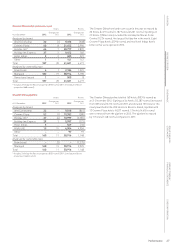

Holiday Inn 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 IHG Annual Report and Financial Statements 2012

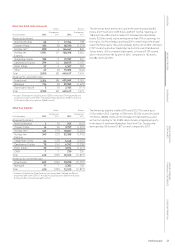

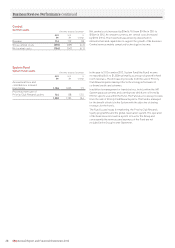

AMEA results

12 months ended 31 December

2012

$m

2011

$m

%

change

Revenue

Franchised 18 19 (5.3)

Managed 152 151 0.7

Owned and leased 48 46 4.3

Total 218 216 0.9

Operating profit before exceptional items

Franchised 12 12 –

Managed 90 87 3.4

Owned and leased 65 20.0

108 104 3.8

Regional overheads (20) (20) –

Total 88 84 4.8

AMEA comparable RevPAR movement on previous year

12 months ended

31 December 2012

Franchised

All brands 7.2%

Managed

All brands 4.6%

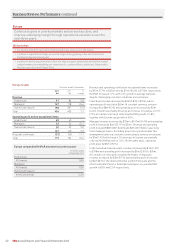

Revenue and operating profit before exceptional items increased

by $2m (0.9%) to $218m and by $4m (4.8%) to $88m respectively.

RevPAR increased 4.9%, with 1.2% growth in average daily rate,

with robust trading in Southeast Asia and Japan, partly offset by

continuing uncertainty impacting some markets in the Middle East.

On both a constant and actual currency basis, franchised revenue

decreased by $1m (5.3%) to $18m and operating profit was flat

at $12m.

Managed revenue and operating profit increased by $1m (0.7%) to

$152m and by $3m (3.4%) to $90m respectively. At constant currency,

excluding the benefit of a $6m liquidated damages receipt in 2011

and after adjusting for the disposal of a hotel asset and partnership

interest in Australia, which contributed $3m to operating profit in

2011, revenue and operating profit increased by $7m (4.8%) and

$11m (14.1%) respectively. RevPAR growth was 4.6% and although

year-end System size was 7.1% higher than at the end of 2011, due to

the phasing of openings towards the end of the year, rooms available

during the year grew by only 2.2%. Operating profit in 2012 benefited

from a $1m increase in profit from an associate and $2m lower

year-on-year bad debt expense.

In the owned and leased estate, revenue and operating profit

increased by $2m (4.3%) to $48m and by $1m (20.0%) to

$6m respectively.

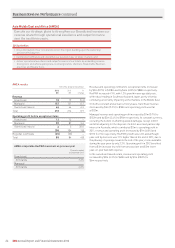

Asia Middle East and Africa (AMEA)

Execute our strategic plans to strengthen our Brands and increase our

revenue share through operational excellence and outperformance

over the next three years.

2013 priorities

• Grow distribution of our core brands across the region, building upon the leadership

position of Holiday Inn;

• build preferred Brands and strengthen our position in key strategic markets; and

• deliver operational excellence and outperformance at our hotels by embedding revenue

driving tools and, where appropriate, localising brands, channels, Responsible Business

practices and People Tools.

Business Review: Performance continued