Comcast 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NBCUniversal Media, LLC

Note 9: Goodwill and Intangible Assets

Goodwill

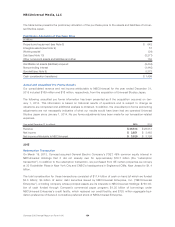

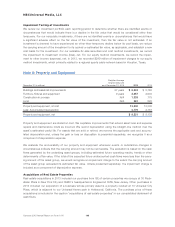

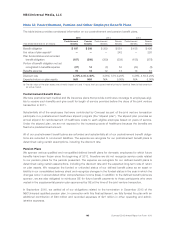

(in millions)

Cable

Networks

Broadcast

Television

Filmed

Entertainment

Theme

Parks Total

Balance, December 31, 2013 $ 13,130 $ 769 $ 1 $ 982 $ 14,882

Acquisitions 20 — 15 — 35

Adjustments(a) (202) (2) 195 — (9)

Balance, December 31, 2014 12,948 767 211 982 14,908

Acquisitions(b) 17 39 58 5,373 5,487

Adjustments(a) (18) — (2) (11) (31)

Balance, December 31, 2015 $ 12,947 $ 806 $267 $6,344 $ 20,364

(a) Adjustments to goodwill in 2015 and 2014 included foreign currency translation. Adjustments to goodwill in 2014 included the

reclassification of Fandango, our movie ticketing and entertainment business, from our Cable Networks segment to our Filmed Entertain-

ment segment.

(b) Acquisitions in 2015 in our Theme Parks segment related to the Universal Studios Japan transaction (see Note 4 for additional

information).

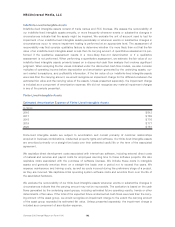

We assess the recoverability of our goodwill annually, or more frequently whenever events or substantive

changes in circumstances indicate that the carrying amount of a reporting unit may exceed its fair value. We

test goodwill for impairment at the reporting unit level. To determine our reporting units, we evaluate the

components one level below the segment level and we aggregate the components if they have similar eco-

nomic characteristics. As a result of this assessment, our reporting units are the same as our four reportable

segments. We evaluate the determination of our reporting units used to test for impairment periodically or

whenever events or substantive changes in circumstances occur. The assessment of recoverability may first

consider qualitative factors to determine whether the existence of events or circumstances leads to a

determination that it is more likely than not that the fair value of a reporting unit is less than its carrying

amount. A quantitative assessment is performed if the qualitative assessment results in a more-likely-than-not

determination or if a qualitative assessment is not performed. The quantitative assessment considers if the

carrying amount of a reporting unit exceeds its fair value, in which case an impairment charge is recorded to

the extent the carrying amount of the reporting unit’s goodwill exceeds its implied fair value. Unless pre-

sented separately, the impairment charge is included as a component of amortization expense.

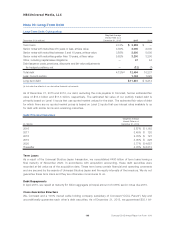

Intangible Assets

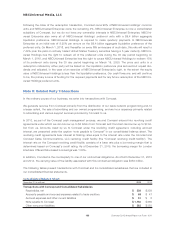

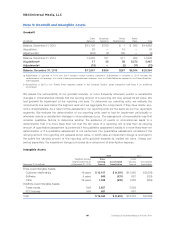

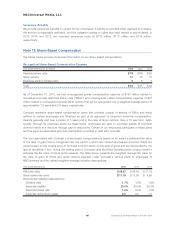

2015 2014

December 31 (in millions)

Weighted-Average

Original Useful Life as

of December 31, 2015

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Finite-Lived Intangible Assets:

Customer relationships 19 years $ 13,107 $ (4,291) $13,093 $(3,636)

Software 5 years 849 (431) 657 (329)

Other 19 years 1,996 (932) 1,556 (864)

Indefinite-Lived Intangible Assets:

Trade names N/A 2,857 3,059

FCC licenses N/A 651 651

Total $ 19,460 $ (5,654) $19,016 $(4,829)

161 Comcast 2015 Annual Report on Form 10-K