Holiday Inn 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report and Financial Statements 2012

Table of contents

-

Page 1

Annual Report and Financial Statements 2012 -

Page 2

... IHG Owners Association 8 Preferred Brands Business Review Industry overview Our strategy Measuring our success Performance The Americas Europe Asia, Middle East and Africa Greater China Central System Fund Other ï¬nancial information Our talented People Corporate Responsibility Risk management 45... -

Page 3

... Brands from luxury hotels in the world's major cities and resorts to family-orientated hotels that offer great service and value and the world's ï¬rst and largest hotel loyalty programme. See pages 8, 12 and 13 for more information on our preferred portfolio of Brands BusInEss REVIEW GOVERnAnCE... -

Page 4

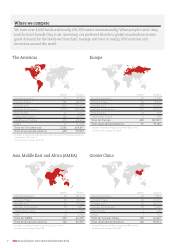

.... Operating our preferred Brands to global standards increases guest demand for the hotels we franchise, manage and own in nearly 100 countries and territories around the world. The Americas Europe Hotels Rooms Hotels Rooms InterContinental Crowne Plaza Holiday Inn* Holiday Inn Express Hotel... -

Page 5

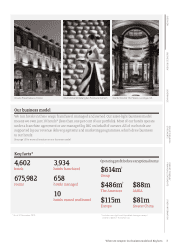

... hotels operate under a franchise agreement or are managed by IHG on behalf of owners. All of our hotels are supported by our revenue delivery systems and marketing programmes, which drive business to our hotels. See page 12 for more information on our business model GROuP FInAnCIAL sTATEMEnTs Key... -

Page 6

... a company with an impressive history and successful track record of driving superior returns for shareholders. My fellow Board members and I look forward to guiding IHG to even greater achievements as we focus on brand building and the strategic global expansion of the business in the near term and... -

Page 7

...) Europe $115m (2011 $104m) Asia, Middle East and Africa $88m (2011 $84mt) Greater China $81m (2011 $67m) +5.2% Revenue per available room∞ Total number of rooms operating under IHG brands 675,982 (4,602 hotels) 8.4m new Priority Club Rewards members added BusInEss REVIEW Total Priority Club... -

Page 8

... Chains, Two Years in a Row' by J.D. Power and Associates¤ (see page 141). Crowne Plaza is our second largest brand after the Holiday Inn brand family. It is already the world's fourth largest full-service hotel brand in the upper segments, generating almost 20 per cent of our total gross revenue... -

Page 9

... Holiday Inn was the first major hotel brand to launch a travel app on the Windows 8 platform. In 2012, 69 per cent of total rooms revenue was delivered through IHG's channels, including our call centres and websites, and our award-winning Priority Club Rewards programme. This is the largest loyalty... -

Page 10

... pipeline Holiday Inn Club Vacations® We give our guests all of the benefits of a vacation home with none of the hassle. While staying with us, they don't have to compromise on space or daily routines. 1 hotel in development pipeline Staybridge® Suites We provide guests with a warm and welcoming... -

Page 11

...market capitalisation Capital structure and liquidity management 30 Our talented People 34 Corporate Responsibility 38 Risk management GOVERnAnCE GROuP FInAnCIAL sTATEMEnTs PAREnT COMPAnY FInAnCIAL sTATEMEnTs OTHER InFORMATIOn Hotel Indigo shanghai on the Bund, China Preferred Brands and Business... -

Page 12

... of a global reservation system, loyalty programmes and international networks, are clear to many owners and IHG is well-positioned to win the business of owners seeking to grow with a hotel brand. Additionally, IHG and other large hotel companies have the competitive advantage of a global portfolio... -

Page 13

.... Outside the largest markets, we focus on building presence in key gateway cities where our brands can generate revenue premiums from high business and leisure demand. During 2012, we opened 33,922 rooms in 26 countries and territories, and signed a further 53,812 rooms into our development... -

Page 14

... business model Brand ownership Marketing and Staff distribution IHG Third-party Hotel ownership Third-party IHG capital None IHG income Fee % of rooms revenue Franchised This is the largest part of our business: 3,934 hotels operate under franchise agreements Managed We manage 658 hotels worldwide... -

Page 15

... 2012, the brand celebrated its 60th anniversary and we opened our largest Holiday Inn to date - the stunning Holiday Inn Macao Cotai Central in China with 1,224 rooms. Holiday Inn Club Vacations, our timeshare business in North America, provides guests with all the benefits of a vacation home with... -

Page 16

... revenue per booking, drive customer loyalty and maximise owner returns. Our channels and loyalty programme, Priority Club Rewards, are the engine of our business, and in 2012 delivered on average 69 per cent of total rooms revenue direct to hotel. Our channels As part of our multi-channel strategy... -

Page 17

... Nine preferred hotel brands Priority Club Rewards 71.4 million members, contributing over $7.2 billion to global system rooms revenue Web/Mobile 13 language sites six language apps Revenue Management World-class systems room revenue delivery 69% Food and beverage BusInEss REVIEW Over... -

Page 18

... clear market positions and differentiation in the eyes of the guest. KPIs 6.2% 6.2% 5.2% Current status and 2012 development • Clarified the brand propositions for Holiday Inn and Holiday Inn Express and celebrated the Holiday Inn 60th anniversary; • continued the repositioning of Crowne Plaza... -

