Comcast 2015 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NBCUniversal Media, LLC

Impairment Testing of Investments

We review our investment portfolio each reporting period to determine whether there are identified events or

circumstances that would indicate there is a decline in the fair value that would be considered other than

temporary. For our nonpublic investments, if there are no identified events or circumstances that would have

a significant adverse effect on the fair value of the investment, then the fair value is not estimated. If an

investment is deemed to have experienced an other-than-temporary decline below its cost basis, we reduce

the carrying amount of the investment to its quoted or estimated fair value, as applicable, and establish a new

cost basis for the investment. For our available-for-sale securities and cost method investments, we record

the impairment to investment income (loss), net. For our equity method investments, we record the impair-

ment to other income (expense), net. In 2013, we recorded $249 million of impairment charges to our equity

method investments, which primarily related to a regional sports cable network based in Houston, Texas.

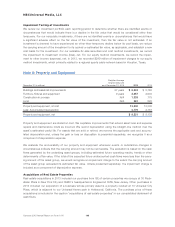

Note 8: Property and Equipment

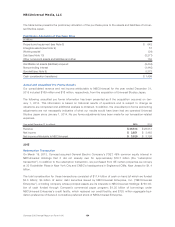

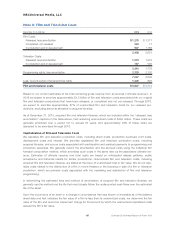

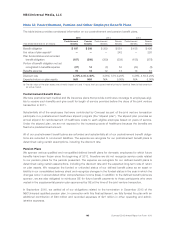

December 31 (in millions)

Weighted-Average

Original Useful Life

as of December 31, 2015 2015 2014

Buildings and leasehold improvements 27 years $ 6,543 $ 5,780

Furniture, fixtures and equipment 9 years 3,457 2,930

Construction in process N/A 1,339 775

Land N/A 961 820

Property and equipment, at cost 12,300 10,305

Less: Accumulated depreciation 2,779 2,167

Property and equipment, net $ 9,521 $ 8,138

Property and equipment are stated at cost. We capitalize improvements that extend asset lives and expense

repairs and maintenance costs as incurred. We record depreciation using the straight-line method over the

asset’s estimated useful life. For assets that are sold or retired, we remove the applicable cost and accumu-

lated depreciation and, unless the gain or loss on disposition is presented separately, we recognize it as a

component of depreciation expense.

We evaluate the recoverability of our property and equipment whenever events or substantive changes in

circumstances indicate that the carrying amount may not be recoverable. The evaluation is based on the cash

flows generated by the underlying asset groups, including estimated future operating results, trends or other

determinants of fair value. If the total of the expected future undiscounted cash flows were less than the carry-

ing amount of the asset group, we would recognize an impairment charge to the extent the carrying amount

of the asset group exceeded its estimated fair value. Unless presented separately, the impairment charge is

included as a component of depreciation expense.

Acquisitions of Real Estate Properties

Real estate acquisitions in 2013 included our purchase from GE of certain properties we occupy at 30 Rock-

efeller Plaza in New York City and CNBC’s headquarters in Englewood Cliffs, New Jersey. Other purchases in

2013 included our acquisition of a business whose primary asset is a property located at 10 Universal City

Plaza, which is adjacent to our Universal theme park in Hollywood, California. The purchase price of these

acquisitions is included in the caption “acquisitions of real estate properties” in our consolidated statement of

cash flows.

Comcast 2015 Annual Report on Form 10-K 160