Comcast 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NBCUniversal Media, LLC

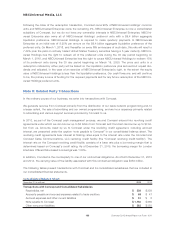

We enter into cofinancing arrangements with third parties to jointly finance or distribute certain of our film

productions. Cofinancing arrangements can take various forms, but in most cases involve the grant of an

economic interest in a film to an investor. The number of investors and the terms of these arrangements can

vary, although investors generally assume full risk for the portion of the film acquired in these arrangements.

We account for the proceeds received from a third-party investor under these arrangements as a reduction to

our capitalized film costs. In these arrangements, the investor owns an undivided copyright interest in the

film, and therefore in each period we record either a charge or a benefit to programming and production

expenses to reflect the estimate of the third-party investor’s interest in the profit or loss of the film. The esti-

mate of the third-party investor’s interest in the profit or loss of a film is determined using the ratio of actual

revenue earned to date to the ultimate revenue expected to be recognized over the film’s useful life.

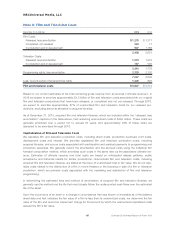

We capitalize the costs of programming content that we license but do not own, including rights to multiyear,

live-event sports programming, at the earlier of when payments are made for the programming or when the

license period begins and the content is available for use. We amortize capitalized programming costs as the

associated programs are broadcast. We amortize multiyear, live-event sports programming rights using the

ratio of the current period revenue to the estimated ultimate revenue or under the terms of the contract.

Acquired programming costs are recorded at the lower of unamortized cost or net realizable value on a pro-

gram by program, package, channel or daypart basis. A daypart is an aggregation of programs broadcast

during a particular time of day or programs of a similar type. Programming acquired by our Cable Networks

segment is primarily tested on a channel basis for impairment, whereas programming acquired by our Broad-

cast Television segment is tested on a daypart basis. If we determine that the estimates of future cash flows

are insufficient or if there is no plan to broadcast certain programming, we recognize an impairment charge to

programming and production expenses.

Note 7: Investments

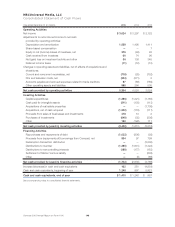

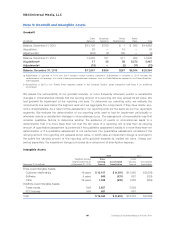

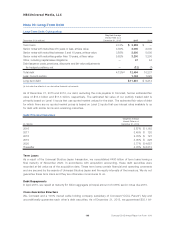

December 31 (in millions) 2015 2014

Fair Value Method $10 $10

Equity Method:

The Weather Channel —335

Hulu 184 167

Other 313 338

497 840

Cost Method 458 32

Total investments $965 $882

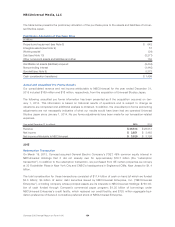

Equity Method

We use the equity method to account for investments in which we have the ability to exercise significant influ-

ence over the investee’s operating and financial policies or where we hold significant partnership or LLC

interests. Equity method investments are recorded at cost and are adjusted to recognize (1) our proportionate

share of the investee’s net income or loss after the date of investment, (2) amortization of the recorded

investment that exceeds our share of the book value of the investee’s net assets, (3) additional contributions

made and dividends received, and (4) impairments resulting from other-than-temporary declines in fair value.

Gains or losses on the sale of equity method investments are recorded to other income (expense), net. If an

equity method investee were to issue additional securities that would change our proportionate share of the

entity, we would recognize the change, if any, as a gain or loss in our consolidated statement of income.

Comcast 2015 Annual Report on Form 10-K 158