Comcast 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NBCUniversal Media, LLC

Our consolidated balance sheet also includes the assets and liabilities of certain legacy pension plans, as well

as the assets and liabilities for pension plans of certain foreign subsidiaries. As of December 31, 2015 and

2014, the benefit obligations associated with these plans exceeded the fair value of the plan assets by $67

million and $51 million, respectively.

Other Employee Benefits

Deferred Compensation Plans

We maintain unfunded, nonqualified deferred compensation plans for certain members of management (each,

a “participant”). The amount of compensation deferred by each participant is based on participant elections.

Participants in the plan designate one or more valuation funds, independently established funds or indices

that are used to determine the amount of investment gain or loss in the participant’s account.

Additionally, certain of our employees participate in Comcast’s unfunded, nonqualified deferred compensa-

tion plan. The amount of compensation deferred by each participant is based on participant elections.

Participant accounts are credited with income primarily based on a fixed annual rate.

In the case of both deferred compensation plans, participants are eligible to receive distributions from their

account based on elected deferral periods that are consistent with the plans and applicable tax law.

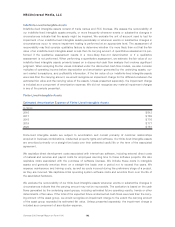

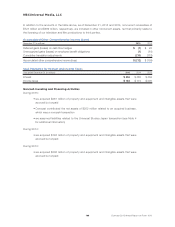

The table below presents the benefit obligation and interest expense for our deferred compensation plans.

Year ended December 31 (in millions) 2015 2014 2013

Benefit obligation $ 417 $ 349 $ 250

Interest expense $28 $24 $18

Retirement Investment Plans

We sponsor several 401(k) defined contribution retirement plans that allow eligible employees to contribute a

portion of their compensation through payroll deductions in accordance with specified plan guidelines. We

make contributions to the plans that include matching a percentage of the employees’ contributions up to

certain limits. In 2015, 2014 and 2013, expenses related to these plans totaled $174 million, $165 million and

$152 million, respectively.

Multiemployer Benefit Plans

We participate in various multiemployer benefit plans, including pension and postretirement benefit plans, that

cover some of our employees and temporary employees who are represented by labor unions. We also partic-

ipate in other multiemployer benefit plans that provide health and welfare and retirement savings benefits to

active and retired participants. We make periodic contributions to these plans in accordance with the terms

of applicable collective bargaining agreements and laws but do not sponsor or administer these plans. We do

not participate in any multiemployer benefit plans for which we consider our contributions to be individually

significant, and the largest plans in which we participate are funded at a level of 80% or greater.

In 2015, 2014 and 2013, the total contributions we made to multiemployer pension plans were $77 million,

$58 million and $59 million, respectively. In 2015, 2014 and 2013, the total contributions we made to multi-

employer postretirement and other benefit plans were $119 million, $125 million and $98 million, respectively.

If we cease to be obligated to make contributions or were to otherwise withdraw from participation in any of

these plans, applicable law would require us to fund our allocable share of the unfunded vested benefits,

which is known as a withdrawal liability. In addition, actions taken by other participating employers may lead

to adverse changes in the financial condition of one of these plans, which could result in an increase in our

withdrawal liability.

Comcast 2015 Annual Report on Form 10-K 166