Comcast 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

From time to time, we engage in transactions in which the tax consequences may be subject to uncertainty.

In these cases, we evaluate our tax positions using the recognition threshold and the measurement attribute

in accordance with the accounting guidance related to uncertain tax positions. Examples of these trans-

actions include business acquisitions and dispositions, including consideration paid or received in connection

with these transactions, certain financing transactions, and the allocation of income among state and local

tax jurisdictions. Significant judgment is required in assessing and estimating the tax consequences of these

transactions. We determine whether it is more likely than not that a tax position will be sustained on examina-

tion, including the resolution of any related appeals or litigation processes, based on the technical merits of

the position. A tax position that meets the more-likely-than-not recognition threshold is measured to

determine the amount of benefit to be recognized in our consolidated financial statements. We classify inter-

est and penalties, if any, associated with our uncertain tax positions as a component of income tax expense.

NBCUniversal

For U.S. federal income tax purposes, NBCUniversal Holdings is treated as a partnership and NBCUniversal

is disregarded as an entity separate from NBCUniversal Holdings. Accordingly, neither NBCUniversal Hold-

ings nor NBCUniversal and its subsidiaries incur any material current or deferred domestic income taxes.

Following the close of the NBCUniversal redemption transaction in March 2013, the taxable income of

NBCUniversal Holdings and NBCUniversal is allocable entirely to us.

We are indemnified by GE for any income tax liability attributable to the NBCUniversal contributed businesses

for periods prior to the close of the NBCUniversal transaction in January 2011 and also for any income tax

liability attributable to NBCUniversal Enterprise for periods prior to the date of the NBCUniversal redemption

transaction. We have indemnified GE for any income tax liability attributable to the businesses we contributed

to NBCUniversal for periods prior to the close of the NBCUniversal transaction.

Current and deferred foreign income taxes are incurred by NBCUniversal’s foreign subsidiaries. In 2015, 2014

and 2013, NBCUniversal had foreign income before taxes of $704 million, $385 million and $524 million,

respectively, on which foreign income tax expense was recorded. We recorded U.S. income tax expense on

our allocable share of NBCUniversal’s income before domestic and foreign taxes, which was reduced by a

U.S. tax credit equal to our allocable share of NBCUniversal’s foreign income tax expense.

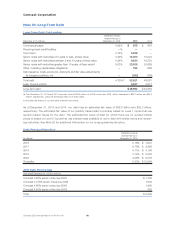

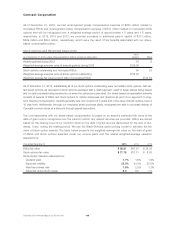

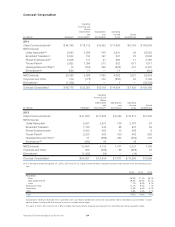

Components of Net Deferred Tax Liability

December 31 (in millions) 2015 2014

Deferred Tax Assets:

Net operating loss carryforwards $ 551 $ 448

Differences between book and tax basis of long-term debt 115 116

Differences between book and tax basis of investments 101 —

Nondeductible accruals and other 3,589 3,383

Less: Valuation allowance 342 375

4,014 3,572

Deferred Tax Liabilities:

Differences between book and tax basis of property and equipment and intangible assets 36,392 35,112

Differences between book and tax basis of investments —186

Differences between book and tax basis of indexed debt securities 457 534

Differences between book and tax basis of foreign subsidiaries and undistributed foreign

earnings 731 504

37,580 36,336

Net deferred tax liability $ 33,566 $ 32,764

Comcast 2015 Annual Report on Form 10-K 108