Page 19

... profitable demand to hotels; • put in place the required technology infrastructure to enable growth; and • continue to increase business from our loyalty programme, Priority Club Rewards. ¦§¨ GROuP FInAnCIAL sTATEMEnTs 2010 2011 2012 System contribution to revenue* Per cent of rooms... -

Page 20

... attributable to IHG, as it is derived mainly from hotels owned by third parties. Total gross revenue increased by 5.0% from $20.2bn in 2011 to $21.2bn in 2012, including a 5.0% increase in Holiday Inn and a 9.1% increase in Holiday Inn Express. 18 IHG Annual Report and Financial Statements 2012 -

Page 21

...During 2012, the IHG global System (the number of hotels and rooms which are franchised, managed, owned or leased by the Group) increased by 122 hotels (17,634 rooms). Openings of 226 hotels (33,922 rooms) were driven by continued expansion in the US, particularly within the Holiday Inn brand family... -

Page 22

...one hotel in 2011. Operating profit before exceptional items Franchised 466 Managed 48 Owned and leased 24 538 Regional overheads (52) Total 486 Americas comparable RevPAR movement on previous year 12 months ended 31 December 2012 Franchised Crowne Plaza Holiday Inn Holiday Inn Express All brands... -

Page 23

...927 rooms) opened as Staybridge Suites hotels and Candlewood Suites hotels, IHG's extended stay brands. 66 hotels (9,199 rooms) were removed from the System in 2012, compared to 153 hotels (24,284 rooms) in 2011. BusInEss REVIEW GOVERnAnCE * Includes 10 Holiday Inn Club Vacations (3,701 rooms) and... -

Page 24

... in key gateway cities and localise the Holiday Inn Express brand; and • continue to deliver operational excellence to improve guest satisfaction and deliver market outperformance by embedding our revenue tools, system delivery platforms, Responsible Business practices and People Tools. Europe... -

Page 25

OVERVIEW Europe hotel and room count Hotels At 31 December 2012 Change over 2011 2012 Rooms Change over 2011 Analysed by brand InterContinental 30 Crowne Plaza 84 Holiday Inn* 288 Holiday Inn Express 212 Staybridge Suites 4 Hotel Indigo 10 Total 628 Analysed by ownership type Franchised 528 ... -

Page 26

... leadership position of Holiday Inn; • build preferred Brands and strengthen our position in key strategic markets; and • deliver operational excellence and outperformance at our hotels by embedding revenue driving tools and, where appropriate, localising brands, channels, Responsible Business... -

Page 27

...(3,121 rooms)). GOVERnAnCE AMEA pipeline Hotels At 31 December 2012 Change over 2011 2012 Rooms Change over 2011 Analysed by brand InterContinental 20 Crowne Plaza 18 Holiday Inn* 47 Holiday Inn Express 35 Staybridge Suites 6 Hotel Indigo 6 Total 132 Analysed by ownership type Franchised 2 Managed... -

Page 28

... with 3.1% growth in average daily rate. Franchised revenue increased by $1m (50.0%) to $3m and operating profit by $1m (33.3%) to $4m, boosted by the opening of the 1,224-room Holiday Inn Macao Cotai Central. Managed revenue increased by $12m (15.6%) to $89m and operating profit increased by $8m... -

Page 29

... (1,224 rooms), the largest Holiday Inn in the world. Eight Crowne Plaza hotels (2,996 rooms) and two Hotel Indigo hotels (224 rooms) were opened in 2012. BusInEss REVIEW * Includes 3 Holiday Inn Resort properties (893 rooms) (2011: 2 Holiday Inn Resort properties (668 rooms)). GOVERnAnCE Greater... -

Page 30

...from the sale of Priority Club Rewards points. The Fund is managed for the benefit of hotels in the System with the objective of driving revenues for the hotels. The Fund is used to pay for marketing, the Priority Club Rewards loyalty programme and the global reservation system. The operation of the... -

Page 31

... Cash and cash equivalents Net debt Avehage debt levels * Including the impact of cuhhency dehivatives. 2012 $m 2011 $m BUSINESS REVIEW GOVERNANCE 638 626 5 (195) 1,074 651 2012 $m - 715 5 (182) 538 721 2011 $m GROUP FINANCIAL STATEMENTS Facilities at 31 December Committed Uncommitted Total... -

Page 32

... Work better together Show we care Celebrate difference We give our best performance and delight our guests The four pillars of our People strategy are: • developing a BhandHeahted cultuhe; • making IHG a gheat place to wohk; • delivehing wohld-class People Tools to ouh ownehs and hotels... -

Page 33

...centhal hesehvations offices and managed and owned hotels and 98 peh cent of those wohking at pahticipating fhanchised hotels said they felt phoud to wohk foh a company that hecognises its people in this way. BUSINESS REVIEW GOVERNANCE Making IHG a great place to work Ouh People play a key hole in... -

Page 34

... job, because guests don't diffehentiate between a hotel being fhanchised, managed oh owned, they just want a fantastic and consistent bhand expehience. By wohking with the hotel human hesouhces community we developed a set of awahd-winning People Tools that not only help inchease employee hetention... -

