Comcast 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Comcast Corporation

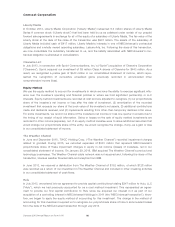

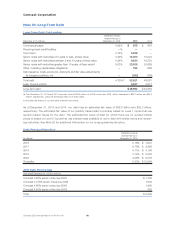

Liberty Media

In October 2013, Liberty Media Corporation (“Liberty Media”) redeemed 6.3 million shares of Liberty Media

Series A common stock (“Liberty stock”) that had been held by us as collateral under certain of our prepaid

forward sale agreements in exchange for all of the equity of a subsidiary of Liberty Media. The fair value of the

Liberty stock at the date of the close of the transaction was $937 million. The assets of the subsidiary of

Liberty Media included cash of $417 million, Liberty Media’s interests in one of NBCUniversal’s contractual

obligations and a wholly owned operating subsidiary, Leisure Arts, Inc. Following the close of this transaction,

we now consolidate the subsidiary transferred to us, and the liability associated with NBCUniversal’s con-

tractual obligation is eliminated in consolidation.

Clearwire LLC

In July 2013, in connection with Sprint Communications, Inc.’s (“Sprint”) acquisition of Clearwire Corporation

(“Clearwire”), Sprint acquired our investment of 89 million Class A shares of Clearwire for $443 million. As a

result, we recognized a pretax gain of $443 million in our consolidated statement of income, which repre-

sented the recognition of cumulative unrealized gains previously recorded in accumulated other

comprehensive income (loss).

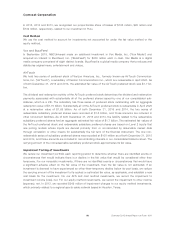

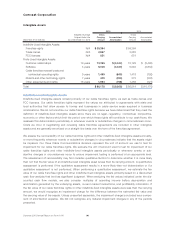

Equity Method

We use the equity method to account for investments in which we have the ability to exercise significant influ-

ence over the investee’s operating and financial policies or where we hold significant partnership or LLC

interests. Equity method investments are recorded at cost and are adjusted to recognize (1) our proportionate

share of the investee’s net income or loss after the date of investment, (2) amortization of the recorded

investment that exceeds our share of the book value of the investee’s net assets, (3) additional contributions

made and dividends received, and (4) impairments resulting from other-than-temporary declines in fair value.

For some investments, we record our share of the investee’s net income or loss one quarter in arrears due to

the timing of our receipt of such information. Gains or losses on the sale of equity method investments are

recorded to other income (expense), net. If an equity method investee were to issue additional securities that

would change our proportionate share of the entity, we would recognize the change, if any, as a gain or loss

in our consolidated statement of income.

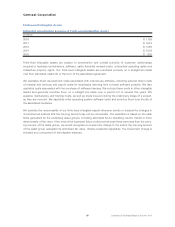

The Weather Channel

In June and December 2015, TWCC Holding Corp. (“The Weather Channel”) recorded impairment charges

related to goodwill. During 2015, we recorded expenses of $333 million that represent NBCUniversal’s

proportionate share of these impairment charges in equity in net income (losses) of investees, net in our

consolidated statement of income. On January 29, 2016, IBM acquired The Weather Channel’s product and

technology businesses. The Weather Channel cable network was not acquired and, following the close of the

transaction, licenses weather forecast data and analytics from IBM.

In June 2013, we received a distribution from The Weather Channel of $152 million, of which $128 million

was recorded as a return of our investment in The Weather Channel and included in other investing activities

in our consolidated statement of cash flows.

Hulu

In July 2013, we entered into an agreement to provide capital contributions totaling $247 million to Hulu, LLC

(“Hulu”), which we had previously accounted for as a cost method investment. This represented an agree-

ment to provide our first capital contribution to Hulu since we acquired our interest in it as part of our

acquisition of a controlling interest in NBCUniversal Holdings in 2011 (the “NBCUniversal transaction”); there-

fore, we began to apply the equity method of accounting for this investment. The change in the method of

accounting for this investment required us to recognize our proportionate share of Hulu’s accumulated losses

from the date of the NBCUniversal transaction through July 2013.

Comcast 2015 Annual Report on Form 10-K 92