Holiday Inn 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 IHG Annual Report and Financial Statements 2012

In particular, we use the following measures to monitor our

performance:

• fee revenue and fee based margins;

• global RevPAR;

• system contribution – the proportion of business delivered to our

hotels by our dedicated IHG booking channels;

• employee engagement; and

• Responsible Business practices.

These KPIs are used to measure the progress of our Group to deliver

Great Hotels Guests Love and achieve our Vision of becoming one of

the great companies in the world.

We have a holistic set of carefully selected key performance

indicators (KPIs) to monitor our success in achieving our strategy.

These are organised around the elements of our strategy:

• ‘Where we compete’, focussing on relevant consumer segments,

the most attractive markets and the appropriate business

model; and

• ‘How we win’, focussing on our corporate priorities of preferred

Brands, talented People, best-in-class Delivery and

Responsible Business.

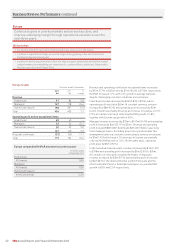

Where we compete

Strategic priorities KPIs

Current status and

2012 development 2013 priorities

Most attractive markets and

appropriate business model

To accelerate profitable growth

of our core business in our

most attractive markets where

presence and scale really count

using the right business model

to drive our fee revenue and

income streams.

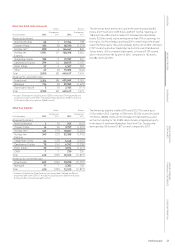

Net rooms supply

647,161 658,348 675,982

2010 2011 2012

• System size grown to 675,982

rooms;

• 4,602 hotels open globally;

• built scale of Hotel Indigo brand

to 50 hotels globally; and

• fee based margins of 42.6%, up

two percentage points on 2011,

a particularly strong result.

• Accelerate growth strategies in

quality locations in agreed scale

markets; and

• continue to leverage scale.

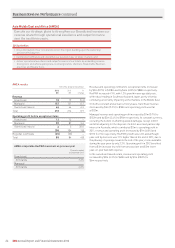

How we win – Delivering Great Hotels Guests Love

Strategic priorities KPIs

Current status and

2012 development 2013 priorities

Preferred Brands

Operate a portfolio of preferred,

locally-relevant brands

attractive to both owners and

guests that have clear market

positions and differentiation in

the eyes of the guest.

Global RevPAR growth/(decline)

Comparable hotels, constant $

6.2%

5.2%

6.2%

201220112010

• Clarified the brand propositions

for Holiday Inn and Holiday Inn

Express and celebrated the

Holiday Inn 60th anniversary;

• continued the repositioning

of Crowne Plaza;

• achieved two new brand launches

in two geographies; and

• achieved strong brand successes

in Greater China, particularly

through the growth of HUALUXE

Hotels & Resorts with 15 signings

for the brand and improved the

strength of Crowne Plaza through

brand preference and awareness.

• Invest to build long-term brand

preference for the Holiday Inn

brand family;

• continue the repositioning of

the Crowne Plaza brand;

• support growth of our new

brands: EVEN Hotels in the US

and HUALUXE Hotels & Resorts

in Greater China; and

• continue to deliver a consistent

brand experience and increased

guest satisfaction through our

needs-based segmentation

analysis.

Our performance against our KPIs over the 2010-2012 period is summarised below:

Growth in fee revenue1

available

le

lab

avai

a

ble

ail

a

2010 2011 2012

Fee based margins

42.6%

40.6%2

35.7%

2011 20122010

1 At constant currency.

2 One percentage point growth on an underlying basis.

Business Review

Measuring our success