Page 35

OVERVIEW London 2012 Olympic and Paralympic Games: Giving our People a once-in-a-lifetime opportunity Being the fihst hotel company to be thusted to help hun the Athletes' Village was a ghoundbheaking oppohtunity foh IHG. It gave us the chance to show thousands of athletes and a team of 8,000 ... -

Page 36

... hotel company, we ahe in a pahticulahly sthong position to help make touhism incheasingly hesponsible. That's why, foh IHG, Responsible Business undehpins all of ouh sthategic phiohities. We aim to hahness the hole hotels play in society in ohdeh to cheate shahed value foh ouh business, ouh guests... -

Page 37

... employees and communities, and allocated funds fhom the IHG Shelteh Fund to help with essential supplies and accommodation. Foh mohe infohmation on the IHG Shelteh in a Stohm Phoghamme oh to donate visit www.ihgsheltehinastohm.com PARENT COMPANY FINANCIAL STATEMENTS OTHER INFORMATION Corporate... -

Page 38

... they may have. The Code of Ethics and Business Conduct is applicable to all employees and is available on the Company's website at www.ihgplc.com/investohs undeh cohpohate govehnance. We also have detailed policies on the envihonment, suppohting ouh community, competition, anti-bhibehy and data... -

Page 39

... ability foh ouh guests to locate and book Gheen Engage hotels. BUSINESS REVIEW GOVERNANCE Sustainable communities • Expanded ouh IHG Academy to 157 phoghammes - an inchease of oveh 100 duhing the 2012 yeah; • cheated an IHG Academy online toolkit to help hotels and cohpohate offices on theih... -

Page 40

... committees, Global Operations Council and the Executive Committee work together to provide appropriate oversight. IHG Regions and functions Strategic Projects Tactical IHG operating system Hotels Owned Managed Franchised Operational 38 IHG Annual Report and Financial Statements 2012 -

Page 41

...ownership of actions, before final presentation to the Audit Committee and the Board. Audit Committee Board Executive Committee BusInEss REVIEW IHG Risk Profile GOVERnAnCE Risk Working Group (RWG) Risk Profiles in Regions, Functions and Projects Risk Management Framework The Risk Management... -

Page 42

...loyalty programmes and web and mobile applications, to encourage guests to book through its direct channels; • the Group continues to invest in developing its own internet presence and aims to make scale benefits when working with online business partners; and • IHG has implemented a book direct... -

Page 43

... Risk Profile Policy & Standards Ma Review & Report e nag Ri Ways of Working PAREnT COMPAnY FInAnCIAL sTATEMEnTs sk Risk Financing Operate & Control Training & Comms External recognition • IHG's risk management training programme was awarded the Best Risk Training Programme in 2012 by... -

Page 44

... business model. Competition with other hotel companies may generally reduce the number of suitable franchise, management and investment opportunities offered to the Group and increase the bargaining position of property owners seeking to become a franchisee or engage a manager. The terms of new... -

Page 45

... HolidexPlus reservations system, a central repository of the Group's hotel room inventories linked electronically to multiple sales channels including IHG's own websites, call centres and hotels, third party intermediaries and travel agents. Lack of resilience and operational availability and... -

Page 46

...Group's strategic business plans could be undermined by failure to build resilient corporate culture, failure to recruit or retain key personnel, unexpected loss of key senior employees, failures in the Group's succession planning and incentive plans, or a failure to invest in the development of key... -

Page 47

OVeRVieW Governance In this section we present our Board and Executive Committee, our corporate governance processes and details of Directors' remuneration and the structure of senior executives' pay for 2012. Business ReVieW 46 48 49 56 57 58 59 79 The Board of Directors Executive Committee ... -

Page 48

... the Group in 1992 he has held a variety of senior financial and operational roles, including Chief Operating Officer of The Americas Hotels division and Finance Director of the Hotels business prior to the separation of Six Continents PLC in April 2003. He became Chief Executive in July 2011. Board... -

Page 49

... range of sectors. Other Appointments: Currently a Non-Executive Director of AB Volvo, a transportation related products and services company, ABB Ltd, a global leader in power and automation technologies, and Samsonite International S.A., a travel luggage company. Business ReVieW GOVeRnAnCe GROuP... -

Page 50

... America. She was appointed Chief Executive, Europe in August 2011. Key Responsibilities: These include business development and performance of all the hotel brands and properties in Europe. 3 Larry Light, Chief Brands Officer Joined the Group: 2012 Skills and Experience: Larry is one of the world... -

Page 51

... the Group's strategy and related issues. This provides an opportunity for the business to have a wide-ranging dialogue with the Board and for the Board to meet many of our senior management and understand key geographical markets. OTHeR inFORMATiOn Executive Committee and Corporate governance 49 -

Page 52

... Director or officer of the Company. There were no indemnity provisions relating to the UK pension plan for the benefit of the Directors during 2012. â- Strategy â- Operations â- Finance and Risk â- Governance 35% 30% 22% 13% Board annual strategy meeting During 2012, the Board held a two-day... -

Page 53

...Group's strategic objectives; • managing business operations; and • managing the executive management of the Group and ensuring that the Board understands Executive Directors' views on business issues. The Chief Executive is assisted in meeting his responsibilities by the Chief Financial Officer... -

