Comcast 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NBCUniversal Media, LLC

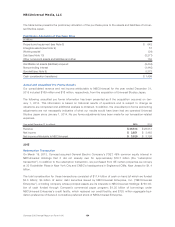

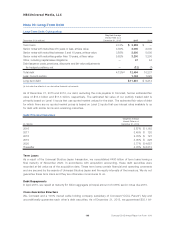

Following the close of the redemption transaction, Comcast owns 96% of NBCUniversal Holdings’ common

units and NBCUniversal Enterprise owns the remaining 4%. NBCUniversal Enterprise is now a consolidated

subsidiary of Comcast, but we do not have any ownership interests in NBCUniversal Enterprise. NBCUni-

versal Enterprise also owns all of NBCUniversal Holdings’ preferred units with a $9.4 billion aggregate

liquidation preference. NBCUniversal Holdings is required to make quarterly payments to NBCUniversal

Enterprise at an initial rate of 8.25% per annum on the $9.4 billion aggregate liquidation preference of the

preferred units. On March 1, 2018, and thereafter on every fifth anniversary of such date, this rate will reset to

7.44% plus the yield on actively traded United States Treasury securities having a 5 year maturity. NBCUni-

versal Holdings has the right to redeem all of the preferred units during the 30 day period beginning on

March 1, 2018, and NBCUniversal Enterprise has the right to cause NBCUniversal Holdings to redeem 15%

of its preferred units during the 30 day period beginning on March 19, 2020. The price and units in a

redemption initiated by either party will be based on the liquidation preference plus accrued but unpaid divi-

dends and adjusted, in the case of an exercise of NBCUniversal Enterprise’s right, to the extent the equity

value of NBCUniversal Holdings is less than the liquidation preference. Our cash flows are, and will continue

to be, the primary source of funding for the required payments and for any future redemption of the NBCUni-

versal Holdings preferred units.

Note 5: Related Party Transactions

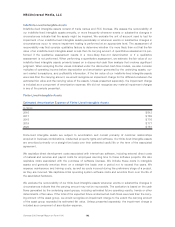

In the ordinary course of our business, we enter into transactions with Comcast.

We generate revenue from Comcast primarily from the distribution of our cable network programming and, to

a lesser extent, the sale of advertising and our owned programming, and we incur expenses primarily related

to advertising and various support services provided by Comcast to us.

In 2013, as part of the Comcast cash management process, we and Comcast entered into revolving credit

agreements under which we can borrow up to $3 billion from Comcast and Comcast can borrow up to $3 bil-

lion from us. Amounts owed by us to Comcast under the revolving credit agreement, including accrued

interest, are presented under the caption “note payable to Comcast” in our consolidated balance sheet. The

revolving credit agreements bear interest at floating rates equal to the interest rate under the Comcast and

Comcast Cable Communications, LLC revolving credit facility (the “Comcast revolving credit facility”). The

interest rate on the Comcast revolving credit facility consists of a base rate plus a borrowing margin that is

determined based on Comcast’s credit rating. As of December 31, 2015, the borrowing margin for London

Interbank Offered Rate-based borrowings was 1.00%.

In addition, Comcast is the counterparty to one of our contractual obligations. As of both December 31, 2015

and 2014, the carrying value of the liability associated with this contractual obligation was $383 million.

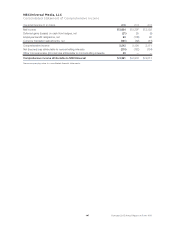

The following tables present transactions with Comcast and its consolidated subsidiaries that are included in

our consolidated financial statements.

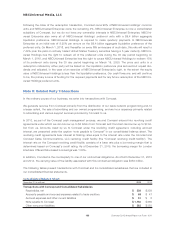

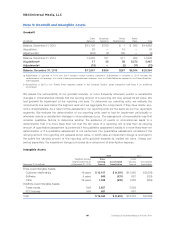

Consolidated Balance Sheet

December 31 (in millions) 2015 2014

Transactions with Comcast and Consolidated Subsidiaries

Receivables, net $ 239 $ 229

Accounts payable and accrued expenses related to trade creditors $68$47

Accrued expenses and other current liabilities $51$8

Note payable to Comcast $ 1,750 $ 865

Other noncurrent liabilities $ 383 $ 383

155 Comcast 2015 Annual Report on Form 10-K