Comcast 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

continue in 2016. In 2015, depreciation and amortization expenses included $20 million related to the accel-

eration of amortization for certain intangible assets and the write-off of certain capitalized costs associated

with the termination of the Time Warner Cable merger and related divestiture transactions. Consolidated

depreciation and amortization expenses increased slightly in 2014 primarily due to increases in capital spend-

ing in our Cable Communications and NBCUniversal segments, as well as increases related to our

acquisitions in 2013 of our corporate headquarters and real estate properties for NBCUniversal.

Segment Operating Results

Our segment operating results are presented based on how we assess operating performance and internally

report financial information. We use operating income (loss) before depreciation and amortization, excluding

impairment charges related to fixed and intangible assets and gains or losses from the sale of assets, if any,

as the measure of profit or loss for our operating segments. This measure eliminates the significant level of

noncash depreciation and amortization expense that results from the capital-intensive nature of certain of our

businesses and from intangible assets recognized in business combinations. Additionally, it is unaffected by

our capital structure or investment activities. We use this measure to evaluate our consolidated operating

performance and the operating performance of our operating segments and to allocate resources and capital

to our operating segments. It is also a significant performance measure in our annual incentive compensation

programs. We believe that this measure is useful to investors because it is one of the bases for comparing

our operating performance with that of other companies in our industries, although our measure may not be

directly comparable to similar measures used by other companies. Because we use operating income (loss)

before depreciation and amortization to measure our segment profit or loss, we reconcile it to operating

income, the most directly comparable financial measure calculated and presented in accordance with gen-

erally accepted accounting principles in the United States (“GAAP”), in the business segment footnote to our

consolidated financial statements (see Note 18 to Comcast’s consolidated financial statements and Note 17

to NBCUniversal’s consolidated financial statements). This measure should not be considered a substitute for

operating income (loss), net income (loss) attributable to Comcast Corporation or NBCUniversal, net cash

provided by operating activities, or other measures of performance or liquidity we have reported in accord-

ance with GAAP.

The revenue and operating costs and expenses associated with our broadcast of the 2015 Super Bowl were

reported in our Broadcast Television segment. The revenue and operating costs and expenses associated

with our broadcast of the 2014 Sochi Olympics were reported in our Cable Networks and Broadcast Tele-

vision segments.

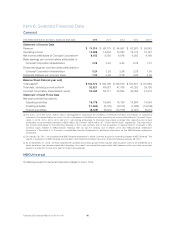

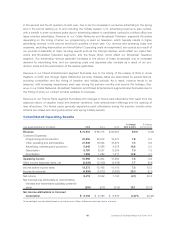

Cable Communications Segment Results of Operations

Revenue and Operating Income

Before Depreciation and Amortization

(in billions)

Revenue

Operating Income

Before Depreciation

and Amortization

20142013

Operating Margin

2015

$18.1 $19.1

$17.2

$44.1 $46.9

$41.8

41.1% 40.8%

41.0%

Comcast 2015 Annual Report on Form 10-K 48