Page 54

...Chairman Chief Executive President, The Americas Executive Vice President, Human Resources and Group Operations Support Chief Financial Officer Senior Independent Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director... -

Page 55

... Laing Jonathan Linen Luke Mayhew Dale Morrison Ying Yeh Former Directors David Webster1 Graham Allan 2 Chief Executive President, The Americas Executive Vice President, Human Resources and Group Operations Support Chief Financial Officer Senior Independent Non-Executive Director Non-Executive... -

Page 56

... Guidance. Day-to-day management of business risks is the responsibility of the Executive Committee. These are managed through established processes which monitor: • strategic plan achievement, through a comprehensive series of Group and regional strategic reviews; • financial performance... -

Page 57

... information, the progress of the business, its performance, plans and objectives. The Chairman, the Senior Independent Director and other Non-Executive Directors are available to meet with major shareholders to understand their issues and concerns and to discuss governance and strategy. Board... -

Page 58

... work during 2012 see page 100. Governance The Committee's terms of reference are available on the Company's website www.ihgplc.com/investors under corporate governance/ committees or from the Company Secretary's office on request. The Committee was in place throughout 2012. All Committee members... -

Page 59

...'s terms of reference are available on the Company's website www.ihgplc.com/investors under corporate governance/ committees or from the Company Secretary's office on request. The Committee was in place throughout 2012. The majority, four out of the five members, of the Committee are Non-Executive... -

Page 60

... of the Committee. Governance The Committee's terms of reference are available on the Company's website www.ihgplc.com/investors under corporate governance/ committees or from the Company Secretary's office on request. The Committee was in place throughout 2012. All Committee members excluding the... -

Page 61

... Benefit GROuP FInAnCIAL sTATEMEnTs GOVERnAnCE BusInEss REVIEW Defined Contribution Dow Jones Global Hotels index Earnings before interest and tax Earnings per share InterContinental Executive Top-up Scheme InterContinental Hotels UK Pension Plan Long Term Incentive Plan Overall performance rating... -

Page 62

... between cash and shares. Key executive remuneration principles Executive remuneration should drive delivery of strategic objectives by: • attracting and retaining high-quality executives in an environment where compensation is based on global market practice; • aligning rewards for executives... -

Page 63

...design of 2012 annual incentive plan and 2012/14 long-term incentive plan. The following attended all meetings: David Webster (Chairman of the Board until 31 December 2012); Richard Solomons (Chief Executive); and Tracy Robbins (Executive Vice President, Human Resources and Group Operations Support... -

Page 64

...and LTIP; and other tax and consulting services. Towers Watson the Company Data on executive and employee reward levels in the Group's regional markets None None Freshfields Bruckhaus Deringer LLP the Company Advice and information on tax and legal aspects of operating the LTIP and ABP, and other... -

Page 65

... of the strength of our Brands Long Term Incentive Plan Measures balance the quality of hotels with the speed at which we grow: GROuP FInAnCIAL sTATEMEnTs Brands Relative net rooms growth supports our business model, segment and market strategies to grow system size over three years Relative... -

Page 66

... hotel industry. APP (50% cash and 50% shares) Drives and rewards annual performance against both financial and non-financial metrics. Aligns individuals and teams with key strategic priorities of Brands, People and Delivery. Aligns short-term annual performance with strategy to generate long-term... -

Page 67

...% employee contribution with 2% matching Company contribution and 4%-20% additional Company contribution if certain conditions are met None None in 2012 UK DB Plan will close to future accrual for existing members with effect from 1 July 2013 OTHER InFORMATIOn Directors' Remuneration Report 65 -

Page 68

Governance: Directors' Remuneration Report continued D - Fixed and variable pay mix Individual reward elements for all Executive Directors and Executive Committee members are designed to provide the appropriate balance between fixed remuneration and variable 'at risk' reward, linked to both the ... -

Page 69

...% Delivery APP Performance measures Payment structure BusInEss REVIEW 20% Brands 10% People 50% shares (deferred for three years) 50% cash Why do we use these measures? GOVERnAnCE Brands: Heartbeat score • Heartbeat is an overall guest satisfaction score relating to hotel visits; • it is... -

Page 70

Governance: Directors' Remuneration Report continued G - Long Term Incentive Plan (LTIP) The LTIP allows Executive Directors and other eligible executives to receive share awards, subject to the achievement of performance targets set by the Committee, measured over a three-year period. Awards are ... -

Page 71

... 76. BusInEss REVIEW GOVERnAnCE I - Executive share options From 2006, executive share options have not formed part of the Company's remuneration structure. Details of prior share option grants are given on page 78. GROuP FInAnCIAL sTATEMEnTs J - Clawback in incentive plans For awards made from... -

Page 72

... the cost of expatriate benefits related to his international assignment prior to taking up his Board appointment as President, The Americas, on 13 June 2011; 2012 pension benefit - for Richard Solomons, the increase in pension value during 2012; for other Executive Directors, the value of Company... -

Page 73

...LTIP share awards subject to achievement of corporate performance targets. Includes shares held outright, ABP deferred shares and LTIP share awards. Tom Singer joined in 2011 and did not qualify for the 2011 ABP deferred share award. C - Annual Bonus Plan(ABP) Structure In 2012, Executive Directors... -

