Holiday Inn 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Notes to the Group Financial Statements 99

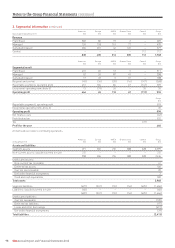

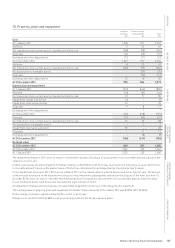

2. Segmental information continued

Americas Europe AMEA Greater China Central Group

Year ended 31 December 2011 $m $m $m $m $m $m

Other segmental information

Capital expenditure (see below) 84 15 14 8 72 193

Non-cash items:

Depreciation and amortisation* 23 24 16 16 20 99

Impairment losses – 2 3 – – 5

Reversal of previously recorded impairment (25) – – – – (25)

Share-based payments cost – – – – 25 25

Share of profit of associates and joint ventures – – (1) – – (1)

* Included in the $99m of depreciation and amortisation is $30m relating to administrative expenses and $69m relating to cost of sales.

Americas Europe AMEA Greater China Central Group

Year ended 31 December 2011 $m $m $m $m $m $m

Reconciliation of capital expenditure

Capital expenditure per management reporting 84 15 14 8 72 193

Management contract acquired on disposal 2 – – – – 2

Timing differences 2 – – 2 – 4

Capital expenditure per the Financial Statements 88 15 14 10 72 199

Comprising additions to:

Property, plant and equipment 6 12 2 10 26 56

Intangible assets 30 3 – – 46 79

Investments in associates and joint ventures 31 – 11 – – 42

Other financial assets 21 – 1 – – 22

88 15 14 10 72 199

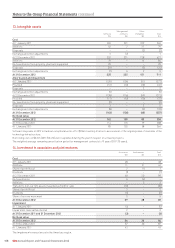

Year ended Year ended

31 December 31 December

2012 2011

Geographical information $m $m

Revenue

United Kingdom 152 139

United States 769 740

People’s Republic of China (including Hong Kong) 238 210

Rest of World 676 679

1,835 1,768

For the purposes of the above table, hotel revenue is determined according to the location of the hotel and other revenue is attributed to the

country of origin. In addition to the United Kingdom, revenue relating to an individual country is separately disclosed when it represents 10%

or more of total revenue.

31 December 31 December

2012 2011

$m $m

Non-current assets

United Kingdom 78 361

United States 590 559

France 329 328

People’s Republic of China (including Hong Kong) 333 331

Rest of World 257 270

1,587 1,849

For the purposes of the above table, non-current assets comprise property, plant and equipment, goodwill, intangible assets and

investments in associates and joint ventures. Non-current assets relating to an individual country are separately disclosed when they

represent 10% or more of total non-current assets, as defined above.