Comcast 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• the deployment of wireless gateways to more than 70% of our residential high-

speed Internet customers

• the improvement of our network infrastructure to increase network capacity

• the expansion of our business services, including the creation of the new enter-

prise service offering designed to serve certain Fortune 1000 companies and

other large nationwide enterprises with multiple locations

• Investments to improve the customer experience, including by hiring additional

personnel and developing and deploying various technology and software tools

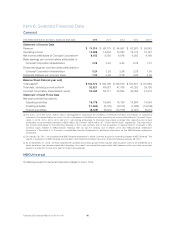

NBCUniversal Segments

• An increase in total NBCUniversal revenue of 11.9% to $28.5 billion

• An increase in total NBCUniversal operating income before depreciation and amor-

tization of 14.8% to $6.4 billion

• An increase in our Filmed Entertainment segment revenue of 45.5% largely due to the

success of Furious 7,Jurassic World and Minions, which each exceeded $1 billion in

worldwide theatrical receipts

• An increase in our Theme Parks segment revenue of 27.3% due to the continued

success of attractions at our Universal theme parks, including The Wizarding World of

Harry Potter™—Diagon Alley™ in Orlando and the Fast & Furious™—

Supercharged™ studio tour in Hollywood

• The continued investment in original programming and sports programming rights at

both our cable networks and broadcast television networks, including the premiere of

NASCAR programming

• The acquisition of a 51% interest in Universal Studios Japan for $1.5 billion

Competition

The results of operations of our reportable business segments are affected by competition, as all of our busi-

nesses operate in intensely competitive, consumer-driven and rapidly changing environments and compete

with a growing number of companies that provide a broad range of communications products and services

and entertainment, news and information content to consumers.

For additional information on the competition our businesses face, see Item 1A: Risk Factors and refer to the

risk factors entitled “Our businesses currently face a wide range of competition, and our businesses and

results of operations could be adversely affected if we do not compete effectively” and “Changes in consumer

behavior driven by alternative methods for viewing content may adversely affect our businesses and challenge

existing business models” within that section.

Seasonality and Cyclicality

Each of our businesses is subject to seasonal and cyclical variations. In our Cable Communications segment,

our results are impacted by the seasonal nature of customers receiving our cable services in college and

vacation markets. This generally results in a reduction in net customer additions in the second quarter and an

increase in net customer additions in the third and fourth quarters of each year.

Revenue in our Cable Communications, Cable Networks and Broadcast Television segments is subject to

cyclical advertising patterns and changes in viewership levels. Our U.S. advertising revenue is generally higher

Comcast 2015 Annual Report on Form 10-K 44