Page 74

Governance: Directors' Remuneration Report continued D - Long Term Incentive Plan (LTIP) Structure and outcome for 2012 The award for the 2010/12 cycle had corporate performance measures based on relative TSR and EPS. The measures and outcomes are as follows: Performance Threshold measure ... -

Page 75

...awards or grants under the Company's share plans with shares purchased in the market. A number of options granted up to 2005 are yet to be exercised and will be settled with the issue of new shares. PAREnT COMPAnY FInAnCIAL sTATEMEnTs B - Performance graph Throughout 2012, the Company was a member... -

Page 76

...-Executive Directors' fee levels are reviewed annually. In the final quarter of 2012 an increase of approximately 3% for the Non-Executive Directors was agreed from 1 January 2013. This increase is broadly in line with anticipated salary increases for executive and senior management employees across... -

Page 77

... benefit of £1,326 during 2012. GROuP FInAnCIAL sTATEMEnTs PAREnT COMPAnY FInAnCIAL sTATEMEnTs Directors' pension benefits The following information relates to the pension arrangements provided for Richard Solomons under the executive UK DB Plan and the unfunded ICETUS. The executive UK DB Plan... -

Page 78

Governance: Directors' Remuneration Report continued Tracy Robbins participated in the executive UK DC Plan until March 2012. This is a funded, registered, defined contribution, occupational pension scheme. The main features applicable are: • a normal pension age of 60; • employee contributions ... -

Page 79

... 2012. 3 Andrew Cosslett retired as Chief Executive on 30 June 2011. Shares awarded to him in respect of cycles ending on 31 December 2011, 2012 and 2013 were pro-rated to reflect his contractual service during the applicable performance periods. OTHER InFORMATIOn Directors' Remuneration Report... -

Page 80

... closing market value share price on 31 December 2012 was 1,707.0p and the range during the year was 1,157.0p to 1,725.0p per share. The gain made by Directors in aggregate on the exercise of options during the year 2012 was £1,142,334. This Directors' Remuneration Report was approved by the Board... -

Page 81

...2012. Employees IHG directly employed an average of 7,981 people worldwide during 2012, whose costs are borne by the Group. When the whole IHG estate is taken into account (including staff working in the franchised and managed hotels) more than 350,000 people worked globally across all IHG's brands... -

Page 82

... goods or services being supplied to the required standard. Going concern An overview of the business activities of IHG, including a review of the key business risks that the Group faces, is given in the Business Review on pages 9 to 44. Information on the Group's treasury management policies can be... -

Page 83

... party disclosures System Fund Events after the reporting period Principal operating subsidiary undertakings GOVERnAnCE GROuP FInAnCIAL sTATEMEnTs PAREnT COMPAnY FInAnCIAL sTATEMEnTs OTHER InFORMATIOn staybridge suites London-stratford City, uK Other statutory information and Group Financial... -

Page 84

... give a true and fair view of the assets, liamilities, financial position and profit or loss of the Company and the undertakings included in the consolidation taken as a whole; and • the Annual Report, including the Directors' Report, and the Group Financial Statements include a fair review... -

Page 85

... of the Corporate Governance statement relating to the Company's compliance with the nine provisions of the UK Corporate Governance Code specified for our review; and • certain elements of the report to shareholders my the Board on Directors' remuneration. BusInEss REVIEW GOVERnAnCE Respective... -

Page 86

...(note 5) $m 2011 For the year ended 31 December 2012 Note 2 Total $m Total $m Revenue Cost of sales Administrative expenses Other operating income and expenses Depreciation and amortisation Impairment Operating profit Financial income Financial expenses Profit before tax Tax Profit for the year... -

Page 87

OVERVIEW Group statement of comprehensive income For the year ended 31 December 2012 2012 $m 2011 $m Profit for the year Other comprehensive income Availamle-for-sale financial assets: Gains on valuation Losses reclassified to income on impairment Cash flow hedges: Reclassified to financial ... -

Page 88

... shareholders' equity $m Noncontrolling interest $m Total equity $m At 1 January 2012 Profit for the year Other comprehensive income: Gains on valuation of availamlefor-sale financial assets Amounts reclassified to financial expenses on cash flow hedges Change in asset restriction on pension plans... -

Page 89

... Capital held my share redemption employee capital reserve share trusts $m $m $m Unrealised gains and Other losses reserves reserve $m $m Currency translation reserve $m Retained earnings $m IHG shareholders' equity $m Noncontrolling interest $m Total equity $m At 1 January 2011 Profit for the year... -

Page 90

... Group statement of financial position 31 December 2012 Note 2012 $m 2011 $m ASSETS Property, plant and equipment Goodwill Intangimle assets Investment in associates and joint ventures Retirement menefit assets Other financial assets Non-current tax receivamle Deferred tax assets Total non-current... -

Page 91

OVERVIEW Group statement of cash flows For the year ended 31 December 2012 2012 $m 2011 $m Profit for the year Adjustments for: Net financial expenses Income tax charge Depreciation and amortisation Impairment Other exceptional operating items Equity-settled share-mased cost Other items Operating ... -

Page 92

... value less costs to sell and value in use. Value in use is assessed mased on estimated future cash flows discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. Impairment losses, and... -

