Comcast 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

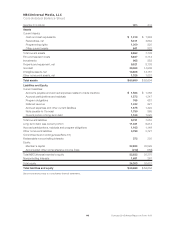

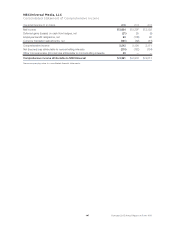

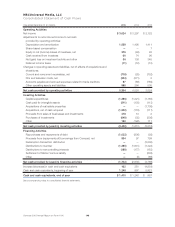

NBCUniversal Media, LLC

Consolidations

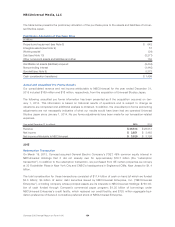

In February 2015, the FASB updated the accounting guidance related to consolidation under the variable

interest entity and voting interest entity models. The updated accounting guidance modifies the consolidation

guidance for VIEs, limited partnerships and similar legal entities. The updated guidance is effective for us as

of January 1, 2016. The updated accounting guidance provides companies with alternative methods of adop-

tion. We do not expect the updated accounting guidance to have a material impact on our consolidated

financial statements.

Debt Issuance Costs

In April 2015, the FASB updated the accounting guidance related to the balance sheet presentation of debt

issuance costs. The updated accounting guidance requires that debt issuance costs be presented as a direct

deduction from the associated debt obligation. We have adopted this guidance as of December 31, 2015 and

as a result we have reclassified unamortized debt issuance costs of $12 million as of December 31, 2014

from other noncurrent assets to a reduction of long-term debt on our consolidated balance sheet. As of

December 31, 2015, unamortized debt issuance costs included in long-term debt was $11 million.

Deferred Income Taxes

In November 2015, the FASB updated the accounting guidance related to the balance sheet presentation of

deferred taxes. The updated accounting guidance requires that all deferred tax liabilities and assets be classi-

fied as noncurrent in a classified balance sheet. The current requirement that deferred tax liabilities and

assets of a tax-paying component of an entity be offset and presented as a single amount is not affected by

the amendments in this update. We have adopted this guidance prospectively as of December 31, 2015.

Therefore, prior periods have not been adjusted to reflect this adoption. The adoption of the updated account-

ing guidance did not have a material impact on our consolidated balance sheet.

Note 4: Significant Transactions

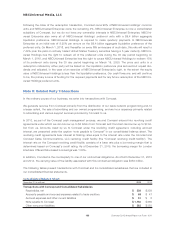

2015

Universal Studios Japan

On November 13, 2015, we acquired a 51% economic interest in Universal Studios Japan for $1.5 billion.

The acquisition was funded through cash on hand and borrowings under our commercial paper program.

Universal Studios Japan is a VIE based on the governance structure and we consolidate Universal Studios

Japan as we have the power to direct activities that most significantly impact its economic performance.

There are no liquidity arrangements, guarantees, or other financial commitments between us and Universal

Studios Japan, and therefore our maximum risk of financial loss is our 51% interest. Universal Studios

Japan’s results of operations are reported in our Theme Parks segment following the acquisition date.

Preliminary Allocation of Purchase Price

Due to the limited amount of time since the date of acquisition, the assets and liabilities of Universal Studios

Japan were recorded at their historical carrying values. We will adjust these amounts to fair value as valu-

ations are completed and we obtain information necessary to complete the analyses, but no later than one

year from the acquisition date. The 49% noncontrolling interest in Universal Studios Japan is recorded in the

equity section of our consolidated financial statements and has been recorded based on the total value of

Universal Studios Japan implied in the transaction. For purposes of this preliminary allocation, the excess of

the total value implied in the transaction over the historical carrying value has been recorded as goodwill.

153 Comcast 2015 Annual Report on Form 10-K