Holiday Inn 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW GOVERNANCE

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS OTHER INFORMATION

Directors’ Remuneration Report 75

From this point forward the information, which is provided in accordance with statutory and/or regulatory requirements, has been audited by

Ernst & Young LLP.

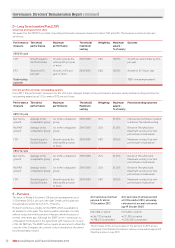

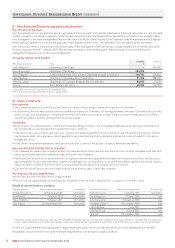

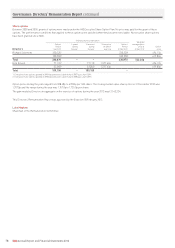

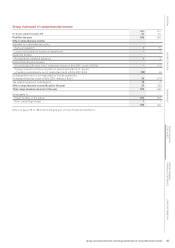

Directors’ remuneration in 2012

The following table sets out the remuneration paid or payable to the Directors in respect of the year to 31 December 2012:

Performance Total emoluments

Base salaries and fees payments1 Benefits2 excluding pensions

2012 2011 2012 2011 2012 2011 2012 2011

£000 £000 £000 £000 £000 £000 £000 £000

Executive Directors

Richard Solomons3 716 616 494 512 48 20 1,258 1,14 8

Kirk Kinsell4 474 449 306 360 663 334 1,443 1,14 3

Tracy Robbins5 409 159 300 145 141 39 850 343

Tom Singer6 540 142 826 – 181 46 1,547 188

Non-Executive Directors

David Webster7 406 406 – – 12 1 418 407

Graham Allan8 31 65 – – – 1 31 66

David Kappler 105 103 – – 2 2 107 105

Jennifer Laing 78 76 – – 3 – 81 76

Jonathan Linen 66 65 – – 64 53 130 118

Luke Mayhew9 88 43 – – 2 – 90 43

Dale Morrison10 66 38 – – 16 13 82 51

Ying Yeh 66 65 – – 11 6 77 71

Former Directors11 – 674 – 756 1 43 1 1,473

Total 3,045 2,901 1,926 1,773 1,144 558 6,115 5,232

5. Audited information on Directors’ emoluments

1 Performance payments comprise cash payments in respect of participation in the

ABP but exclude bonus payments in deferred shares, details of which are set out

in the ABP table on page 76. Tom Singer’s performance payment includes a cash

payment of £480,000 which he received in March 2012 to compensate him for

incentives from his previous employer that he had to forgo.

2 Benefits for Executive Directors incorporate all tax assessable benefits arising

from the individual’s employment. This includes, but is not limited to, benefits

such as the provision of a fully expensed company car, private healthcare,

financial counselling and other benefits as applicable to the individual’s work

location. Benefits for Non-Executive Directors include, but are not limited to,

travel and accommodation expenses relating to attendance at Board and

Committee meetings.

3 Richard Solomons was promoted to Chief Executive on 1 July 2011.

4 Kirk Kinsell received base salary of $750,800 which equates to the figure in the

above table, using an exchange rate of $1=£0.63. Benefits incorporate the cost of

expatriate benefits related to his international assignment prior to taking up his

Board appointment as President, The Americas, on 13 June 2011.

5 Tracy Robbins was appointed as a Director on 9 August 2011. Her benefits include

receipt of a cash allowance in lieu of pension contributions of £117,700.

6 Tom Singer was appointed as a Director on 26 September 2011. His benefits

include receipt of a cash allowance in lieu of pension contributions of £162,000.

7 David Webster retired as Chairman of the Board on 31 December 2012.

8 Graham Allan resigned as a Director on 15 June 2012.

9 Luke Mayhew was appointed as a Director on 1 July 2011.

10 Dale Morrison was appointed as a Director on 1 June 2011.

11 2011 amounts relate to Andrew Cosslett, James Abrahamson and Ralph Kugler,

all of whom ceased to be Directors in 2011. Sir Ian Prosser retired as a Director on

31 December 2003. However, he had an ongoing healthcare benefit of £1,326

during 2012.

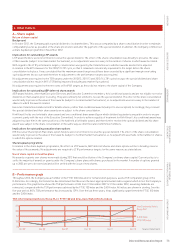

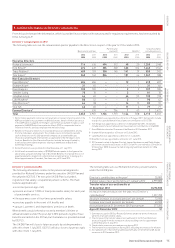

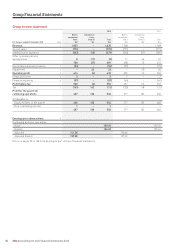

Directors’ pension benefits

The following information relates to the pension arrangements

provided for Richard Solomons under the executive UK DB Plan and

the unfunded ICETUS. The executive UK DB Plan is a funded,

registered, final salary, occupational pension scheme. The main

features applicable are:

• a normal pension age of 60;

• pension accrual of 1⁄30th of final pensionable salary for each year

of pensionable service;

• life assurance cover of four times pensionable salary;

• pensions payable in the event of ill health; and

• spouses’, partners’ and dependants’ pensions on death.

When benefits would otherwise exceed a member’s lifetime or

annual allowance under the post-April 2012 pensions regime, these

benefits are limited in the IC Plan, but the balance is provided instead

by ICETUS.

The UK DB Plan will close to future accruals by existing members

with effect from 1 July 2013. ICETUS will also close to future accruals

with effect from 1 July 2013.

The following table sets out Richard Solomons’ pension benefits

under the UK DB plan:

£

Director’s contributions in the year1 35,000

Transfer value of accrued benefits at 1 January 2012 6,999,800

Transfer value of accrued benefits at

31 December 2012 8,272,500

Increase in transfer value over the year, less Director’s

contributions2 1,237,700

Absolute increase in accrued pension3 per annum 72,900

Increase in accrued pension4 per annum 63,500

Accrued pension at 31 December 20125 per annum 377,200

Age at 31 December 2012 51

1 Contributions paid in 2012 by Richard Solomons under the terms of the plans

were 5% of full pensionable salary.

2 The increase in the transfer value of accrued benefits for Richard Solomons

arises principally from the increase in salary resulting from his appointment

as Chief Executive in July 2011.

3 The absolute increase in accrued pension during 2012.

4 The increase in accrued pension during 2012, excluding any increase for inflation.

5 Accrued pension is that which would be paid annually on retirement at 60, based

on service to 31 December 2012.