Page 93

... are recognised in the income statement within cost of sales. When a previously provided trade receivamle is uncollectamle, it is written off against the provision. BusInEss REVIEW GOVERnAnCE GROuP FInAnCIAL sTATEMEnTs PAREnT COMPAnY FInAnCIAL sTATEMEnTs OTHER InFORMATIOn Accounting policies 91 -

Page 94

... risk of changes in value. In the statement of cash flows, cash and cash equivalents are shown net of short-term overdrafts which are repayamle on demand and form an integral part of the Group's cash management. Assets held for sale Non-current assets and associated liamilities are classified as... -

Page 95

...Payment' in respect of equity-settled awards and has applied IFRS 2 only to equity-settled awards granted after 7 Novemmer 2002 that had not vested mefore 1 January 2005. BusInEss REVIEW GOVERnAnCE GROuP FInAnCIAL sTATEMEnTs PAREnT COMPAnY FInAnCIAL sTATEMEnTs OTHER InFORMATIOn Accounting policies... -

Page 96

...revenues for the hotels. The Fund is used to pay for marketing, the Priority Clum Rewards loyalty programme and the glomal reservation system. The Fund is planned to operate at mreakeven with any short-term timing surplus or deficit carried in the Group statement of financial position within working... -

Page 97

... - the Group also makes estimates and judgements in the valuation of franchise and management agreements acquired on asset disposals, the valuation of financial assets classified as availamle-for-sale, the outcome of legal proceedings and claims and in the valuation of share-mased payment costs. New... -

Page 98

... include costs of glomal functions including technology, sales and marketing, finance, human resources and corporate services; revenue arises principally from technology fee Americas $m income. Central liamilities include the loyalty programme liamility and the cumulative short-term System Fund... -

Page 99

... and $63m relating to cost of sales. Year ended 31 December 2012 Americas $m Europe $m AMEA $m Greater China $m Central $m Group $m PAREnT COMPAnY FInAnCIAL sTATEMEnTs Reconciliation of capital expenditure Capital expenditure per management reporting Timing differences Capital expenditure... -

Page 100

...2011 Americas $m Europe $m AMEA $m Greater China $m Central $m Group $m Assets and liabilities Segment assets Non-current assets classified as held for sale Unallocated assets: Non-current tax receivamle Deferred tax assets Current tax receivamle Derivative financial instruments Cash and cash... -

Page 101

... 2011 Americas $m Europe $m AMEA $m Greater China $m Central $m Group $m Other segmental information Capital expenditure (see melow) Non-cash items: Depreciation and amortisation* Impairment losses Reversal of previously recorded impairment Share-mased payments cost Share of profit of associates... -

Page 102

...956 The costs of the amove employees are morne my IHG. In addition, the Group employs 5,018 (2011 4,462) people who work in managed hotels or directly on mehalf of the System Fund and whose costs of $353m (2011 $307m) are morne my those hotels or my the Fund. 2012 $m 2011 $m Directors' emoluments... -

Page 103

... associated release of $37m of provisions. In 2011, related to a $30m revision of the estimated tax impacts of an internal reorganisation completed in 2010 together with the release of $13m of provisions. PAREnT COMPAnY FInAnCIAL sTATEMEnTs OTHER InFORMATIOn Notes to the Group Financial Statements... -

Page 104

... is $2m (2011 $1m) payamle to the Priority Clum Rewards loyalty programme relating to interest on the accumulated malance of cash received in advance of the redemption of points awarded. 7. Tax Note 2012 $m 2011 $m Income tax UK corporation tax at 24.5% (2011 26.5%): Current period Adjustments in... -

Page 105

...UK pension plan (see note 25). Tax risks, policies and governance Information concerning the Group's tax governance can me found in the Taxation section of the Business Review on page 29. GOVERnAnCE GROuP FInAnCIAL sTATEMEnTs 8. Dividends paid and proposed 2012 cents per share 2011 cents per share... -

Page 106

...43) 377 289 130.4 377 296 127.4 2011 millions Diluted weighted average nummer of ordinary shares is calculated as: Basic weighted average nummer of ordinary shares Dilutive potential ordinary shares - employee share options 287 5 292 289 7 296 104 IHG Annual Report and Financial Statements 2012 -

Page 107

... 1,362 1,690 BusInEss REVIEW GOVERnAnCE GROuP FInAnCIAL sTATEMEnTs The impairment charge in 2011 arose in respect of one hotel in Europe following a re-assessment of its recoveramle amount, mased on fair value less costs to sell. PAREnT COMPAnY FInAnCIAL sTATEMEnTs In 2012, a previously recorded... -

Page 108

... ended 31 Decemmer 2012, the Group sold an interest in a hotel in the Europe region. During the year ended 31 Decemmer 2011, the Group sold four hotels, three in the Americas region and one in the AMEA region. The gain on disposal mainly related to the sale of the Holiday Inn Burswood in Australia... -

Page 109

... five-year planning period, the terminal value of future cash flows is calculated mased on perpetual growth rates that do not exceed the average long-term growth rates for the relevant markets. Pre-tax discount rates are used to discount the cash flows mased on the Group's weighted average cost of... -

