR Growth equal to

the DJGH index

Growth exceeds the

index by 8% per year

or more

20%/100% 50% 102.5% Maximum vesting if current

performance maintained

2012/14 cycle

Net rooms

growth

Average of the

comparator group

1st in the comparator

group

20%/100% 25% 51.25% Between Threshold and

Maximum vesting if current

performance maintained

RevPAR

growth

Average of the

comparator group

1st in the comparator

group

20%/100% 25% 51.25% Between Threshold and

Maximum vesting if current

performance maintained

TSR Growth equal to

the DJGH index

Growth exceeds the

index by 8% per year

or more

20%/100% 50% 102.5% Maximum vesting if current

performance maintained

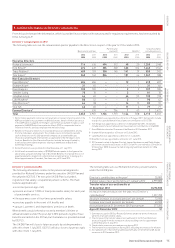

Accrued value of annual

pension if retired

31 December 2012

Accrued value of annual pension

at 31 December 2012, assuming

retirement at normal retirement

age (9 October 2021)

£245,180, of which:

• £46,770 is funded

• £198,410 is unfunded

£377,200, of which:

• £71,950 is funded

• £305,250 is unfunded

The increase in the accrued value of the pension in 2012 arises

principally from Richard Solomons’ salary review when appointed

Chief Executive in July 2011.

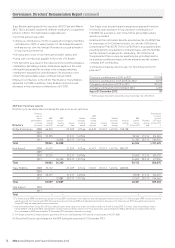

Governance: Directors’ Remuneration Report continued