Comcast 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

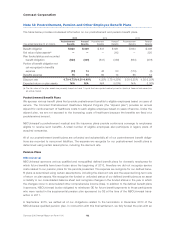

Intangible Assets

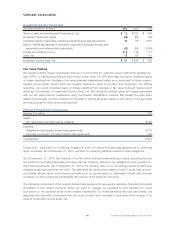

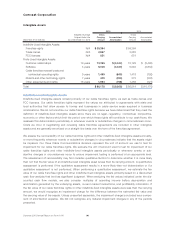

2015 2014

December 31 (in millions)

Weighted-Average

Original Useful Life

as of December 31, 2015

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Indefinite-Lived Intangible Assets:

Franchise rights N/A $ 59,364 $ 59,364

Trade names N/A 2,857 3,083

FCC licenses N/A 651 651

Finite-Lived Intangible Assets:

Customer relationships 19 years 13,396 $ (4,442) 15,129 $ (5,495)

Software 4 years 6,008 (3,429) 5,040 (2,832)

Cable franchise renewal costs and

contractual operating rights 9 years 1,499 (849) 1,418 (792)

Patents and other technology rights 7 years 409 (350) 373 (330)

Other agreements and rights 18 years 1,994 (798) 1,456 (721)

Total $ 86,178 $ (9,868) $ 86,514 $ (10,170)

Indefinite-Lived Intangible Assets

Indefinite-lived intangible assets consist primarily of our cable franchise rights, as well as trade names and

FCC licenses. Our cable franchise rights represent the values we attributed to agreements with state and

local authorities that allow access to homes and businesses in cable service areas acquired in business

combinations. We do not amortize our cable franchise rights because we have determined that they meet the

definition of indefinite-lived intangible assets since there are no legal, regulatory, contractual, competitive,

economic or other factors which limit the period over which these rights will contribute to our cash flows. We

reassess this determination periodically or whenever events or substantive changes in circumstances occur.

Costs we incur in negotiating and renewing cable franchise agreements are included in other intangible

assets and are generally amortized on a straight-line basis over the term of the franchise agreement.

We assess the recoverability of our cable franchise rights and other indefinite-lived intangible assets annually,

or more frequently whenever events or substantive changes in circumstances indicate that the assets might

be impaired. Our three Cable Communications divisions represent the unit of account we use to test for

impairment for our cable franchise rights. We evaluate the unit of account used to test for impairment of our

cable franchise rights and other indefinite-lived intangible assets periodically or whenever events or sub-

stantive changes in circumstances occur to ensure impairment testing is performed at an appropriate level.

The assessment of recoverability may first consider qualitative factors to determine whether it is more likely

than not that the fair value of an indefinite-lived intangible asset is less than its carrying amount. A quantitative

assessment is performed if the qualitative assessment results in a more-likely-than-not determination or if a

qualitative assessment is not performed. When performing a quantitative assessment, we estimate the fair

value of our cable franchise rights and other indefinite-lived intangible assets primarily based on a discounted

cash flow analysis that involves significant judgment. When analyzing the fair values indicated under the dis-

counted cash flow models, we also consider multiples of operating income before depreciation and

amortization generated by the underlying assets, current market transactions, and profitability information. If

the fair value of our cable franchise rights or other indefinite-lived intangible assets were less than the carrying

amount, we would recognize an impairment charge for the difference between the estimated fair value and

the carrying value of the assets. Unless presented separately, the impairment charge is included as a compo-

nent of amortization expense. We did not recognize any material impairment charges in any of the periods

presented.

Comcast 2015 Annual Report on Form 10-K 96