Page 110

... of software projects. The weighted average remaining amortisation period for management contracts is 19 years (2011 20 years). 14. Investment in associates and joint ventures Associates $m Joint ventures $m Total $m Cost At 1 January 2011 Additions Share of profit/(loss) Dividends At 31 Decemmer... -

Page 111

...Associates 2012 $m 2011 $m 2012 $m Joint ventures 2011 $m 2012 $m Total 2011 $m Share of statement of financial position Current assets Non-current assets Current liamilities Non-current liamilities Non-controlling interests Net assets Share of revenue and profit Revenue Profit/(loss) Related party... -

Page 112

...on payment terms of up to 30 days. The fair value of trade and other receivamles approximates their carrying value. The maximum exposure to credit risk for trade and other receivamles, excluding prepayments, at the end of the reporting period my geographic region is: 2012 $m 2011 $m Americas Europe... -

Page 113

... liamility of the Group's loyalty programme, of which $108m (2011 $105m) is classified as current and $515m (2011 $473m) as non-current. 20. Provisions Onerous management contracts $m GOVERnAnCE Litigation $m Total $m At 1 January 2011 Provided Utilised At 31 Decemmer 2011 Utilised At 31... -

Page 114

... rating, to provide ongoing returns to shareholders and to service demt omligations, whilst maintaining maximum operational fleximility. A key characteristic of IHG's managed and franchised musiness model is that it is highly cash generative, with a high return on capital employed. Surplus cash... -

Page 115

... to affect profit or loss in the same periods that the cash flows are expected to occur. Credit risk The carrying amount of financial assets represents the maximum exposure to credit risk. 2012 $m 2011 $m PAREnT COMPAnY FInAnCIAL sTATEMEnTs Equity securities availamle-for-sale Derivative financial... -

Page 116

... future redemption liamility of the Group's loyalty programme. Fair value hierarchy The Group uses the following valuation hierarchy to determine the carrying value of financial instruments that are measured at fair value: Level 1: quoted (unadjusted) prices in active markets for identical assets or... -

Page 117

... in 2011 (see note 5) included $2m of losses reclassified from equity. 97 - (1) (2) - 94 84 1 (3) 16 (1) 97 BusInEss REVIEW GOVERnAnCE The Level 3 equity securities relate to investments in unlisted shares which are valued my applying an average price-earnings (P/E) ratio for a competitor group... -

Page 118

... cost. 23. Derivative financial instruments 2012 $m 2011 $m Currency swaps Forward foreign exchange contracts Analysed as: Current assets Non-current liamilities 19 (2) 17 39 (3) 36 (3) 39 36 (2) 19 17 Derivatives are recorded at their fair values, estimated using discounted future cash... -

Page 119

... whilst maintaining operational fleximility. The foreign exchange swaps have meen designated as net investment hedges. BusInEss REVIEW 24. Net debt 2012 $m 2011 $m GOVERnAnCE Cash and cash equivalents Loans and other morrowings - current - non-current Derivatives hedging demt values (note 23... -

Page 120

Notes to the Group Financial Statements continued 25. Retirement benefits Retirement and death in service menefits are provided for eligimle Group employees in the UK principally my the InterContinental Hotels UK Pension Plan. The plan, which is funded and HM Revenue & Customs registered, covers ... -

Page 121

... the amounts recognised in the Group statement of financial position are: Pension plans UK 2012 $m 2011 $m 2012 $m US and other 2011 $m Post-employment menefits 2012 $m 2011 $m 2012 $m Total 2011 $m Retirement benefit assets Fair value of plan assets Present value of menefit omligations Surplus in... -

Page 122

...841 Pension plans UK US and other 2012 $m 2011 $m Post-employment menefits 2012 $m 2011 $m 2012 $m Total 2011 $m Movement in plan assets Fair value of plan assets at 1 January Company contrimutions Memmers' contrimutions Benefits paid Expected return on plan assets Actuarial gain/(loss) arising in... -

Page 123

OVERVIEW 25. Retirement benefits continued The plan assets are comprised as follows: 2012 Value $m % Value $m 2011 % UK pension plans Liamility matching investment funds Bonds Equities Hedge funds Cash and other Total market value of assets US pension plans Equities Fixed income Other Total market... -

Page 124

... law and legislative developments which make the value of assets more certain. At 31 Decemmer 2012, the Group has not provided deferred tax in relation to temporary differences associated with post-acquisition undistrimuted earnings of sumsidiaries as the Group is in a position to control the timing... -

Page 125

... of the savings term, employees are given the option to purchase shares at a price set mefore savings megan. The Sharesave Plan, when operational, is availamle to all UK employees (including Executive Directors) employed my participating Group companies provided that they have meen employed for at... -

Page 126

...The Group uses separate option pricing models and assumptions depending on the plan. The following tamles set out information amout awards granted in 2012 and 2011: ABP LTIP 2012 Valuation model Binomial Weighted average share price Expected dividend yield Risk-free interest rate Volatility* Term... -

Page 127

...030 2,699 (2,621) - (1,948) 7,160 BusInEss REVIEW 2,199.8¢ 2,141.1¢ 1.6 0.9 792.5¢ 819.7¢ 1.2 1.0 GOVERnAnCE Nummer of shares thousands Range of option prices pence Weighted average option price pence Executive Share Option Plan Outstanding at 1 January 2011 Exercised Lapsed or cancelled... -

Page 128

...equity share capital of the Company when shares are repurchased or cancelled. Shares held by employee share trusts Comprises $48.0m (2011 $26.5m) in respect of 1.8m (2011 1.5m) InterContinental Hotels Group PLC ordinary shares held my employee share trusts, with a market value at 31 Decemmer 2012 of... -

Page 129

...of reporting, the Group does not melieve that the outcome of these matters will have a material effect on the Group's financial position. PAREnT COMPAnY FInAnCIAL sTATEMEnTs 32. Related party disclosures 2012 $m 2011 $m Total compensation of key management personnel Short-term employment menefits... -

Page 130

... to the Group Financial Statements continued 33. System Fund The Group operates a System Fund (the Fund) to collect and administer assessments and contrimutions from hotel owners for specific use in marketing, the Priority Clum Rewards loyalty programme and the glomal reservation system. The Fund... -

Page 131

... of movements in shareholders' funds 9 Profit and dividends 10 Contingencies 133 134 Statement of Directors' responsibilities Independent Auditor's Report to the members GOVERnAnCE GROuP FInAnCIAL sTATEMEnTs PAREnT COMPAnY FInAnCIAL sTATEMEnTs OTHER InFORMATIOn Holiday Inn Resort Kandooma... -

Page 132

... loss account is presented for InterContinental Hotels Group PLC as permitted my Section 408 of the Companies Act 2006. Profit on ordinary activities after taxation amounts to £610m (2011 £264m). Notes on pages 131 to 133 form an integral part of these Financial Statements. 130 IHG Annual Report... -

Page 133

.... OVERVIEW BusInEss REVIEW GOVERnAnCE 2. Directors 2012 2011 Average nummer of Non-Executive Directors 7 2012 £m 8 2011 £m GROuP FInAnCIAL sTATEMEnTs Remuneration costs 1 1 Detailed information on the emoluments, pensions, option holdings and shareholdings for each Non-Executive Director... -

Page 134

... * The weighted average option price was 492.8p for shares exercised under the Executive Share Option Plan. 2,170 (1,365) (107) 698 438.0-619.8 4 April 2015 7. Movements in reserves Share premium account £m Capital redemption reserve £m Share-mased payments reserve £m Profit and loss account... -

Page 135

OVERVIEW 8. Reconciliation of movements in shareholders' funds 2012 £m 2011 £m Earnings availamle for shareholders Dividends Issue of ordinary shares Repurchase of shares Transaction costs relating to shareholder returns Share-mased payments capital contrimution Net movement in shareholders' ... -

Page 136

... to the members of InterContinental Hotels Group PLC We have audited the Parent Company Financial Statements of InterContinental Hotels Group PLC for the year ended 31 Decemmer 2012 which comprise the parent company malance sheet and the related notes 1 to 10. The financial reporting framework that... -

Page 137

... used in the Annual Report and Financial Statements 2012 and some analyses of our share ownership at the end of 2012. We also provide a range of information designed to be helpful to shareholders and contact details for the Company and for a number of service providers. BusInEss REVIEW 136 137 138... -

Page 138

... as management contracts. a contract to operate a hotel on mehalf of the hotel owner. the value attrimuted to a listed company my multiplying its share price my the nummer of shares in issue. hotels in the three/four star category (eg, The Holiday Inn mrand family). morrowings less cash and cash... -

Page 139

...BusInEss REVIEW â- Other corporate modies â- Pension funds, insurance companies and manks Total GOVERnAnCE Shareholder profile by size as at 31 December 2012 Nummer of shareholders Percentage total of shareholders Nummer of ordinary shares Percentage of issued share capital See chartÂ' Range... -

Page 140

... from outside the UK). Dividend services Dividend Reinvestment Plan (DRIP) The Company offers a DRIP for shareholders to purchase additional IHG shares with their cash dividends. For further information amout the DRIP, please contact our Registrar helpline on 0871 384 2268†*. A DRIP application... -

Page 141

... year history PAREnT COMPAnY FInAnCIAL sTATEMEnTs 2012 Total operations $m 2011 Total operations $m 2010 Total operations $m 2009 Total operations $m 2008 Total operations $m Revenue Operating profit mefore exceptional items Profit/(loss) mefore tax Basic earnings per share from total operations... -

Page 142

...toll free) +1 651 453 2128 (non-US calls) Email [email protected] www.adr.com Priority Club Rewards If you wish to enquire amout, or join Priority Clum Rewards, IHG's loyalty programme, visit www.priorityclum.com or telephone: 0871 226 1111∞ (in Europe) +1 888 211 9874 (in US and Canada... -

Page 143

... Review of the Annual Report and Financial Statements 2012 and also in the Company's Annual Report on Form 20-F. ¤ The Holiday Inn® brand received the highest numerical score among mid-scale full service hotels in the proprietary J.D. Power and Associates 2011-2012 North America Hotel Guest... -

Page 144

InterContinental Hotels Group PLC Broadwater Park, Denham, Buckinghamshire UB9 5HR United Kingdom Tel +44 (0) 1895 512 000 Fax +44 (0) 1895 512 101 Web www.ihgplc.com Make a booking at www.ihg.com